For legacy automaker Ford, time is both friend and foe. The company’s enduring presence is a beacon to investors, a sign that longevity is a virtue. However, this historical legacy was recently dimmed by a significant downgrade courtesy of Morgan Stanley, sending shockwaves through the market. Ford shares nosedived nearly 4% in Wednesday’s trading session.

Morgan Stanley’s Adam Jonas didn’t just revise Ford’s rating from Overweight to Equal Weight; he also slashed the price target to $12 from $16. The crux of the issue lies in China, the birthplace of Ford’s Territory compact SUV.

China’s oversupply of approximately nine million vehicles poses a critical challenge. Although not all will reach U.S. shores, targeting new markets in Europe, Africa, or Asia will inevitably erode Ford’s market share and profitability. Regulatory pressures in the electric vehicle sector only compound this conundrum, as highlighted by Jonas.

New Avenues for Ford

Despite the turbulence, Ford isn’t hitting the brakes just yet. Glowing previews of the upcoming 2024 Mustang Dark Horse have set hearts racing. This sleek model, unveiled recently on AutoBlog, promises to captivate enthusiasts, offering hope for a brighter future despite current economic uncertainties.

Additionally, Ford has commenced production of the electric Capri in Cologne, Germany, marking its second electric vehicle in the region. Boasting similarities to the Explorer but with a distinct “flatter roofline,” the Capri is positioned as an SUV coupe with shared technical underpinnings. While only the large battery models are initially available, reports suggest smaller battery variants will hit the market by year-end.

Investing Outlook and Analysis

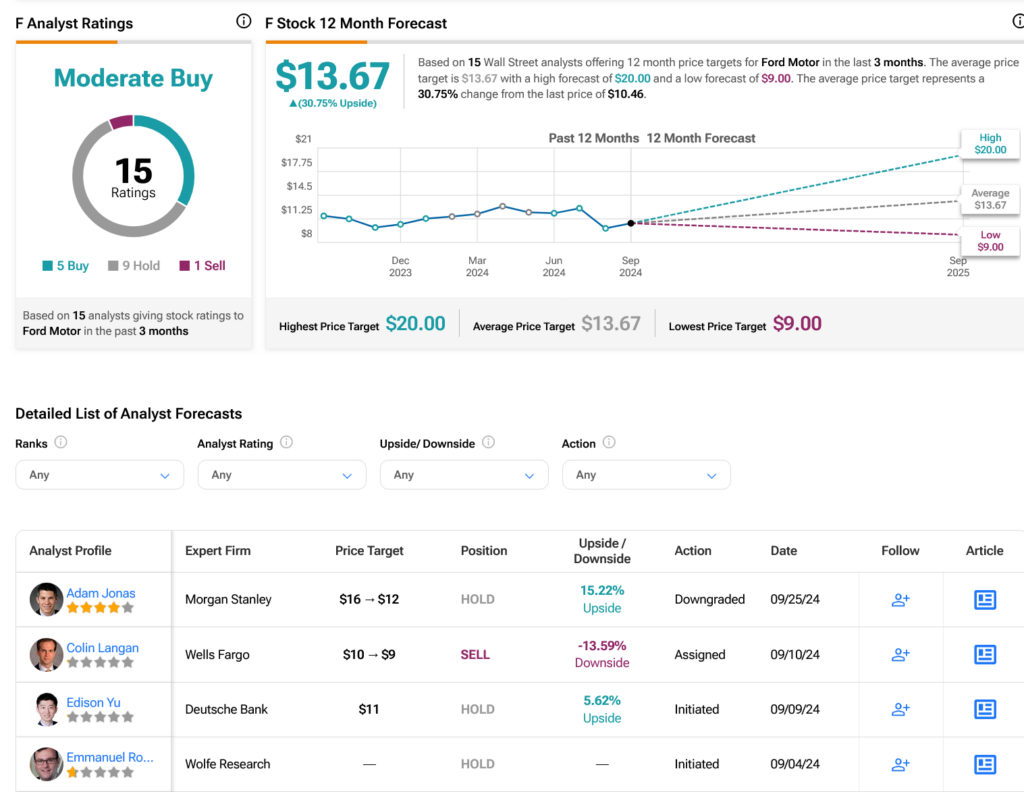

Wall Street analysts remain cautiously optimistic, with a Moderate Buy consensus on Ford stock supported by five Buy, nine Hold, and one Sell ratings in the past quarter. Despite a 10.14% decline in share price over the past year, the average price target of $13.67 suggests a substantial 30.75% upside potential.

Explore more Ford analyst ratings