Shares of Goodyear Tire GT gained 23% since the company reported third-quarter 2024 results. It reported third-quarter 2024 adjusted earnings per share (EPS) of 37 cents, surpassing the Zacks Consensus Estimate of 25 cents. The company reported EPS of 36 cents in the year-ago quarter.

The company generated net revenues of $4.82 billion, which declined 6.2% on a year-over-year basis and missed the Zacks Consensus Estimate of $4.98 billion due to lower replacement volume.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

In the reported quarter, tire volume was 42.5 million units, down 6.2% from the year-ago period’s levels.

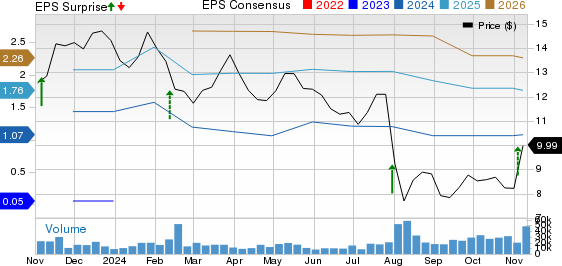

The Goodyear Tire & Rubber Company Price, Consensus and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Segmental Performance

In the reported quarter, the Americas segment generated revenues of $2.86 billion, which declined 8.4% year over year and missed our estimate of $2.97 billion due to lower replacement volume. The segment registered an operating income of $251 million, which fell 2.7% from the year-ago period’s figures. The operating income was hit by lower replacement volume, inflation and unfavorable price/mix and raw material costs. The figure also missed our expectation of $269.5 million.

Revenues in the Europe, Middle East and Africa segment were $1.35 billion, down 1.9% from the year-ago period’s levels due to the adverse impact of foreign currency exchange rates and lower replacement volume. The figure also missed our estimate of $1.37 billion. The operating income for the segment was $24 million, which rose 9% on a year-over-year basis due to the Goodyear Forward plan and improved net price/mix compared to raw material costs. The metric also surpassed our expectation of $19.4 million.

Revenues in the Asia Pacific segment fell 4.6% year over year to $618 million due to lower volume and missed our estimate of $681.4 million. The segment’s operating profit was $72 million, up 28.6% from the year-ago quarter’s figure due to the Goodyear Forward plan, improved net price/mix compared to raw material costs and lower net inflationary costs. The figure also topped our estimate of $69.2 million.

Financial Position

Selling, general & administrative expenses fell to $663 million from $673 million in the year-ago period.

Goodyear had cash and cash equivalents of $905 million as of Sept. 30, 2024, up from $902 million as of Dec. 31, 2023.

Long-term debt and finance leases amounted to $7.43 billion as of Sept. 30, 2024, up from $6.83 billion as of Dec. 31, 2023.

Capital expenditure in the first nine months was $912 million, up from $807 million reported in the year-ago quarter.

GT Revises 2024 Outlook

For full-year 2024, Goodyear now expects capital expenditures to be $1.20 billion, down from the previous estimate of $1.25 billion. It expects interest expenses to be $525 million and depreciation and amortization to be $1 billion.

Zacks Rank & Key Picks

GT currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto space are Dorman Products, Inc. DORM, Tesla, Inc. TSLA and BYD Company Limited BYDDY, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DORM’s 2024 sales and earnings suggests year-over-year growth of 3.66% and 51.98%, respectively. EPS estimates for 2024 and 2025 have improved 25 cents and 21 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for TSLA’s 2024 sales suggests year-over-year growth of 2.94%. EPS estimates for 2024 and 2025 have improved by 20 cents and 13 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for BYDDY’s 2024 sales and earnings suggests year-over-year growth of 23.61% and 31.51%, respectively. EPS estimates for 2024 and 2025 have improved by 23 cents and 26 cents, respectively, in the past seven days.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report