The Federal Reserve’s recent decision to maintain interest rates at a two-decade high post its fifth policy meeting of 2024, hints towards a potential change coming in September. Fed Chair Jerome Powell’s subtle nod towards a future rate cut stems from moderating inflation and a stable labor market that still lacks any signs of overheating.

Powell’s mention of a potential September rate cut comes in light of easing inflationary pressures, with the central bank closely monitoring essential good and service prices drifting towards its targeted 2% inflation figure.

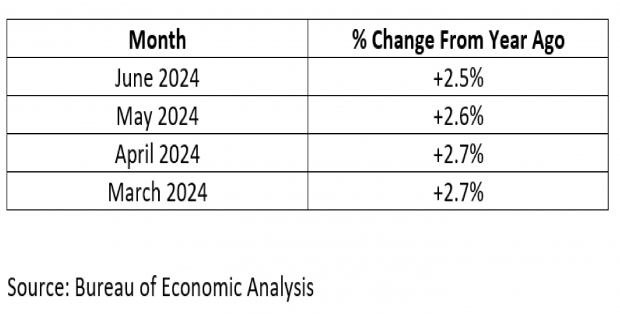

With the Federal Reserve’s key inflation indicator, the personal consumption expenditures (PCE) index, showing a monthly slowdown, market participants are increasingly betting on a September rate decrease. According to the CME FedWatch Tool, the probability of a quarter-point rate cut in September has risen to 68.5%, up from 52% in May. Moreover, expectations of multiple cuts by year-end have grown.

Tech Stocks Poised for Growth

Tech companies like NVIDIA Corporation (NVDA) stand to benefit from lower interest rates, as reduced borrowing costs lead to improved profit margins and cash flows, enhancing their financial outlook.

Notably, NVIDIA’s current-year earnings estimates have seen a 1.5% increase in the last 60 days, with an expected earnings growth rate of 106.9%. The company’s favorable position is further supported by a Zacks Rank #3 (Hold).

Glittering Opportunities in Gold

In a low-interest-rate environment, gold shines as a preferred investment choice over fixed-income options due to weakening appeal. This shift in preference drives up the price of gold, positively impacting gold mining stocks like Barrick Gold Corporation (GOLD).

With an increased current-year earnings estimate of 9.4% over the past 60 days and an expected earnings growth rate of 38.1%, Barrick Gold, ranked at #2 (Buy), is set to capitalize on the impending market trends.

Homebuilders Set to Flourish

Lower interest rates typically lead to reduced mortgage rates, a favorable condition for the housing market. Companies like PulteGroup, Inc. (PHM) are expected to benefit from increased demand and reduced input costs, an advantage that could potentially boost their financial performance.

PulteGroup has seen a 3.4% growth in its current-year earnings estimate over the last 60 days, with an anticipated earnings growth rate of 13.3%, accompanied by a Zacks Rank #2.

Over the past year, shares of NVIDIA, Barrick Gold, and PulteGroup have witnessed respective gains of 148.4%, 11.8%, and 58.7%, showcasing the market’s confidence in these companies amidst changing economic conditions.

Image Source: Zacks Investment Research