Enterprises flourishing at breakneck speeds can captivate investors with whirlwind excitement. The more they burgeon, the more alluring they become to investment voyagers. SoundHound AI (NASDAQ: SOUN) is a maven in artificial intelligence (AI) voice services, igniting customer experiences across numerous arenas, from streamlining drive-thru orders to orchestrating seamless interactions with AI chatbots during a drive.

Venturing boldly into the realm of potential, SoundHound AI enticed bullish investors, especially upon revelation earlier this year that Nvidia had inked a deal with the enterprise. However, as SoundHound AI has been spiraling skyward with rapid growth, its losses and cash hemorrhage have also escalated. Are investors on the precipice of concern, or could this be a gem in the AI stock treasure trove?

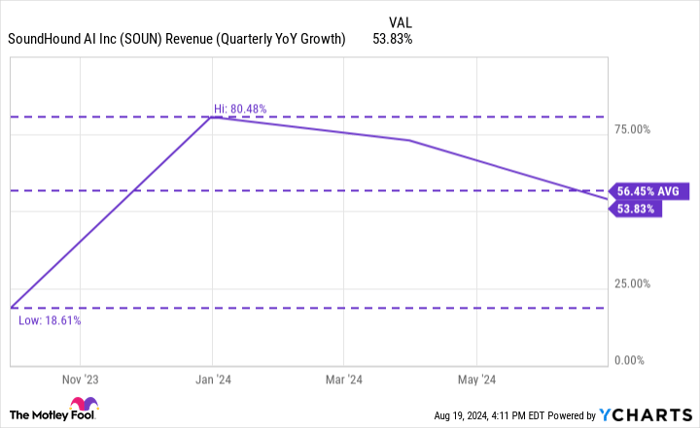

The Melodious Tune of SoundHound’s Growth: Sailing Above 50%

For an emergent AI ace like SoundHound AI, the shining star that captivates investors is its impressive growth trajectory. With sales still below megacap thresholds, there’s a glimmer of hope for valuation to skyrocket if operations continue to ascend.

SoundHound AI’s revenue in the recent quarter ending in June tallied $13.5 million. While seemingly modest compared to larger growth stocks, its crescendo shone with a remarkable 54% year-over-year sales surge. The resonance of its growth has echoed powerfully over recent quarters as investments in AI-related products and services remain robust.

The company’s prowess in propulsion endures. SoundHound AI unveiled plans to acquire Amelia, an enterprise AI software luminary, set to catalyze expansion into novel verticals ranging from healthcare to finance, promising combined revenues of at least $150 million in the upcoming year—nearly double the projected $80 million for 2024.

The Elusive Path to Profitability

Despite a horizon brimming with growth for SoundHound AI, both organically and through recent acquisitions, the quandary remains the strength of its bottom line. Presently unprofitable, the company’s losses are on a swift incline. In the latest quarter, net losses swelled from $23.3 million to over $37.3 million—a 60% surge, eclipsing the velocity of revenue growth.

While the company hints at cost synergies and “profitability expansion in subsequent years” from the Amelia deal, it skirts the revelation of when or if the company will stray from the red zone. Beyond profitability looms cash burn, a looming specter for SoundHound AI. Absent positive cash inflow, external funding through debt or equity markets may loom, paving the way for dilution and potential turbulence in the stock price.

Investing in the Echoes: SoundHound AI’s Soundness as an Investment

SoundHound AI orchestrates impressive top-line growth, yet investors dare not mute the dissonance reverberating from its bottom line and cash outflows. The euphoria surrounding the AI maestro has exhibited signs of flagging, with its value dipping around 2% in the recent three months. Even amid brisk expansion, sans enhanced cash flow or profitability, SoundHound hasn’t demonstrated unwavering sustainability in its operations.

Top-line acceleration commands attention, yet it falls short to overshadow the distressing fundamentals, hinting at a potential dilution vortex. In the realm of AI stocks, safer and superior alternatives may eclipse the radiance of SoundHound AI.

Delving Into SoundHound AI: Is it a Sound Investment?

Ponder this before setting sail on the SoundHound AI voyage:

The Motley Fool Stock Advisor analyst ensemble unveiled what they deem the 10 prime stocks for investment tacitly undermining SoundHound AI’s potential. The 10 selected stocks could yield staggering returns in the ensuing years.

Reflect on Nvidia’s erstwhile ascension to this distinguished list on April 15, 2005. If you had invested $1,000 upon recommendation, a bountiful $792,725 fortune awaits you!*

Stock Advisor unfurls an easy, lucid blueprint for investors, steering the course to success with portfolio construction guidelines, regular analyst insights, and bimonthly stock revelations. The Stock Advisor service has outpaced the S&P 500 returns more than fourfold since 2002*.

*Stock Advisor returns as of August 22, 2024

*David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.