General Motors GM delivered strong Q3 results this morning posting stellar growth and raising its full-year profit guidance.

Seeing a sharp post-earnings rally, GM shares spiked +9% in today’s trading session with Tesla’s TSLA stock down -0.3% ahead of its Q3 report after-market hours on Wednesday, October 23.

General Motors Q3 Results

Fueled by its North American operations, General Motors’ Q3 sales increased 10% year over year to $48.75 billion compared to $44.13 billion in the comparative quarter. This also surpassed Q3 sales estimates of $43.98 billion by 11%. More impressive, Q3 earnings spiked 30% to $2.96 per share versus EPS of $2.28 a year ago and crushed expectations of $2.49 a share by 19%.

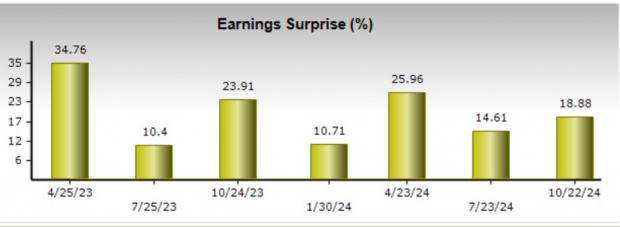

Notably, General Motors has surpassed the Zacks EPS Consensus for nine consecutive quarters posting an average earnings surprise of 17.54% in its last four quarterly reports.

Image Source: Zacks Investment Research

Extending the rally in GM shares on Tuesday was that General Motors now expects its full-year adjusted EPS in the range of $10.00-$10.50, and above the current Zacks Consensus of $9.92 per share or 29% growth.

Image Source: Zacks Investment Research

Tesla’s Q3 Expectations

Pivoting to Tesla, Q3 sales are thought to have increased 9% to $25.57 billion. On the bottom line, Tesla’s Q3 EPS is expected to dip -12% to $0.58 (Current QTR below) compared to $0.66 per share in the prior-year quarter.

Price cutting initiatives amid increased EV competition from legacy players such as General Motors and Ford F have weighed on Tesla’s near-term earnings outlook. Tesla’s annual EPS is now projected to dip to $2.25 versus $3.12 a share in 2023. However, FY25 EPS is forecasted to stabilize and rebound with projections at $3.02 per share.

Image Source: Zacks Investment Research

Tesla has missed earnings expectations in each of its last four quarterly reports posting an average EPS surprise of -7.99%. Still, the Zacks ESP (Expected Surprise Prediction) does indicate Tesla should reach its Q3 earnings expectations with the Most Accurate Estimate also having Q3 EPS pegged at $0.58.

Image Source: Zacks Investment Research

Recent Performance & Valuation Comparison

Year to date, GM shares have now soared nearly +50% to impressively outperform the broader indexes and Tesla’s -13%.

Image Source: Zacks Investment Research

Despite a very impressive YTD rally, GM still trades at just 4.9X forward earnings with TSLA at 97.3X. Although investors are still paying a noticeable premium for Tesla’s stock TSLA does trade at a discount to its decade-long median of 119.2X forward earnings and well below its extreme highs.

Tesla’s price-to-sales (P/S) ratio of 7X is closer to its 10-year median of 5.2X and nicely beneath the high of 23.8X during this period. Meanwhile, General Motors’ P/S ratio of 0.3X is pleasantly under the optimum level of less than 2X.

Image Source: Zacks Investment Research

Final Thoughts

Considering General Motors value, the post-earnings rally in GM shares could certainly continue. Furthermore, the leveling of Tesla’s valuation should bring back higher investor sentiment if the EV leader can deliver strong Q3 results as well.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report