Artificial Intelligence (AI) has dominated headlines and boardroom discussions for the past couple of years. The tech and business landscape is abuzz with AI chatter, from social media to corporate financial reports. For companies, AI offers the promise of increased efficiency and innovation. For investors, the field of AI presents a unique chance to ride the wave of technological advancement. If you have $3,000 to spare and a keen interest in tech stocks, allocating $1,000 into each of the following three AI companies could set you up for long-term gains.

1. Microsoft’s Strategic AI Vision

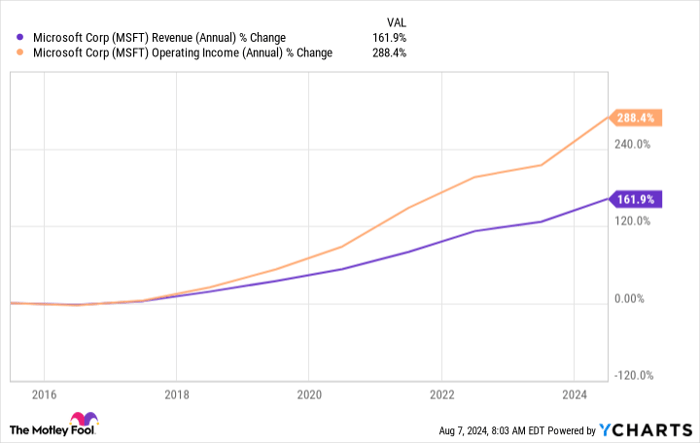

Microsoft (NASDAQ: MSFT) has strategically positioned itself in the realm of AI through a groundbreaking partnership with OpenAI, the brains behind the revolutionary ChatGPT. Opting for collaboration over in-house development, Microsoft leverages OpenAI’s AI prowess while OpenAI gains access to Microsoft’s Azure cloud platform. This synergy allows Microsoft to focus on integrating cutting-edge AI models into its existing suite of products and services, propelling its competitive edge and solidifying its financial standing.

In a tech landscape where competition is fierce, Microsoft’s move to incorporate AI seamlessly into its widely-used Office products and devices is a strategic masterstroke. By intertwining AI capabilities with its already-popular offerings, Microsoft charts a path towards sustained growth, aligning with its long-standing reputation for innovation and customer-centric solutions.

2. Apple’s Calculated AI Play

While others rushed to flaunt their AI prowess, Apple (NASDAQ: AAPL) took a deliberate stride with its AI strategy. Focused on user experience enhancement, Apple recently unveiled its bespoke AI offering, Apple Intelligence, tailored to complement its state-of-the-art hardware ecosystem. With hardware traditionally driving Apple’s revenue, the advent of Apple Intelligence aims to reinvigorate the brand and spark consumer interest, potentially offsetting stagnant revenue growth.

The impending release of AI-powered Apple products heralds a new era for the tech giant, as it seeks to leverage AI innovation to reinvigorate its market presence and reignite consumer excitement. With smartphones constituting a significant portion of Apple’s revenue, the integration of AI capabilities into its upcoming devices presents a strategic opportunity to propel financial performance and recapture market share.

3. CrowdStrike’s Cyber Resilience

Despite recent setbacks following a major software glitch, CrowdStrike (NASDAQ: CRWD) remains a formidable player in the cybersecurity realm. Renowned for its AI-driven security solutions, CrowdStrike continues to attract clients due to its robust endpoint protection capabilities. While recent challenges have dented its stock value, the fundamental strength of CrowdStrike’s product offering and its proven track record in cybersecurity bode well for long-term investors.

Amidst short-term uncertainties, CrowdStrike’s value proposition remains compelling, especially at its current discounted stock price. With cybersecurity representing a burgeoning market opportunity, CrowdStrike’s AI-centric approach positions it as a key player in safeguarding digital assets and combating cyber threats in the years to come.

Empowering Investment Decisions

As you consider opportunities in the AI sector, evaluating the long-term potential and strategic positioning of companies like Microsoft, Apple, and CrowdStrike is key to making informed investment decisions. Be it harnessing AI for product enhancement or fortifying cybersecurity defenses, these companies exemplify the transformative power of AI in driving business success and investor returns.

The Hunt for Hidden Gems: Unveiling the Top Stock Picks

Fans of the stock market were recently abuzz when the Fool Stock Advisor analyst team revealed its latest discoveries. Within their treasure trove of investment opportunities lie what they consider to be the 10 best stocks for investors right now. Surprisingly, the tech behemoth Microsoft did not make the cut. However, the chosen 10 are anticipated to yield monumental returns in the years ahead.

The Power of Historical Context

Looking back, the significance of such picks becomes even more evident. For instance, cast your memory to April 15, 2005, when Nvidia first appeared on a similar list. Had you heeded the advice and invested $1,000 back then, the stunning payoff today would amount to $668,029. A testament to the potential growth lurking in these recommended stocks.

An Analytical Goldmine

Guiding investors on their journey to financial success, Stock Advisor offers a roadmap to prosperity in the form of expert advice, portfolio construction tips, and bi-monthly stock recommendations. This service has outperformed the S&P 500 by leaps and bounds, boasting returns that have more than quadrupled the benchmark since its inception in 2002.

*Stock Advisor returns as of August 12, 2024