The “Magnificent Seven” symbolizes a league of tech titans, including powerhouses like Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, and Tesla. Despite its stature as the smallest, Tesla’s $700 billion market cap echoes its colossal influence.

While all Magnificent Seven companies hold merit for investment, Microsoft shines brightly. With $1,000 earmarked for investment and financial basics covered, Microsoft poses as a key contender for a place in your portfolio.

Microsoft: A Multifaceted Tech Marvel

Microsoft stands out in 2025 with its diversified business model, setting it apart from its tech peers. Unlike others reliant on specific products or services for success, Microsoft’s success weaves through various sectors, emphasizing its versatility.

- Apple: Rides the iPhone wave.

- Nvidia: Hinged on GPU sales.

- Alphabet: Thrives on Google ad revenue.

- Amazon: Flourishes through e-commerce.

- Meta: Leans heavily on digital ads.

- Tesla: Success tied to EV production and innovation.

Microsoft’s expansive business footprint, encompassing enterprise and consumer software, cloud services, gaming, social media, and hardware, illustrates its adaptive strength. Its dependence on individual segments remains moderate.

Microsoft’s Financial Fortitude

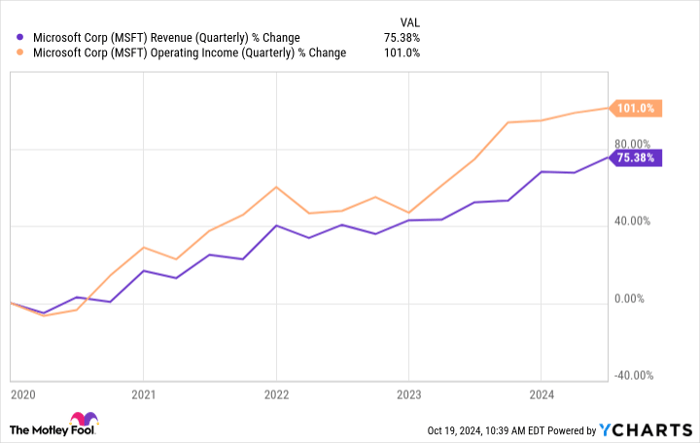

Microsoft’s fiscal prowess in recent years remains unparalleled. In the fourth quarter of fiscal 2024, revenue and operating income surged by 15% year-over-year, reaching $64.7 billion and $27.9 billion, respectively.

The company’s doubling of operating income in the past five years underscores its operational prowess. Azure, its cloud platform, emerges as a high-margin growth engine driving this success.

The burgeoning cloud computing sector spells continued growth for Microsoft. Even moderating growth rates would bolster its financial standing in the upcoming years.

Microsoft: Premium but Plausible for Long-Term Investors

Though bearing a premium tag, Microsoft’s stock trades at around 31.6 times forward earnings, well above the S&P 500 average. However, premium valuation is customary for unrivaled companies like Microsoft.

Shareholders receive value through dividends and stock buybacks, with a $0.83 quarterly dividend and a recently announced $60 billion buyback program. While not a bargain or income stock, Microsoft appeals to long-term investors for its enduring value.

A Second Shot at a Lucrative Venture

Ever regret missing the bus on top stocks? Then this is for you.

Occasionally, our expert analysts reveal a groundbreaking opportunity that you can’t afford to pass up.

Market Insights: The Double Down Phenomenon

The Power of “Double Down” Stocks

Imagine a scenario where investing in a stock is akin to placing a winning bet at the blackjack table. The thrill of doubling down on a promising stock early in its lifecycle can lead to monumental wealth creation. Such is the allure of “Double Down” stocks, where the potential for exponential gains fuels investor excitement.

Historical Success Stories

Looking back in time, iconic companies like Amazon, Apple, and Netflix stand out as prime examples of the rewards reaped by investors who seized the “Double Down” opportunity. A snapshot of the past reveals staggering returns:

- Amazon: An investment of $1,000 during the 2010 “Double Down” recommendation would have blossomed into a remarkable $21,294!

- Apple: Those who committed $1,000 following the 2008 “Double Down” call would now be sitting on a handsome $44,736!

- Netflix: Investors who heeded the 2004 “Double Down” advice with $1,000 would be astounded to find themselves holding a staggering $416,371!

The Current Landscape

As the investment world buzzes with anticipation, three exceptional companies are in the spotlight with fresh “Double Down” alerts. The overarching sentiment suggests that this moment holds the promise of significant growth and prosperity for savvy investors.

For those eager to explore further, the allure of potential riches beckons.

Unlocking Opportunity

While the investment realm is fraught with uncertainties, the allure of “Double Down” stocks adds a layer of excitement and potential for substantial financial gains. The key lies in recognizing ripe opportunities and seizing them before they slip away into the annals of missed chances.