Hello, Reader.

As Election Day draws closer, you may feel like a shadow of uncertainty looms over the country – and our portfolios.

You’re not alone in feeling the weight of this moment. A recent LifeStance Health survey found that 79% of Americans are experiencing election-related anxiety

The markets are feeling it too. On Wednesday, all three major indexes took a dive over, among other reasons, political uncertainty.

And with a post-election landscape that seems to promise chaos, investors are searching for safe harbors.

In unpredictable times like these, there’s one asset with staying power that could ease your mind and stabilize your portfolio…

Gold.

So, in today’s Smart Money, I’ll show you why it is crucial to keep this time-tested metal in your corner during these turbulent times, both before and after November 5.

Of course, gold isn’t the only opportunity in a chaotic market. So, we’ll also take a look at a proven strategy to protect and strengthen your portfolio in the days and months ahead.

Let’s dive in…

History Shows…

While elections themselves don’t directly drive market movements, the confluence of events during election seasons can create perfect storms for market volatility. And right now, we’re facing both political turmoil and escalating global tension.

That’s especially true this year, with polls failing to show a clear winner, reminiscent of the contentious 2000 election between George W. Bush and Al Gore.

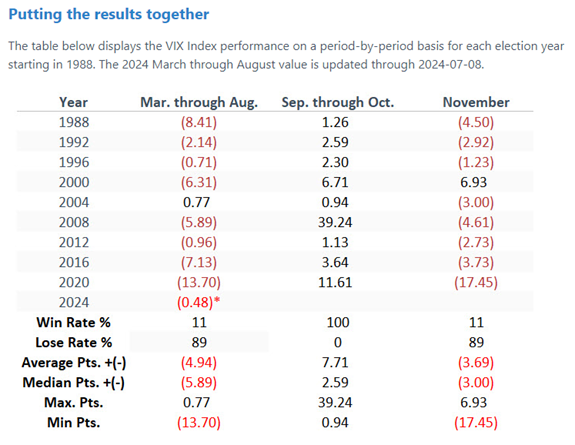

Looking at the CBOE Volatility Index (VIX), we can see that, during presidential election years since 1985, market volatility typically rises in September and October, and then subsides in November.

But there were two notable exceptions – November 2000 and 2008.

Source: SentimentTrader

It is worth nothing, though, that those two periods were entirely different. 2008 was dominated by the financial crisis, rather than a traditional election-cycle phenomenon.

This year’s election could come down to an even tighter deadlock than in 2000, with the results being disputed for weeks afterward.

Here’s where gold comes in…

Now, sure, gold is a shiny rock that produces nothing. It doesn’t manufacture products or generate earnings, and it will never design a new iPhone app or a revolutionary biotech drug.

Even the legendary Warren Buffett shares this sentiment. As he’s said, “Gold has two significant shortcomings, being neither of much use nor procreative.”

But here’s what Buffett missed: This “lifeless” asset often springs to life during times of chaos and uncertainty – exactly like we’re experiencing now. Although gold may be an asset that “will never produce anything,” that doesn’t mean it will never produce a profit for investors.

To the contrary, gold occasionally offers great, if not spectacular, trading opportunities. The gold market loves everything most ordinary investors despise, including economic crises and falling stock markets.

To refer back to 2000 and 2008, gold excelled in both cases.

One year after the 2000 election, the S&P 500 tumbled 21%, while gold gained 6%. Two years after, the S&P fell 35%, while gold climbed 21%.

One year after the 2008 election, the S&P gained just 7%, while gold soared more than 43%. Two years after, the S&P advanced 27%, but gold had rocketed 82%.

Historically, gold has tended to move up when stock prices move down. It zigs when stocks zag. That quality is valuable when stocks are performing poorly… like they did during the “lost decade” following the dot-com crash.

Many investors may not realize that the S&P 500 produced a loss during the 11-year span from August 2000 to August 2011. The blue-chip index produced a loss of 8% during those fruitless years.

But gold shined brightly. Its priced soared nearly 600%.

Gold has already surged more than 30% this year amid global tensions and economic instability. And some gold-related trades have performed even better than that.

For example, I recommend a gold mining company to my Fry’s Investment Report subscribers back in January. And since that recommendation, the stock is up over 60%.

History has shown us that political upheaval and gold prices are old dancing partners. So, I would guess that the gold market will become even more upbeat over the next few months.

Indeed, with another contentious election on the very immediate horizon, many investors would be foolish not to turn to this trusted hedge against uncertainty.

Using Volatility to Your Advantage

Of course, I do not suggest putting all of your money into gold. There will still be opportunities that present themselves in the market.

However, with the expected upcoming market volatility, you’ll want to have a trading plan in place. Because while the election has everyone on edge, it’s what comes after that will truly drive markets in the months ahead.

Fortunately, my colleague InvestorPlace Senior Analyst Louis Navellier has such a plan.

At his special “Day-After Summit” presentation on Tuesday, October 29, at 7 p.m. Eastern, Louis will reveal a powerful system designed to not just survive post-election volatility, but profit from it.

The trades that the system has flagged have beaten the S&P 500 by 6-to-1 in back-tests going back to 1990. And of the 19 open trades in the core portfolio where this system is now in use, 18 are winners.

Louis says that, with this system, “you’ll not only have the rare chance to triple your money or more in a matter of weeks… but also avoid the massive losses that will be triggered by the market reaction we see coming.”

Louis will be showing folks how to turn the volatility I see coming into profits by using this system at his “Day-After Summit” on Tuesday evening. He’ll even be giving away a post-election trade for free. He tells me it’s designed to pay off no matter who wins the election.

So, make sure to sign up for that at this link.

And I’ll see you back here next week.

Regards,

Eric Fry