Amidst the noise surrounding Tesla (NASDAQ: TSLA), the company has found itself at the centerpiece of discussions, with most headlines painting a grim picture. From challenges in the electric vehicle (EV) market to reorganizations resulting in layoffs and speculations regarding the cancellation of the planned sub-$25,000 model, Tesla appears to be facing relentless headwinds.

Image source: Tesla.

Assessing Tesla’s Valuation

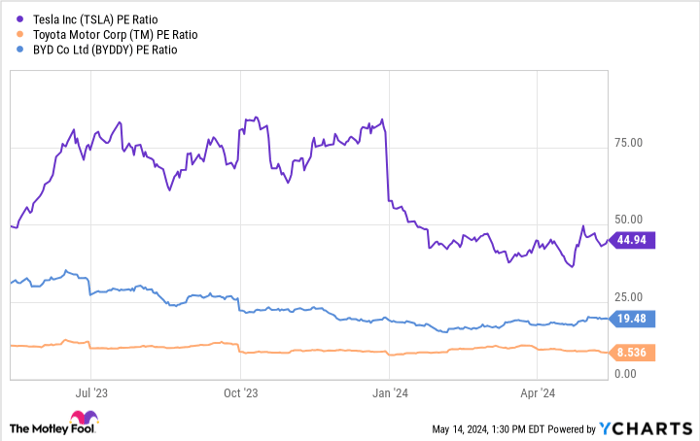

When comparing Tesla to other automakers, the stock appears expensive and overvalued. For instance, Tesla’s P/E ratio currently stands at 42, significantly higher than that of Toyota, the second-most-valuable automaker, and approximately twice that of China-based EV manufacturer BYD.

TSLA PE Ratio data by YCharts.

Despite Tesla’s operational efficiency and robust margins, its stock may not be a prudent investment solely from an automotive standpoint. Nevertheless, viewing Tesla through the lens of its futuristic pursuits reveals a potential that shines through and suggests an undervalued status in the market.

Many market observers see Tesla as a premier investment opportunity to capitalize on the potential of artificial intelligence (AI), even though further development is required before the company can fully leverage its AI initiatives.

The Path Forward: Tesla’s Potential Unleashed

CEO Elon Musk’s grand vision for Tesla involves positioning it as the world’s most valuable company. This ambition hinges on enhancing the capabilities of its full self-driving software and the humanoid robot named Optimus.

On the self-driving front, Musk envisages launching a robotaxi service enabled by vehicles capable of autonomous operation. This unique ride-hailing business model has the potential to revolutionize the transportation sector, with Musk referring to it as an opportunity characterized by “quasi-infinite” demand – a sentiment echoed by many industry analysts.

Quantifying the true potential of pioneering technology like Tesla’s is challenging. Nonetheless, utilizing a Monte Carlo simulation, ARK Invest estimates that Tesla’s robotaxi service could yield revenue of up to $440 billion, approximately four times the total company revenue in 2023.

While Optimus might not unlock revenue streams as significant as the robotaxi service, analysts at Morgan Stanley believe that Optimus could revolutionize up to 30% of the global labor market by performing tasks currently undertaken by humans. Musk envisions Optimus eventually surpassing revenue generated from Tesla’s vehicle manufacturing operations.

Although Optimus is already operational at Tesla’s production facilities, Musk anticipates expanding its role by year-end, with plans to make it market-ready by 2025.

The Current Investment Landscape

While Tesla’s appeal from an EV manufacturing perspective may be limited, the true investment allure lies in its AI ventures. Although short-term challenges may dissuade risk-averse investors, those with a long-term outlook and a risk appetite could find Tesla to be an attractive option.

Reverberating the wisdom of prominent investor Warren Buffett, who suggested, “Be greedy when others are fearful, and fearful when others are greedy,” it is evident that apprehension clouds the discussion on investing in Tesla today.

Considering Tesla’s track record of achievements, the strides made in AI development, and the transformative impact these technologies could have on society, Tesla emerges as a credible long-term growth opportunity for discerning investors.

Seeking Investment Opportunities Beyond the Noise

Despite the flurry of negative press, Tesla remains a compelling investment prospect for individuals willing to look beyond short-term hurdles. As the company navigates its challenges, its strategic focus on AI innovation positions it favorably for sustained growth and market disruption. For investors attuned to long-term potential and primed for risk, Tesla could well be the beacon amid the storm.