Editas Medicine, Inc.‘s stock, with the ticker symbol EDIT on the NASDAQ, fumbled in the second quarter of 2024. The company reported a loss of 82 cents per share, missing expectations of a loss of 69 cents as forecasted by Zacks. This defeat marks a stark contrast to the 56 cents loss per share documented in the same quarter a year ago.

The company’s revenue stream took a hit with Collaboration and other research and development (R&D) revenues plummeting to $0.5 million from $2.9 million in the previous year. This significant drop failed to meet the Zacks Consensus Estimate of $7 million and was largely a result of diminishing drug supply activities with partners.

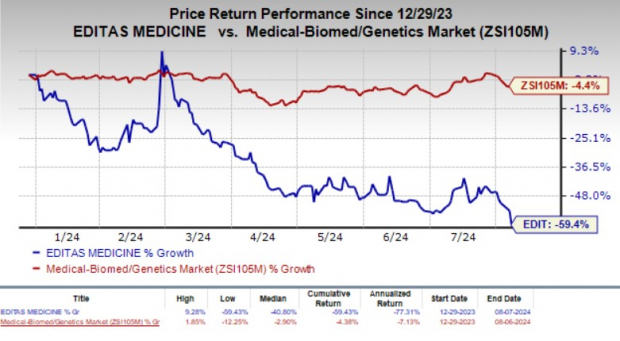

Following this disappointing revelation, Editas’ shares nosedived by 12.2% on August 7th.

Quarterly Overview

R&D expenses ballooned by 82% in the second quarter of 2024, soaring to $54.2 million compared to $29.8 million in the corresponding period last year. The surge can be mainly attributed to inflated clinical and manufacturing costs associated with Editas’ reni-cel program and other research endeavors.

Meanwhile, general and administrative expenses escalated to $18.2 million, up by 6% year over year, driven by augmented intellectual property and patent-related fees stemming from increased legal actions.

Editas’s cash reserves stood at $318.3 million as of June 30, 2024, a dip from $376.8 million recorded on March 31, 2024. The company expects this remaining balance, in conjunction with anticipated annual license fees and upfront payment from Vertex Pharmaceuticals (VRTX), to sustain operational and capital expenditures until 2026.

In late 2023, Vertex acquired rights to Editas’ Cas9 gene-editing tool for its newly authorized sickle cell disease gene therapy, Casgevy.

Year to date, Editas’ shares have plummeted by 59.4%, significantly surpassing the industry-wide decline of 4.4%.

Pipeline Progress

With no approved products in its arsenal presently, Editas is laser-focused on advancing its pipeline.

The company is scrutinizing the safety and effectiveness of reni-cel (renizgamglogene autogedtemcel) in the phase I/II/III RUBY study for treating sickle cell disease (SCD).

Editas has wrapped up enrollment and is actively dosing SCD patients in the adult segment of the RUBY study. Enrollment has been completed for the adolescent group as well. The company remains on course to unveil substantial data from the RUBY study by the end of 2024.

Additionally, Editas is exploring reni-cel for treating transfusion-dependent beta thalassemia (TDT). The adult cohort’s enrollment is complete, and patients are being dosed in the EdiTHAL study for TDT. The company is also positioned to disclose additional clinical data from the EdiTHAL study by the end of 2024.

During the quarter, Editas reported new optimistic data from both the RUBY and EdiTHAL studies involving reni-cel. Further efficacy data is expected upon the completion of data analysis from these studies by the end of the year.

Zacks Rank & Stocks to Consider

Editas currently holds a Zacks Rank #3 (Hold).

Some more promising candidates in the biotech sector are Annovis Bio (ANVS) and Akero Therapeutics (AKRO), both flaunting a Zacks Rank #2 (Buy) at present.

Over the past 60 days, the Zacks Consensus Estimate for Annovis’ 2024 per-share loss has remained steady at $2.46, while for 2025, it has narrowed from $1.95 to $1.91. Year to date, ANVS shares have plunged by 57.1%.

ANVS has surpassed estimates in three of the last four quarters, with a single miss, averaging a minor negative surprise of 1.39%.

In the last 60 days, estimates for Akero Therapeutics’ 2024 loss per share have slimmed down from $3.87 to $3.82. Forecasts for 2025 losses have stayed put at $4.29 during the same period. AKRO shares have seen a 1.4% uptick year to date.

Akero has beaten estimates once in the past four quarters, missed twice, and met expectations once, averaging a negative surprise of 5.10%.