If you’ve caught wind of the recent tech buzz, artificial intelligence (AI) is practically inescapable. It’s become as pervasive as a summer hit song on the radio.

The AI craze has drawn in a swarm of investors looking to profit from this burgeoning sector. Consequently, stocks of numerous companies involved in AI have soared to record heights, with the likes of Nvidia, Microsoft, and CrowdStrike basking in the limelight. Yet, there’s one colossal tech player that remains woefully underrated among the crowd: Taiwan Semiconductor Manufacturing (NYSE: TSM). Despite TSMC’s stock climbing a noteworthy 65% this year, many investors are still overlooking its substantial long-term potential.

The Backbone of AI: TSMC Spearheads the AI Pipeline

TSMC holds the title of the world’s largest semiconductor foundry, commanding a commanding 61% share of the global semiconductor foundry market as of 2023. Distinguishing itself through a foundry model, TSMC customizes semiconductors (chips) based on clients’ specific requirements rather than generic sales.

To understand TSMC’s pivotal position in the AI pipeline, let’s trace back the process. Robust AI models utilized in natural language processing (consider OpenAI’s ChatGPT, Netflix recommendations, and Amazon’s Alexa) necessitate copious amounts of data for optimal performance. This data trove must be stored and processed in data centers, relying on high-performance AI chips and graphic processing units (GPUs) for efficient operation.

While Nvidia dominates the supply of high-performance AI chips and GPUs, TSMC emerges as the linchpin. Responsible for manufacturing the cutting-edge chips that power AI hardware for companies like Nvidia, TSMC reportedly controls approximately 90% of all AI chip production. Without TSMC’s chips, the AI infrastructure would endure substantial weakening, particularly at its current scale.

Prospects of Revenue Surge for TSMC

Primarily, TSMC derives its revenue from two primary sources: smartphones (38% of Q1 revenue) and high-power computing (46% of revenue).

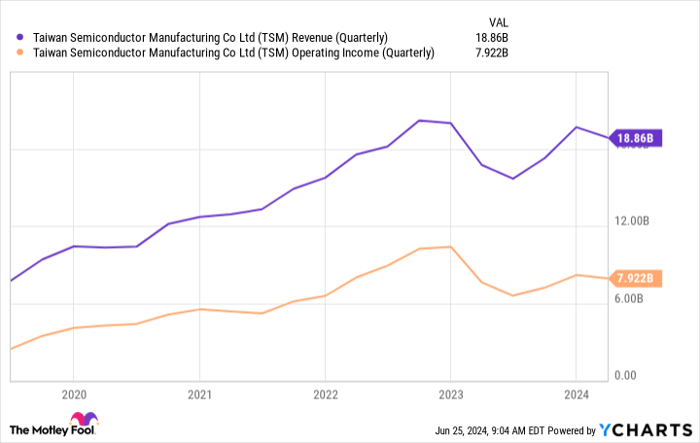

A recent dip in the global smartphone market directly impacted TSMC’s revenue, serving as a leading cause of its downturn in the first half of 2023. Although the company concluded the year on a strong note, it is yet to reclaim its pre-decline momentum fully.

Encouragingly, relief seems imminent. In the latest earnings call, TSMC’s CEO forecasted a doubling of AI-related revenue this year, constituting a “low-teens percentage” of the 2024 revenue. More impressively, he anticipated a 50% annual growth rate in AI-related revenue over the next five years, amounting to 20% of the overall revenue.

While smartphones remain a cornerstone of TSMC’s revenue (with Apple alone a substantial contributor), AI chips could offer a dual benefit for the chip manufacturer. Given the mounting demand, TSMC wields considerable clout and can leverage its market dominance to enhance its pricing power. The ability to hike prices without incremental costs could enhance its margins and bolster free cash flow.

The Price Conundrum: TSMC’s Steep Valuation

Despite my conviction in TSMC’s undervaluation, the stock’s valuation is deemed lofty by conventional metrics. Its price-to-earnings (P/E) ratio hovers around 32, notably exceeding its five-year average.

While TSMC’s stock may seem relatively expensive, its growth potential validates the premium. This justification transcends AI and its pivotal role in the burgeoning ecosystem.

An anticipated resurgence in the smartphone and PC markets should further boost TSMC’s financial standing. Coupled with its above-average dividend, investors have additional incentives to retain the stock for the long haul.

Is Taiwan Semiconductor Manufacturing a Worthy Investment?

Before diving into Taiwan Semiconductor Manufacturing stock, ponder over this:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe to be the next groundbreaking tech stock.

The Hidden Gems: A Closer Look at Stock Picks Unveiled

Missed Opportunities Amidst Promising Selections

Selecting the right stocks can be a make-or-break moment for investors. Yet, in the whirlwind of anticipated wonders and overlooked treasures, some opportunities slip through the cracks. Case in point: while the 10 best stocks to purchase now were being touted, it is revealed that Taiwan Semiconductor Manufacturing failed to clinch a spot among them. Nevertheless, the chosen ten showcase a potential for colossal returns in the imminent future.

A Glimpse into Past Triumphs

Reflecting on historical triumphs often proves enlightening. Consider the case of Nvidia, which found itself on a similar list on April 15, 2005. Imagine you had taken a daring leap and invested $1,000 based on this suggestion—your portfolio today would be soaring at an impressive $774,526!* The moral of the story? The past is not just a foreign country—it’s a treasure trove waiting to be discovered.

Stock Advisor: Shaping Success, Decade after Decade

Stock Advisor isn’t just another run-of-the-mill publication; it is a vital blueprint for investors across the globe. Providing a roadmap for success, with insights on crafting a robust investment portfolio, regular analyst updates, and unveiling two fresh stock picks every month, Stock Advisor has continued to stand the test of time. Remarkably, since its inception in 2002, this service has not merely outpaced but quadrupled the returns of the esteemed S&P 500, cementing its reputation as a beacon of hope for savvy investors.

Embracing the Call-to-Action

For those eager to delve deeper into the world of top stock picks and navigate the tumultuous waters of investment with confidence, a beckoning call-to-action awaits. Explore the mentioned 10 stocks with a fresh viewpoint, and perhaps uncover your own hidden gem among the financial markets. The landscape may seem daunting, but with informed guidance, the possibilities are endless.