Alphabet’s Recent Momentum

Technology powerhouse Alphabet Inc has been a hot topic of discussion in investment circles lately, with its stock registering an impressive 5% surge over the past month. One key driver of this uptrend is the growing interest in artificial intelligence.

Recent Developments Fueling Enthusiasm

A recent revelation by Benzinga Neuro that Sir Demis Hassabis, the head of Google’s AI arm, is spearheading the development of a research-focused AI model has ignited excitement. This model aims to enhance interdisciplinary cooperation and boost efficiencies in research endeavors.

Furthermore, Alphabet’s self-driving technology unit, Waymo, unveiled its latest sixth-generation hardware in late August. This innovative move is anticipated to cut costs and enhance performance, especially in challenging weather conditions like winters. Noteworthy projections by automotive research entity S&P Global Mobility indicate that autonomous vehicle sales in the U.S. may hit 230,000 units by 2034.

Surge in Trading Activity

Trading momentum in Alphabet’s stock, reflected through implied volatility (IV) in the options market for GOOG, has witnessed a significant uptick. The IV rank, a measure of current IV relative to the trailing 52-week average, soared from 28% to nearly 75% by the recent close.

IV signifies the market’s anticipation of price fluctuations, leading to elevated option premiums during high IV periods due to heightened demand.

The recent spike in GOOG trading activity is likely linked to Alphabet’s forthcoming third-quarter earnings report slated for October 22. While bullish trades dominate the scene, there are reports from Benzinga Insights indicating the presence of bearish sentiment among certain large players.

The Role of Direxion’s ETFs

The high-octane trading arena surrounding Alphabet presents a fertile ground for financial services firm Direxion. Its leveraged and inverse exchange-traded funds keyed into GOOGL provide traders with swift, directional plays on the tech behemoth.

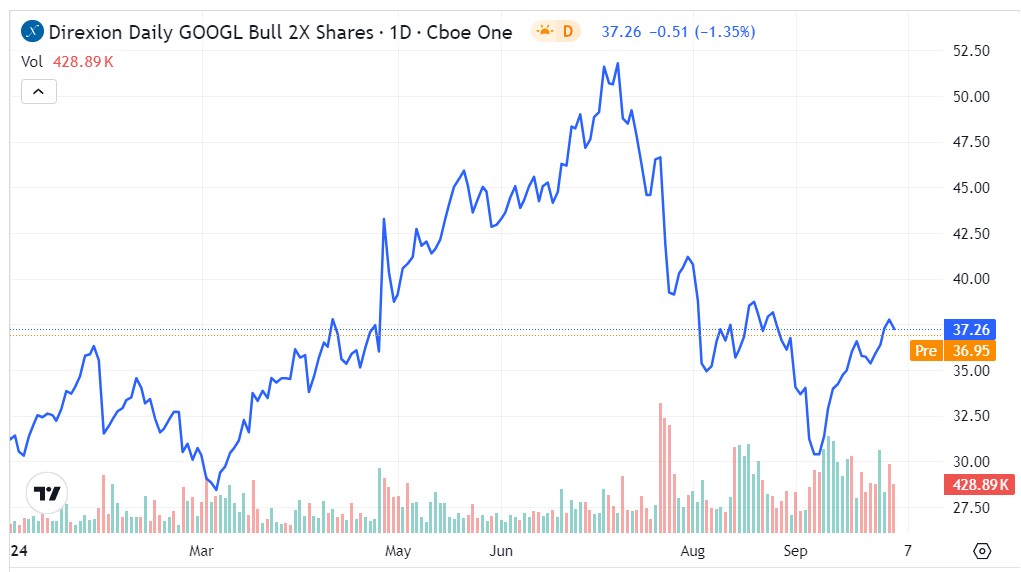

The Bullish Side – GGLL

Direxion’s GOOGL bull fund, the Daily GOOGL Bull 2X Shares (GGLL), has showcased robust performance, delivering over 19% in returns since the start of the year. Looking ahead to Alphabet’s Q3 disclosure, GGLL saw a commendable 23% surge since September 10.

- As anticipation builds for the impending litmus test, rising volume levels inject optimism among bullish traders.

- To attract potential speculators, GGLL needs to overcome the $38 resistance hurdle.

The Bearish Stance – GGLS

In contrast, Direxion’s GOOGL bear fund, the Daily GOOGL Bear 1X Shares (GGLS), has faced challenges, witnessing a 19% decline in value year-to-date.

- GGLS is currently trading below both its 50-day and 200-day moving averages, signaling a marked capitulation.

- Struggling to hold above the $14 support line, GGLS is at a critical juncture.

- Despite setbacks, GGLS has rebounded significantly from its yearly low of $12.34. Coupled with bearish options activity, pessimists are finding some solace in recent movements.

Credit for featured photo: AS Photography on Pixabay.