Entering the enigmatic realm of FedEx options trading reveals a tale of intrigue today. Behind the curtain, high-stakes investors have unveiled a bearish sentiment towards FedEx (FDX), sending ripples through the market landscape. As this unusual activity surfaces, it beckons the attention of retail traders, painting a vivid picture of whispers and shadows in the trading world.

Today’s revelation stems from Benzinga’s meticulous tracking of publicly available options data. The curtain has been drawn on 13 unorthodox options trades concerning FedEx, disrupting the traditional narrative. The very essence of these clandestine maneuvers often hints at a clandestine source of knowledge – a spark that can ignite fireworks in the financial scape.

Diving into the preciseness of these trades, a captivating split in sentiment emerges: 23% flutter with bullish hopes, while a resounding 69% resonate with bearish vibes. Among these transactions lie a solitary put trade, standing at an amount of $30,420, juxtaposed against the backdrop of 12 calls, towering at a monumental $551,923.

Unveiling the Enigmatic Price Range

Intriguingly, the trading currents hint towards a magnetic pull within the price spectrum, with investors’ scopes locked on a zone stretching from $280.0 to $310.0 for FedEx over the past three lunar cycles. This mystical range acts as a beacon, guiding the ships of these investors through the stormy seas of uncertainty.

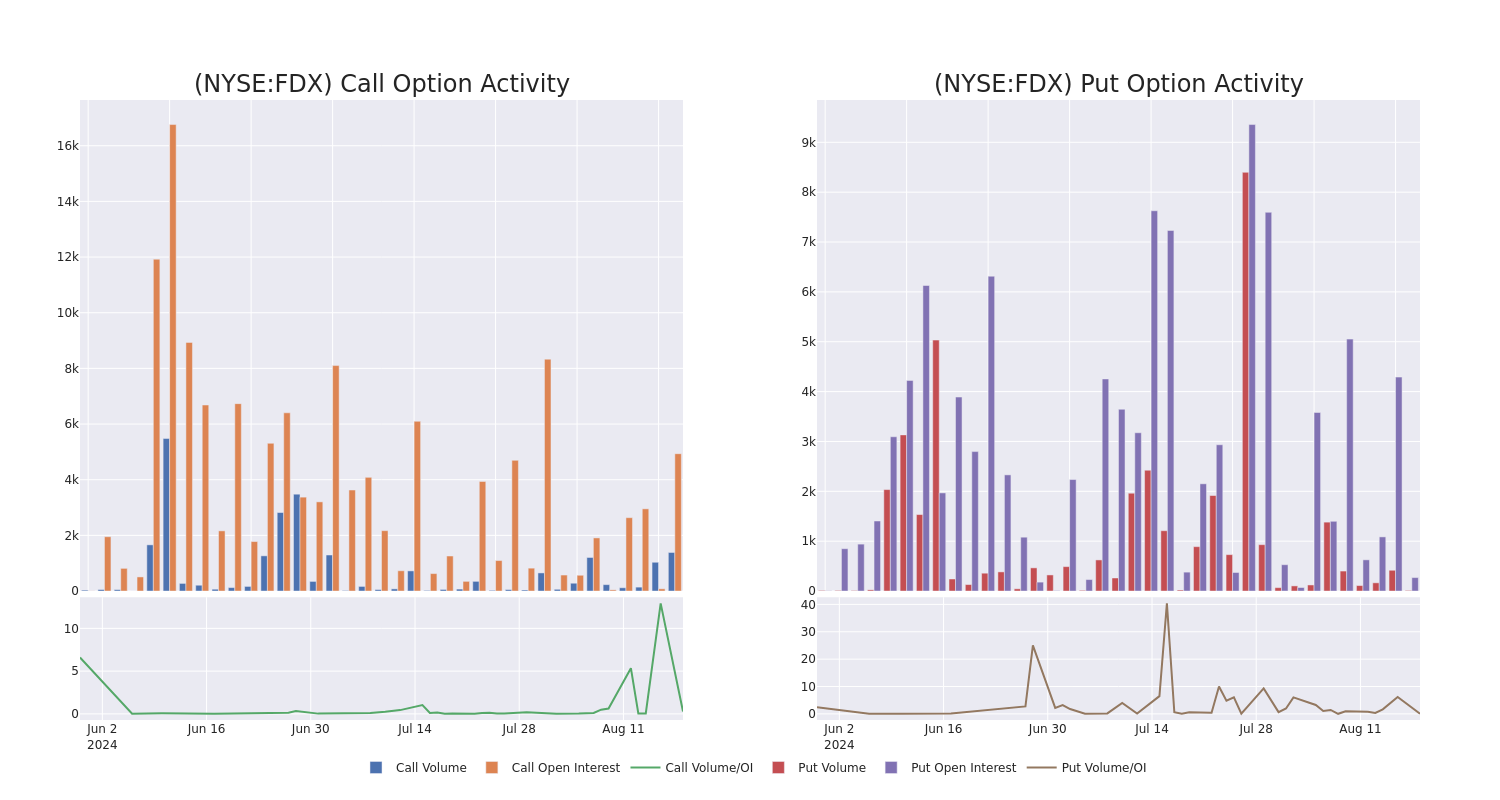

Decoding the Veil: Volume & Interest Insights

Peeling off the layers of obscurity, deciphering the volume and open interest serves as the compass for seasoned traders in the vast ocean of options trading. These metrics, akin to celestial constellations, illuminate the liquidity and investor curiosity surrounding FedEx’s options within a defined strike price corridor. Visualizing the ebb and flow of the market currents over the preceding moon’s cycle offers a glimpse into the unseen forces that shape these transactions.

Chronicles of FedEx Options Activity Over the Last 30 Days

Intriguing Moments in Options Trading

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | CALL | SWEEP | BEARISH | 06/20/25 | $32.05 | $31.95 | $31.95 | $290.00 | $102.2K | 280 | 88 |

| FDX | CALL | TRADE | BULLISH | 10/18/24 | $19.05 | $18.7 | $19.0 | $280.00 | $76.0K | 671 | 43 |

| FDX | CALL | SWEEP | BEARISH | 06/20/25 | $32.15 | $31.65 | $31.65 | $290.00 | $66.6K | 280 | 38 |

| FDX | CALL | SWEEP | BEARISH | 10/18/24 | $8.65 | $8.6 | $8.65 | $300.00 | $60.5K | 1.5K | 294 |

| FDX | CALL | SWEEP | BEARISH | 12/20/24 | $25.5 | $25.4 | $25.5 | $280.00 | $53.5K | 478 | 71 |

Unveiling the Essence of FedEx

Stepping out of the shadows of trading strategies, let us now unveil the essence of FedEx itself. A pioneer in overnight delivery since 1973, FedEx stands as the stalwart of the global express package sphere. With revenues derived in diverse proportions – 47% from express delivery, 37% from ground services, and 10% from freight shipments – FedEx’s multifaceted approach echoes a tale of resilient diversity. This narrative expands to other avenues, including FedEx Office and FedEx Logistics, painting a panoramic view of their global operations. The acquisition of TNT Express in 2016 burgeoned FedEx’s presence across European shores, solidifying its stance as a global giant in the delivery landscape.

Having deciphered the cryptic dances of options trading, our gaze now shifts to the concrete realm of FedEx itself, peering into its current market stance and unfolding performance.

An Insightful Glimpse into FedEx’s Current Standing

- On the trading frontier with a volume of 522,299, FDX’s price now dances to the tune of a 0.98% rise, settling at $288.21.

- RSI readings unveil a stock in the throes of neutrality, oscillating between the realms of overbought and oversold territories.

- The tantalizing prospect of an upcoming earnings release lingers, with the countdown standing at 31 days.

The world of options trading is akin to a daring expedition – risky yet alluring, blending uncertainty with the promise of grandeur. As traders navigate this labyrinth, balancing on the tightrope of risk and reward, informed decisions and vigilance become their trusted allies in this exhilarating journey.

For those enthralled by the mystique of options trading and seeking to stay attuned to the latest whispers from the market, a guiding beacon is offered by platforms like Benzinga Pro, providing real-time alerts and insights to illuminate this intricate path.