Unearthing Undervalued Gems

Even in a market swirling with euphoria and breaking all-time records, there still lie hidden treasures – undervalued stocks waiting to be plucked. As fresh funds are continuously funneled into the market, the wise eye spots a collection unparalleled in value.

1. PayPal: Unveiling the Diamond in the Rough

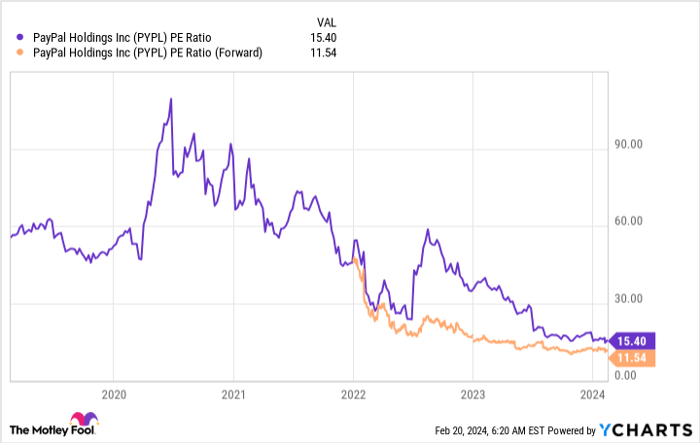

PayPal (NASDAQ: PYPL) shines as one of the brightest stars among undervalued stocks. Despite a robust 9% increase in revenue and an impressive 61% surge in earnings per share in the last quarter, the market unjustly overlooks its growth potential. Trading at a mere 11.5 times forward earnings, this sleeper stock is a hidden gem begging to be claimed.

2. MercadoLibre: More Than Just an Echo of Amazon

MercadoLibre (NASDAQ: MELI), often likened to the “Amazon of Latin America,” boasts a diversified portfolio extending beyond e-commerce. With a striking 76% and 61% YoY growth in revenue for its commerce and fintech segments respectively, MercadoLibre’s expansion knows no bounds. Trading at a modest 6.8 times sales, this stock presents an irresistible opportunity.

3. Airbnb: The Unstoppable Force

Airbnb (NASDAQ: ABNB) stands as a testament to resilience, defying odds and hurdling every challenge in its path. With a remarkable 17% uptick in Q4 revenue and a notable increase of 12% in booked experiences, Airbnb remains an undervalued powerhouse trading at a mere 26 times free cash flow. Predicting a robust future, Airbnb’s massive buyback program speaks volumes of its confidence in the company’s trajectory.

4. dLocal: The Unsung Hero

dLocal (NASDAQ: DLO) may not command the spotlight, but its provision of payment services in emerging markets like Indonesia and India has garnered widespread acclaim. With a staggering 47% surge in revenue and a bright profit outlook, dLocal’s stock price of 21 times forward earnings paints a tantalizing picture of exponential growth.

5. Visa: The Ever-Sturdy Giant

Visa (NYSE: V) stands as a beacon of stability in the credit card processing realm. Marking a formidable 9% revenue growth and a 20% increase in EPS for the fiscal first quarter of 2024, Visa’s valuation at 32 times earnings presents a rare buying opportunity. With a track record of consistent growth and profitability, Visa remains an essential inclusion in any discerning investor’s portfolio.

When on the lookout for promising investments in the current market frenzy, these five undervalued growth stocks offer a ray of hope amidst the chaos. Seize the opportunity before the market awakens to their true potential.