The Story of Home Depot

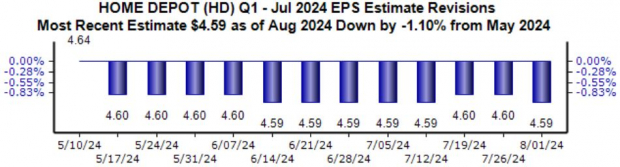

Home Depot shares have been like a rollercoaster in 2024, failing to keep up with the S&P 500. Expectations for the upcoming quarter have dipped, with analysts predicting a slight 1.3% drop in earnings per share compared to the same period last year. The company’s sales took a hit, dropping by 2.8%, causing some post-earnings volatility.

Walmart’s Growth Trajectory

Walmart, on the other hand, has been on a winning streak in 2024, with both earnings and sales showing robust growth. Analysts are optimistic about the upcoming quarter, forecasting a 6.5% increase in earnings per share and $168.4 billion in sales. The spotlight will once again be on Walmart’s eCommerce segment, which has been a standout performer for the retail giant.

The Challenges Facing Deere & Co.

Deere & Co. has had a tough year, with its shares plummeting 11% and lagging far behind the S&P 500. Sales for the company dropped by 12% in the latest period, primarily due to weakened global demand in the agricultural sector. Analysts are bearish about the upcoming results, with a more than 15% expected decline in earnings per share since mid-May.

The CEO of Deere & Co. remains resolute in the face of challenges, expressing confidence in the company’s ability to weather the storm. Despite the positive outlook, the stock is currently rated as a Zacks Rank #4 (Sell) ahead of the earnings release.

The Final Verdict

The Q2 earnings season has been a mixed bag so far, with positive performances offset by challenges faced by certain companies. As we gear up for the upcoming week, all eyes will be on Home Depot HD, Walmart WMT, and Deere & Co. DE as they step into the earnings spotlight.