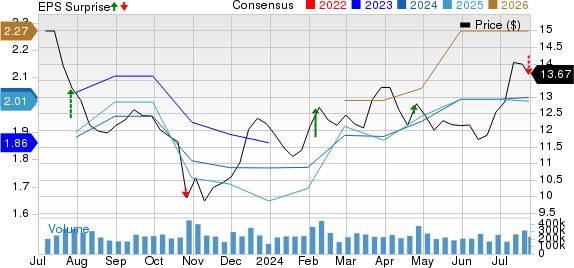

On the wings of a mixed earnings report, Ford (F) recently launched its financial scorecard for the second quarter of 2024, revealing adjusted earnings per share of 47 cents – a slump from the prior year’s 72 cents, and a miss against the predicted 64 cents. Despite revenue growth to $47.8 billion, a 6.3% upswing from the previous year, the figures fell short of analysts’ rosy projections.

The Tale of Ford’s Segments

Zooming in on the segmental breakdown, Ford’s Blue segment steered 3% higher in total wholesale volume, reaping 741,000 units. The revenue echoes this climb, rising 7% to $26.7 billion, though earnings before interest and taxes (EBIT) manifested a more conservative growth at $1.71 billion. Ford’s Model e segment, however, rang a more somber tune, a 23% dip in wholesale volume to 26,000 units, and revenues drooping 37% to $1.1 billion. Loss before taxes widened to a hefty $1.14 billion.

Meanwhile, the Ford Pro segment surfed a 3% surge in wholesale volume, backing 375,000 units, albeit falling shy of the expected 408,000 units. Revenue grew by 9% year over year to $17 billion. The financial highlight was an EBIT of $2.56 billion with a stunning margin of 15.1%, surpassing projected figures.

Ford’s overall automotive revenues peaked at $44.8 billion in the second quarter, riding on the prominent performances of Ford Blue and Ford Model e.

Financial Fortitude

The financial snapshot showcased Ford’s adjusted free cash flow hitting $3.2 billion. The automaker boasted $19.95 billion in cash and cash equivalents by Jun 30, 2024, with long-term debt hovering at $18.69 billion, excluding Ford Credit. Ford also declared its regular dividend of 15 cents per share for the third quarter of 2024, payable on Sep 3, 2024.

Guidance in the Rearview

Although Ford upheld its adjusted EBIT outlook for 2024 at $10-$12 billion, it revised its adjusted free cash flow forecast upwards to $7.5-$8.5 billion, from the initial forecast of $6.5-$7.5 billion. The capital spending estimate was pegged in the range of $8-$9 billion.

Market Outlook & Key Players

Within the vibrant auto landscape, Ford sits at a Zacks Rank #3 (Hold). Notable peers in the arena include Suzuki Motor Corporation (SZKMY), BYD Company Limited (BYDDY), and Honda Motor Co., Ltd. (HMC). SZKMY and BYDDY earned a Zacks Rank #1 (Strong Buy) each, while HMC secured a Zacks Rank #2 (Buy). Investors can explore further stocks via Zacks’ list of top-ranked options.

With various estimates painting a hopeful future, notably SZKMY with a projected earning upturn of 2.09%, BYDDY boasting sales and earnings growth estimates of 21.11% and 9.93% respectively, and HMC on a steadier path with year-over-year growth estimates of 0.73%.