Want to outperform your peers and the market? Investing is all about stacking the odds of success in your favor. Today we are going to discuss ways to do so:

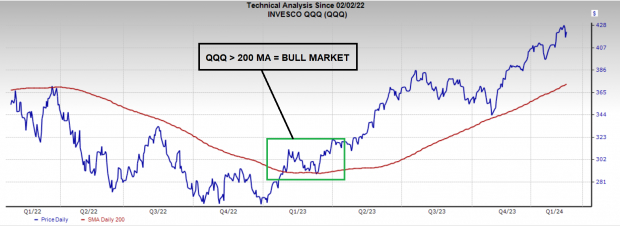

Determining the Bull Market

Ensure that you are in a bull market because roughly 75% of stocks follow the market direction. Just like a farmer must wait for the right season before planting crops, an investor should wait for a bull market before aggressively buying stocks. In other words, a farmer would not grow crops in the dead of winter when the ground is frozen over, and a savvy investor should not take on too much long exposure in a bear market environment.

Identifying a Bull Market

To determine market direction, overlay a 200-day moving average on the daily chart. Above the 200-day means stocks are in a bull market, and below it means investors should be cautious. In conjunction with the 200-day, investors can track the net new highs versus lows in the market to confirm whether it’s a bull market or not.

Embracing Momentum

Buy stocks that already have momentum. Newton’s First Law of Motion states that “A body in motion will remain in motion,” and the same applies to stocks. Finding stocks that have already doubled or are showing robust momentum is key.

Investing in Disruptors

The best stocks come from industries that are disrupting the way we live. Investing in companies that are driving innovation and changing the status quo can lead to substantial returns in the long run.

Utilizing the Zacks Rank

The Zacks Rank is an effective method to gauge a company’s fundamentals. It was created by Len Zacks, a seasoned investor who has spent years on Wall Street, and it revolves around the impact of earnings estimate revisions on stock prices.

Managing Risk with Asymmetric Bets

The beauty of the stock market is that one does not have to be perfect. By taking asymmetric bets with a favorable reward-to-risk ratio, investors can capitalize on the market’s dynamics, even with a less than perfect prediction accuracy.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.