Market Overview

The rollercoaster of market sentiment in 2021 has been akin to a tempest in a teapot. Ford investors have not escaped the tumult, witnessing a 14.5% slip in their stocks since the start of the year. Yet, this statistical spiral belies a far more intricate tale sparked by Ford’s lackluster Q2 performance and the ensuing punishment meted out to the stock.

Bank of America’s Bullish Outlook

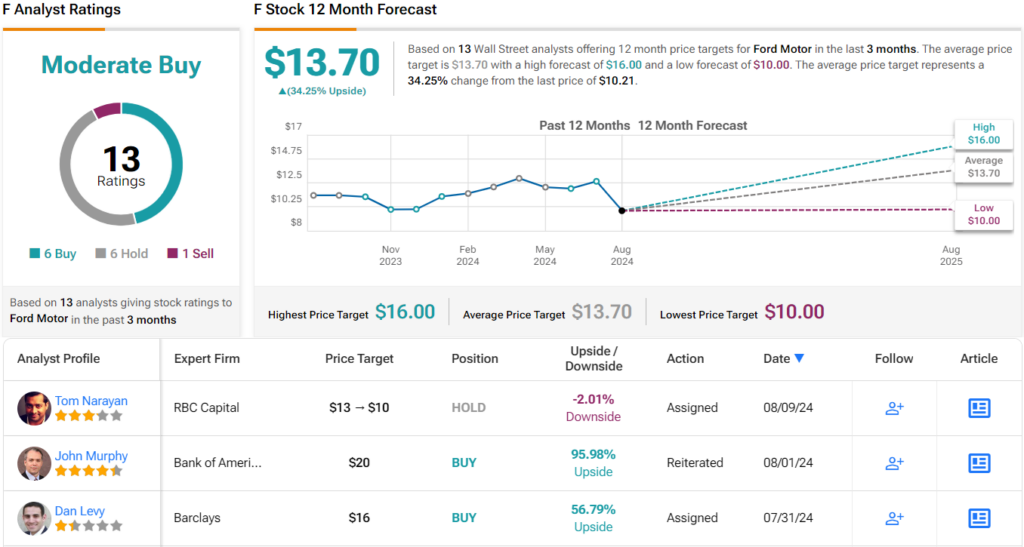

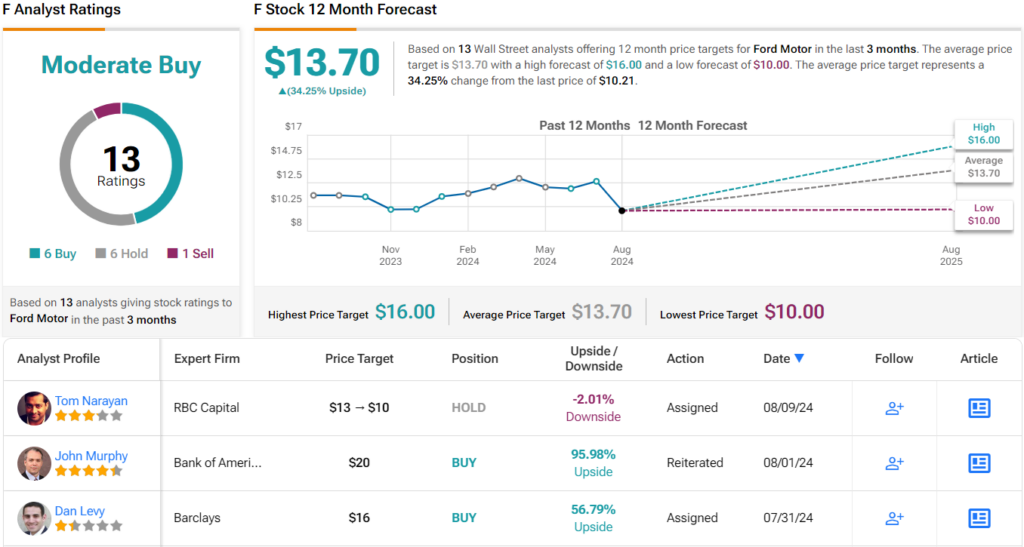

Despite the recent tribulations, Bank of America’s John Murphy remains a staunch optimist regarding Ford’s future. Acknowledging recent quality concerns and operational missteps, Murphy anticipates an upturn. By hinging Ford’s fate on product innovation and incremental profit ameliorations, particularly through Ford Pro’s burgeoning service and software ventures, Murphy envisions a brighter tomorrow. The subtle transition of Ford’s prowess into the retail sector silently underscores the automaker’s strategic diversification for Murphy. Tackling the milieu of electric vehicles, Murphy acknowledges the uphill battle, but also lauds Ford’s efforts in cost containment. With a Buy rating and an audaciously high price target of $20 – an exorbitant 97% surge from current levels – Murphy’s faith in Ford shines undimmed.

RBC’s Cautious Skepticism

Contrasting Bank of America’s effusive optimism, RBC’s Tom Narayan adopts a more restrained stance when appraising Ford’s trajectory. With a nod toward the investment community’s favoritism for General Motors – a trend augmented by GM’s spirited stock buyback campaign – Narayan spots divergence. As GM aggressively reduces its share count by 18% over the past year and greenlights further massive repurchases, Ford’s tepid buyback strategy pales in comparison. Awarding Ford a Sector Perform rating and pegging its price target at $10, Narayan suggests that Ford’s stock may have reached its zenith.

Street Consensus

The broader Wall Street landscape paints a mosaic of varied opinions: 5 Buy ratings, 5 Holds, and 1 Sell converge to sketch Ford’s Moderate Buy consensus outlook. Despite this schism in sentiment, bullish projections take the helm, with an average price target of $13.70 – implying a 34% surge over the upcoming year. The battleground for Ford’s stock remains fiercely contested, with divergent forecasts clouding the road ahead.

Concluding Remarks

Your investment journey with Ford is akin to navigating the lanes of a bustling city thoroughfare – fraught with twists, turns, and diverging paths. The dichotomous analyses from Bank of America and RBC provide a microcosm of the warring perspectives entangling Ford stock. Whether you choose to anchor your faith in Bank of America’s roseate forecast or tether to RBC’s cautious pessimism, the road ahead remains shrouded in uncertainty but brimming with opportunity. Choose your lane wisely and buckle up for the thrilling ride that awaits in the Ford stock arena.

To discover hidden gems in the stock market’s troves, embark on a voyage through TipRanks’ “Best Stocks to Buy,” where insights abound in the quest for financial conquest.

Disclaimer: The assessments articulated in this content are the solitary opinions of the highlighted analysts. The material is intended solely for informational undertakings, urging rigor in personal analysis before venturing into any investment exploits.