As the summer travel rush approaches, investors should pay attention to Panama-based airlines operator Copa Holdings CPA and India’s MakeMyTrip Limited MMYT for potential investment opportunities.

Here’s a closer look at why these travel-related stocks might be worth considering before their quarterly earnings announcements on May 15.

Copa Holdings: A Strategic Look

Copa Holdings exhibited strong financial performance last year, driven by impressive operating margins, low unit costs, and robust travel demand. With Copa Airlines and Copa Columbia leading the way, the company has secured a key position in South America’s airline industry, connecting North and Central America, the Caribbean, and beyond through its Panama City hub.

Despite a challenging prior-year quarter, Copa Holdings is expected to report a slight decrease in Q1 sales by -3% to $837.31 million with projected earnings of $3.09 per share, compared to $3.99 per share last year. Notably, Copa Holdings has consistently exceeded earnings estimates for the past 12 quarters, beating Q4 expectations by 14% in February with an EPS of $4.47 versus the Zacks Consensus of $3.90 per share.

An attractive aspect for investors is that CPA trades at just 6.4X forward earnings, a significant discount compared to the S&P 500’s 21.9X and the Zacks Transportation-Airline Industry’s average of 18.4X. When compared to leading U.S. airlines, this places Copa Holdings well below Southwest Airlines LUV at 24.6X and slightly beneath Alaska Air Group ALK and Delta Air Lines DAL at 9.3X and 7.9X respectively.

Image Source: Zacks Investment Research

MakeMyTrip Limited: Unlocking Potential

Aside from its foothold in India’s economy, MakeMyTrip Limited also caters to the U.S. market, offering a range of travel services from air tickets to holiday packages, hotel bookings, and more.

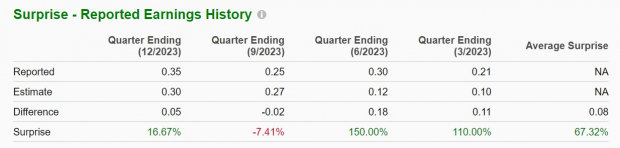

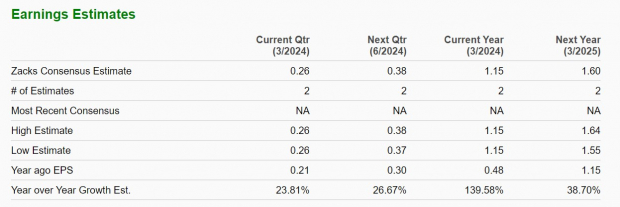

As MakeMyTrip Limited gears up for its fiscal fourth-quarter results, its expansion story remains intriguing, with Q4 sales anticipated to grow by 31% to $195.15 million. Earnings are also expected to rise by 24% to $0.26 per share compared to $0.21 per share in the corresponding quarter. Remarkably, MakeMyTrip Limited has outperformed earnings estimates in three of the last four quarters, with Q3 EPS of $0.35 surpassing estimates by 16% in January.

Image Source: Zacks Investment Research

Promising Growth Trajectories

Copa Holdings is expected to witness a total sales increase of 7% in both fiscal 2024 and FY25, with projected figures nearing $4 billion. Despite a projected -3% dip in annual earnings this year, forecasts suggest a rebound and a 9% rise in FY25 to $17.70 per share.

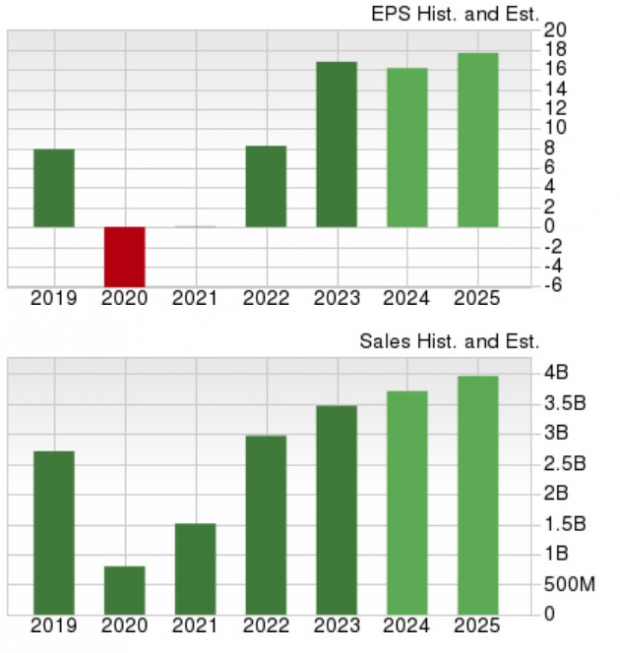

Image Source: Zacks Investment Research

On the other hand, MakeMyTrip Limited is poised for a total sales surge of 33% in FY24 to $787.71 million, compared to $593.04 million last year. Furthermore, an 18% increase is expected in the following year, reaching $934.78 million. Crucially, annual earnings are forecasted to skyrocket by 139% in FY24 to $1.15 per share from $0.48 per share in 2023. Additionally, a further 39% growth in EPS is projected for FY25, with forecasts at $1.60 per share.

Image Source: Zacks Investment Research

Final Thoughts

Embracing the ongoing recovery in the travel sector post-pandemic, both Copa Holdings and MakeMyTrip Limited are shining stars. With a Zacks Rank #2 (Buy) for Copa Holdings and a Zacks Rank #1 (Strong Buy) for MakeMyTrip Limited, the future looks bright for these travel stocks.