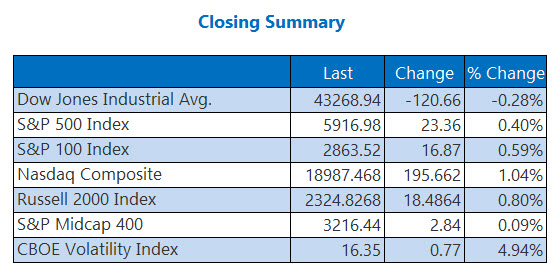

The Nasdaq and S&P 500 scored healthy wins Tuesday, rising ahead of a highly-anticipated earnings report from Nvidia (NVDA). The Dow dropped 120 points for a fourth-straight loss, after global tensions resurfaces amid escalating tensions between Russia and Ukraine. Elsewhere, Treasury prices rose and yields fell traders cycled into safe haven assets, and the Cboe Volatility Index (VIX) rose for a third session in four.

Continue reading for more on today’s market, including:

5 Things to Know Today

- Moscow sent signals to the West that it’s prepared for a nuclear response, after confirming that Ukraine used U.S.-made long-range missiles to attack Russian territory. (CNBC)

- Merck (MRK) reported positive results for its new, blockbuster cancer drug Keytruda. (MarketWatch)

- Watch out for incoming short-term headwinds.

- More on Lowe’s gloomy forecast.

- Why one analyst thinks it’s time to buy BioNTech stock.

Commodity Prices Pop on Russia-Ukraine War Developments

Oil prices were scattered today, as markets around the world react to the developments in the Russia-Ukraine war. For the session, December-dated West Texas Intermediate (WTI) crude rose 23 cents, or 0.3%, to settle at $69.39 a barrel.

Gold prices, meanwhile, hit their highest mark in a week. Following Ukraine’s attack on Russia, investors went on a safe-haven buying spree, while they also awaited updates from the Federal Reserve regarding interest rates. At last check, gold futures are 0.7% higher to trade at $2,633.50 an ounce.