Legacy automaker Ford (F) faced a rough ride in Friday’s market as its share price skidded over 1.5%. The double whammy of dwindling Transit Connect inventory in the U.S. and a glimmer of hope for its green initiatives failed to spark investor confidence.

In a move signaling the end of an era, back in March 2023, Ford officially ceased Transit Connect production for the North American market. Now, reports indicate the last remnants of the line have vanished from the U.S. With dwindling sales, a successor model for the Transit Connect failed to materialize, leaving American consumers empty-handed.

Prospective buyers, however, aren’t entirely out of luck. A fresh iteration of the model, sporting a complete redesign, has surfaced in Europe.

Electric Roads: Ford’s Innovative Tilts

Despite dialing back its green ambitions, Ford has buzzed back to life with a revelation—tackling a core challenge in electric vehicles: charging. Unveiled through a recent patent filing dating back to August, Ford’s brainchild involves transforming roads into power sources. It envisions electric vehicles’ induction coils linking with specialized chargers embedded in road surfaces—effectively turning roads into constant charging routes to juice up vehicles while on the move.

However, hurdles loom large, especially concerning power transfer efficiency. Ford’s patent outlines strategies to surmount these obstacles and drive its innovation forward.

Assessing Ford’s Stock Potential

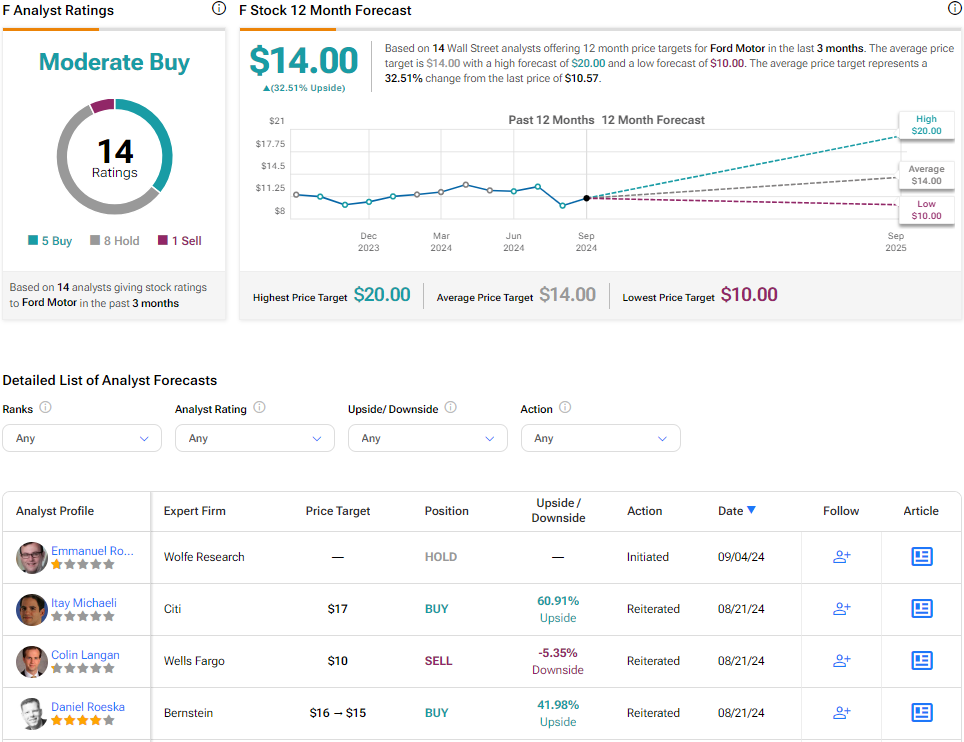

As investors grapple with Ford’s fluctuating trajectory, Wall Street analysts maintain a Moderate Buy consensus on F stock. Recent evaluations reveal a mix of five Buy, eight Hold, and one Sell ratings over the past three months. Despite a 5.33% decline in its share value over the last year, a promising $14 per share average price target signifies a possible 32.51% upside potential for Ford’s stock.

Explore more F analyst ratings