Unveiling Costco Wholesale

Come dive into the vast ocean of growth stocks and behold membership-only retail giant Costco Wholesale (COST). In a world of hypergrowth stocks, Costco stands as a beacon of resilience, having returned a staggering 556% over the last decade, outshining the S&P 500 Index by a wide margin.

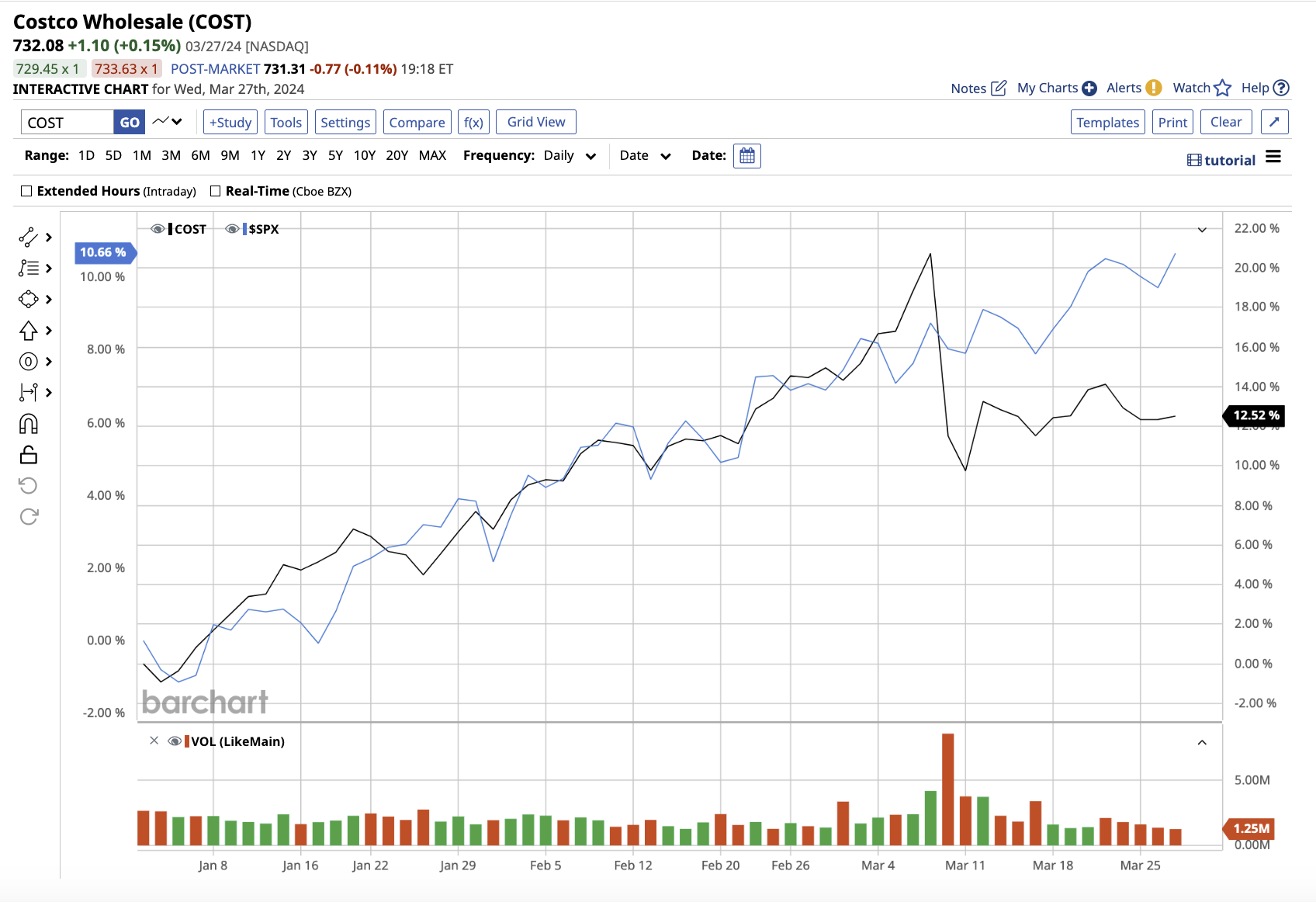

While AI plays may dazzle, COST stock has gained a respectable 11% year-to-date, beckoning patient investors with its steady growth trajectory.

The Membership-based Model

Costco’s genius lies in its membership-based business model, a win-win for both company and consumer. Individuals are offered bulk products at discounted rates, exclusive deals, and discounts. In exchange, the company rakes in a steady stream of revenue, tallying at $1.1 billion in the second quarter of fiscal 2024.

Costco’s global footprint boasts 875 warehouses and e-commerce sites across several countries, ensuring diversification and global growth avenues.

Growth Prospects and Financial Health

Analysts foresee a 4.9% revenue surge to $254 billion and a 12.4% rise in earnings for fiscal 2024. The coming year may see revenue and earnings leap by 7.2% and 9.3%, respectively.

Although COST stock may seem pricey next to Walmart’s valuation, its sturdy membership model and global reach position it as a steady ship amid turbulent waters, ripe for steady wealth-building.

Analyst Sentiments

Wall Street resoundingly echoes a “strong buy” sentiment for COST stock, with a slew of analysts endorsing its potential. The mean price target of $774.58 implies a 5.7% upside, while the high target of $905 hints at a promising 23.5% potential gain within the next year.

Sailing with Marvell Technology

As the AI realm burgeons, semiconductor maven Marvell Technology (MRVL) emerges as a beacon of innovation. With AI product demand on the rise, Marvell’s impact on high-performance networking solutions and advanced storage technologies is profound.

With a valuation of $62 billion, MRVL stock has surged 17.5% year-to-date, eclipsing broader market indices.

Marvell Technology Reports Strong Fourth Quarter Results

Bucking Trends with Financial Resilience

Marvell’s total revenue for the fourth quarter of fiscal 2024 defied expectations by climbing 1% year-on-year to $1.43 billion. Surpassing both company forecasts and Wall Street estimates, the company showcased financial resilience amidst a challenging economic landscape.

AI Driving Growth in Data Center Segment

CEO Matt Murphy attributed the remarkable performance to the robust growth in the data center end market revenue, seeing a significant 38% sequential rise and a substantial 54% year-over-year increase, primarily fueled by advancements in artificial intelligence technology.

Forecasting Through Near-term Challenges

Despite anticipating soft demand affecting consumer, carrier infrastructure, and enterprise networking in the near term, Marvell’s management remains optimistic about continued sequential growth in the data center segment. The company foresees a temporary setback in the first quarter of fiscal year 2025, with expectations for a rebound in performance by the second half of the fiscal year.

Analysts’ Projections and Market Outlook

Analysts predict a slight decline in revenue and earnings for fiscal 2025, followed by a notable resurgence in both metrics for fiscal 2026. Trading at 29 times forward earnings and eight times forward sales, Marvell’s stock is considered reasonably valued, especially given the company’s promising prospects in the artificial intelligence sector.

What Are Analysts Saying About MRVL Stock?

Following the stellar Q4 results, Wall Street analysts have expressed growing confidence in Marvell’s stock. Stifel Nicolaus analyst Tore Svanberg reaffirmed his “buy” rating on the stock, setting a price target of $86. Overall, sentiment on the Street towards MRVL stock is overwhelmingly positive, with the majority of analysts recommending it as a “strong buy.” Expectations for the stock’s performance indicate a potential upside of nearly 24%, with a high target price projecting an even more significant increase over the next year.