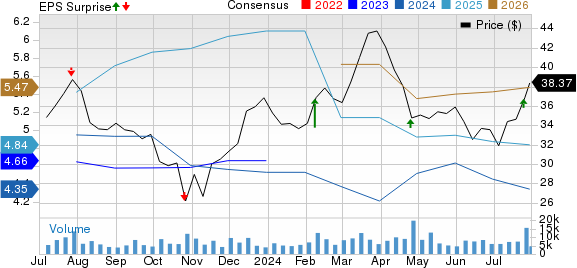

In a surprising turn of events, Harley-Davidson, Inc. (HOG) showcased an impressive surge of 13.3% post its second-quarter earnings release on Jul 25. The company’s stellar performance in both earnings and revenues sent waves of excitement among investors. Notably, the top and bottom lines have experienced a substantial increase from last year. Adding to the thrill is the announcement of a $1 billion share repurchase program that extends to 2026, garnering favor with stakeholders.

The second quarter of 2024 saw HOG beating the Zacks Consensus Estimate with adjusted earnings of $1.63 per share, marking a 34% increase from the previous year. The exceptional performance was primarily a result of higher revenues and operating income from the Motorcycles & Related Products segment. The company recorded consolidated revenues of $1.62 billion, up by 12% compared to the same period last year.

Segmental Performance

Harley-Davidson Motor Company: The Motorcycle and Related Products segment emerged as the star performer, witnessing a remarkable 13% revenue growth to $1.35 billion. Notably, motorcycle shipments worldwide surged by 16% to 49,700 units, surpassing all estimates. With motorcycle sales raking in $1.07 billion, a 20% increase from the previous year, the segment’s operating income climbed to $198 million, outstripping expectations.

During the quarter, the company faced a minor hiccup with a 3% decrease in global motorcycle unit retail, while North America sales dropped by 1%. However, in regions like EMEA, Asia Pacific, and Latin America, the performance was a mixed bag. Revenues from parts & accessories and apparel saw slight declines compared to the projections.

Harley-Davidson Financial Services: The financial arm saw revenues reach $264 million, marking a 10% increase from the previous year. Although operating income rose by 21%, it fell short of the estimated figures.

LiveWire: Noteworthy was the LiveWire segment, which witnessed an astounding 379% increase in shipments, totaling 158 units. Despite a slight revenue decline, the operating loss experienced a narrowing trend, albeit slightly wider than anticipated.

Financial Overview

In terms of financials, the company reported a rise in selling, general, and administrative expenses for the HDMC unit, while also shedding light on dividends paid out in the quarter. Harley-Davidson’s cash reserves stood at $1.85 billion as of Jun 30, 2024, displaying a significant increase from the previous year. Concurrently, the long-term debt showcased a decrease from the levels reported in Jun 30, 2023.

Future Projections

For the remainder of 2024, HOG has set expectations of revenue decline in the HDMC segment, coupled with specific operating income margin projections. The focus remains on stabilizing operations across various segments while remaining proactive in managing capital expenditures and operational losses.

Industry Insights

While Harley-Davidson’s performance takes center stage, notable competitors such as General Motors, Ford, and PACCAR Inc. have also unveiled their second-quarter results. Each company’s financial reports herald a unique narrative within the auto sector, providing diverse perspectives on the current market landscape.