In 2023, the “Magnificent Seven” stocks outshone the market, and all indicators suggest they are poised for another stellar performance in 2024. This exclusive group, comprising renowned giants like Microsoft and Apple, has been the subject of considerable investment interest.

However, amidst this constellation of stars, one standout luminary has waned. Apple, the tech behemoth, has lost its luster as a prospective investment, and there are compelling reasons to look elsewhere within this illustrious cohort.

The Decline of Apple as an Investment Prospect

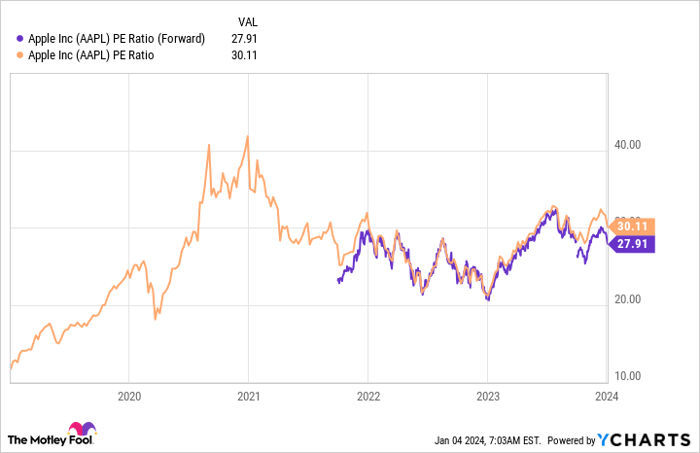

Once upon a time, Apple’s stock was fairly valued, but those days are now a distant memory. The company’s stock currently trades at around 30 times earnings – a valuation typically reserved for companies exhibiting exceptional growth. Despite its impeccable execution, Apple’s revenue declined in every quarter of 2023, revealing a discrepancy between the stock’s valuation and the company’s actual performance.

Consequently, Apple now faces a formidable journey to justify its valuation. In contrast, three other stocks within the “Magnificent Seven” cohort are not only more attractively priced but are also exhibiting superior growth potential, making them standout candidates for investment in 2024.

Compelling Alternatives to Apple Stock

Of the remaining six stocks, Alphabet, Amazon, and Meta Platforms emerge as more compelling investment opportunities.

While Alphabet and Meta Platforms are involved in diverse ventures, their primary focus remains on advertising. The latter part of 2022 and early 2023 witnessed a challenging period for the advertising industry. However, in Q3, both companies experienced a marked resurgence, fueling substantial growth in ad revenues (Meta’s ad revenue surged 24% to $33.6 billion, while Alphabet’s rose 9.4% to $59.6 billion).

The tailwinds that propelled these firms in Q3 are expected to persist through Q4 and well into 2024, positioning them for a robust performance throughout the year.

Amazon, while also navigating the advertising landscape, has been relatively insulated from the industry’s previous woes due to the nascent stage of its ad segment. However, with a burgeoning emphasis on high-margin segments and ads, Amazon’s evolving business model is witnessing a substantial transformation. This evolution is reflected in the remarkable rise of Amazon’s gross margins over the past decade, driven by robust performance in AWS (its cloud computing division), ad services, subscriptions, and third-party seller services.

Optimal gross margins are conducive to improved profit margins, a trend clearly evidenced at Amazon. As the company steadily turns the corner to establish itself as a consistently profitable entity, the outlook for Amazon in 2024 is exceedingly promising.

With these three stocks, the prevailing sentiment centers around the anticipation and optimism for the year ahead. On the other hand, Apple is weighed down by uncertainties regarding iPhone weaknesses. The choice becomes clear: the three alternatives are not only more appealing but also competitively priced.

From a forward-looking perspective, Meta Platforms and Alphabet are considerably cheaper in comparison to Apple. Historically, these two have traded within the same valuation range as Apple, signaling strong growth potential for their stocks in 2024.

Despite the challenges in making a direct comparison with Amazon, given its distinct business focus and its ongoing journey to optimize profits, it is evident that Amazon is also poised to outperform Apple significantly in the coming years, potentially surpassing its current profit margins.

Apple may have been the stock to own over the past decade, but superior options have emerged, making a compelling case to look beyond its waning appeal.

Should you invest $1,000 in Alphabet right now?

Before diving into Alphabet stock, it’s worth considering this: The Motley Fool Stock Advisor analysts have recently identified what they believe to be the ten best stocks for investors to purchase now, with Alphabet not making the cut. The stocks that did make the list hold the potential for substantial returns in the years ahead.

The Stock Advisor service provides investors with a user-friendly blueprint for success, offering guidance on portfolio-building, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has delivered returns more than triple that of the S&P 500.

Investors are overlooking the shadow cast by Apple and eagerly embracing the optimism surrounding these compelling investment opportunities. The allure of these options, coupled with their competitive pricing, presents a compelling case for investors to reassess their investment strategies for the year ahead.