Legacy automaker Ford (F) is accelerating its momentum with a groundbreaking new patent focusing on electric vehicles and their batteries. The company’s recent patent, filed back in November 2021 and published on October 15 under US 12115880 B2, is a game-changer in the electric vehicle landscape. Ford investors were quick to respond, driving shares up nearly 2% in Wednesday afternoon’s trading session.

Pioneering Electric Vehicle Monitoring

The patent introduces “battery electric vehicle monitoring systems and methods for track usage and off-roading,” addressing a critical need in today’s electric vehicle market. The challenge of utilizing electric vehicles for specialized applications like off-roading has been hampered by charging infrastructure limitations. However, Ford’s innovative patent empowers users to monitor their vehicle’s battery life accurately during track usage or off-road adventures. This breakthrough technology is a testament to Ford’s commitment to driving innovation in the electric vehicle sector.

Revving Up with Gas-Powered Vehicles

While Ford’s electric vehicle advancements are making headlines, the company’s gas-powered vehicles are also creating a buzz. The recent teaser video release of the Mustang GTD, boasting an impressive 815 horsepower V8 engine, promises race car-like performance. Ford’s ambitious goal of achieving a lap time of under seven minutes at the renowned Nurburgring race track in Germany has piqued the interest of automotive enthusiasts worldwide. With Ford’s strategic marketing efforts, the anticipation for the official lap time reveal is building excitement among fans and investors alike.

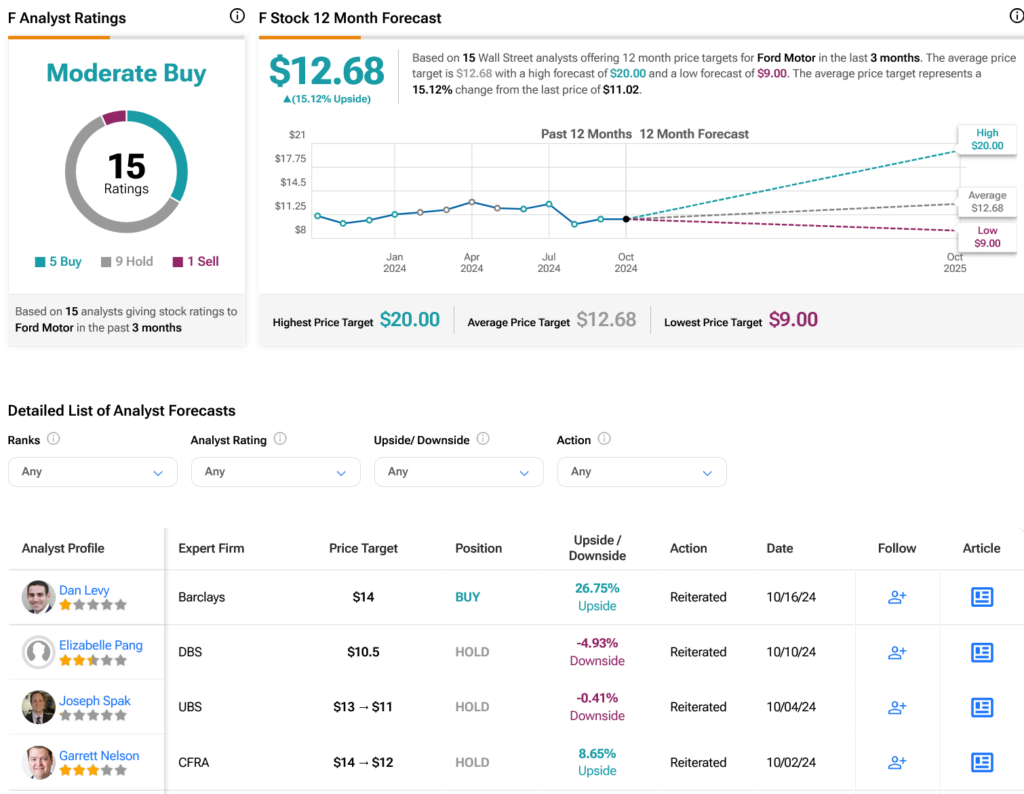

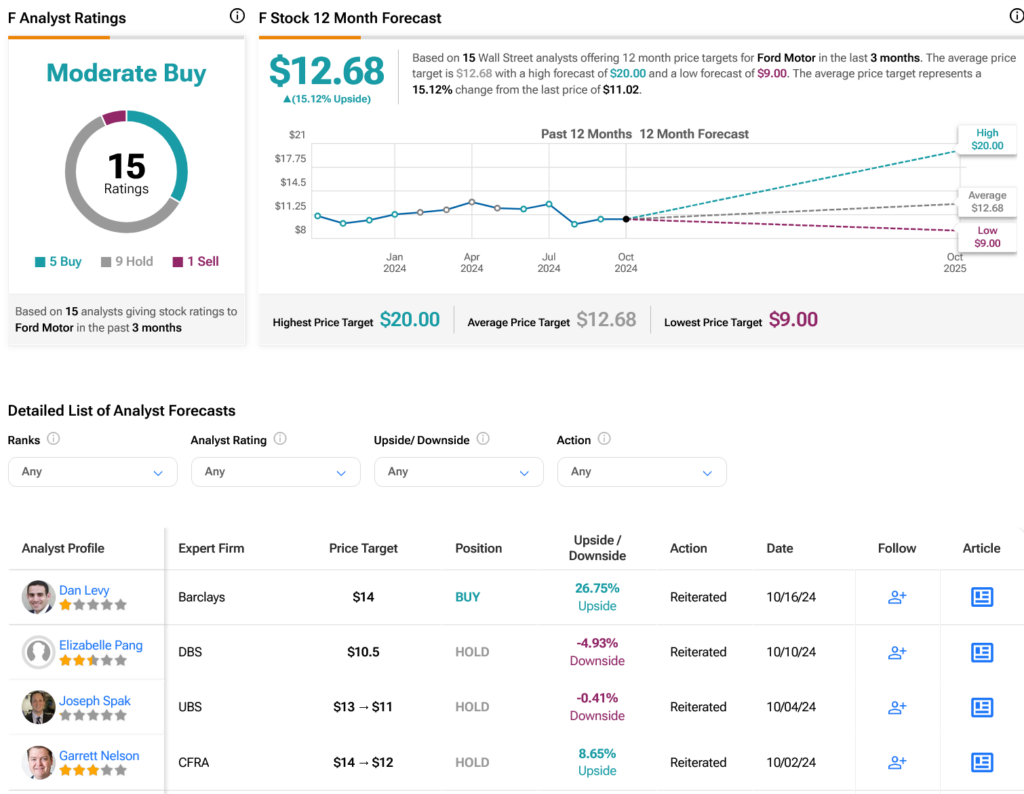

Analysts Assess Ford’s Stock Outlook

On Wall Street, analysts maintain a Moderate Buy consensus rating on Ford (F) stock. With five Buy ratings, nine Holds, and one Sell assigned in the past three months, market sentiment reflects a balanced view of Ford’s future prospects. Despite a 1.65% decline in its share price over the past year, the average price target of $12.68 per share indicates a promising 15.12% upside potential. Investors are closely monitoring Ford’s innovative initiatives and market performance to make informed investment decisions in the dynamic automotive sector.

Explore more analyst ratings for Ford (F) here.