When a CEO bids adieu to a business, the typical response is anxiety among investors. However, Ford (F) defies the norm. The departure of Ted Cannis, the CEO of its Pro business, is not a harbinger of trouble. Cannis is leaving due to the simplest of reasons: retirement. With a successor already identified, investors greeted his exit with a 1.5% surge in Thursday’s trading.

Cannis helmed Ford’s lucrative “Pro” business, specializing in fleet operations and commercial ventures. This year alone, Ford Pro raked in nearly $70 billion in revenue, contributing $184.5 billion to Ford’s sales since 2021. Cannis’s departure leaves big shoes to fill, and Ford will undoubtedly seek a successor capable of replicating his success.

Andrew Frick will take Cannis’s place temporarily, transitioning from his current role as head of Ford’s “Blue” operations. The Blue team caters more to traditional retail aspects, ensuring a seamless transition from Cannis’s strategies. However, Frick’s tenure will be short-lived as he serves as an interim CEO until a permanent replacement is found.

New Pickup Celebrates Detroit Lions

The deep-rooted connection between Ford and Detroit shines bright with the launch of a special edition F-150 Hybrid showcasing the NFL’s Detroit Lions. A CBS report highlights that only 800 of these vehicles will be crafted, instantly turning them into coveted collectibles. The fervor in Detroit is palpable, with fans nurturing hopes of a Super Bowl appearance for the Lions. Though a long shot, Detroit has always clung to eternal optimism regarding the Lions. Bolstered by this one-of-a-kind hybrid truck, who’s to say the Lions can’t make it to the top this year?

Buy, Hold, or Sell Ford Stock?

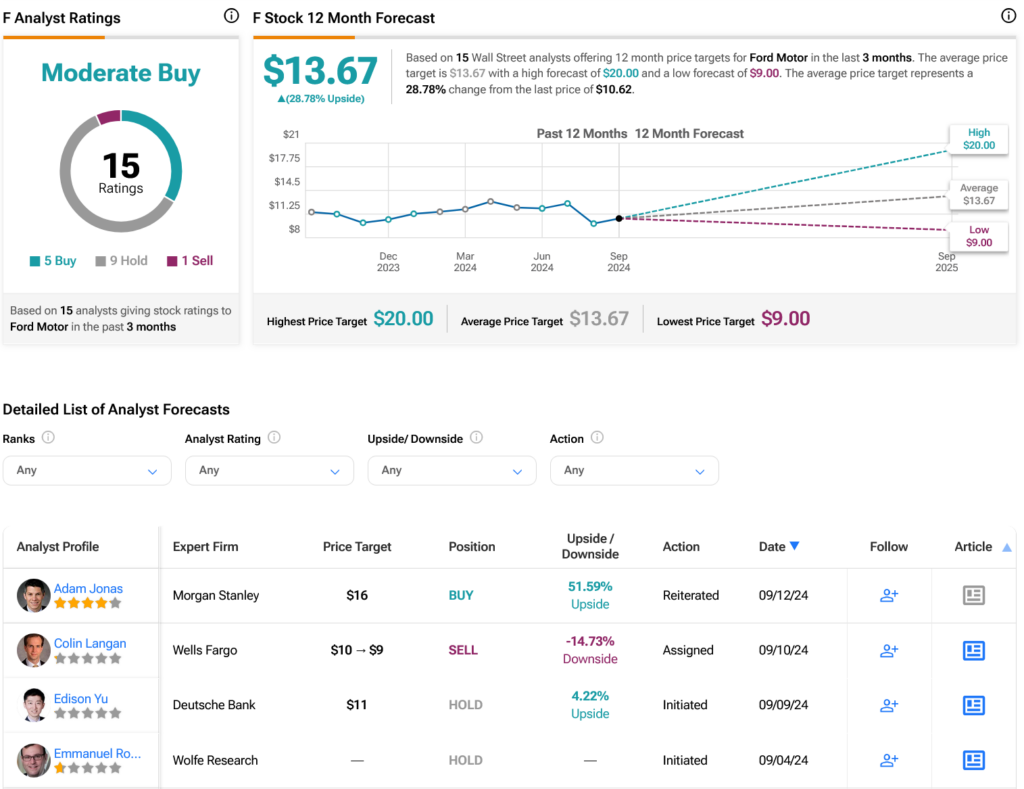

Analysts on Wall Street maintain a Moderate Buy consensus on Ford stock with five Buys, nine Holds, and one Sell over the past three months. Despite a 10.47% drop in share price over the previous year, the average price target of $13.67 per share forecasts a promising 28.78% potential upside.

Explore more Ford analyst ratings