Last year, the world experienced a seismic shift in the realm of artificial intelligence (AI). Companies entrenched in this niche emerged as stock market darlings, propelled by phenomenal growth figures. Despite chatter about an “AI bubble,” experts predict that the AI industry will inject over $15 trillion into the global economy by 2030, setting a towering stage for innovation and economic advancement.

The Meteoric Rise of Nvidia

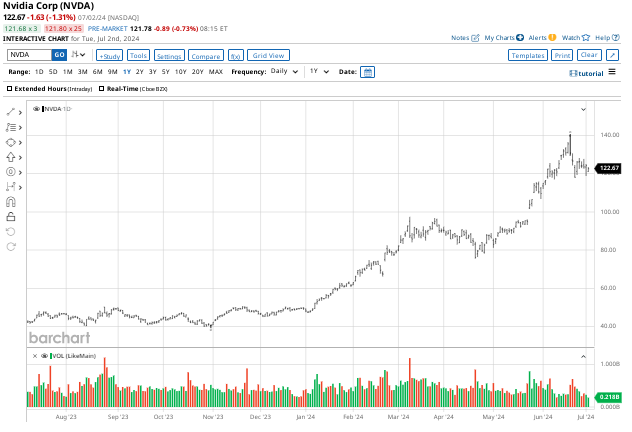

Enter Nvidia Corp (NVDA), the vanguard of the AI revolution. In 2023, NVDA shares catapulted by a staggering 238%, solidifying its dominance. The momentum continued with a 159% surge in the first half of 2024. Over five years, the stock soared by a mind-boggling 2,827%, recently breaching the $3 trillion market cap milestone.

Seizing Opportunities Amid Market Corrections

Despite recent fluctuations – with NVDA stock correcting by about 12% – seasoned investors like Rep. Nancy Pelosi seized the moment, signaling confidence in the company’s trajectory by acquiring 10,000 shares in late June.

Innovations and Growth Trajectory

Challenges loom, particularly in the realm of AI chip scarcity and the encroaching competition from rivals like Advanced Micro Devices. Nevertheless, market analysts maintain an optimistic outlook on Nvidia, consistently revising their price targets upwards.

Nvidia’s Stock Split

The successful 10-for-1 stock split on June 10 saw NVDA shares becoming more accessible to a wider investor base. This move, while adjusting the per-share price, left the company’s valuation untouched, opening doors for new entrants to partake in the Nvidia narrative.

Impressive Earnings Performance

Nvidia’s stellar financial performance continues to dazzle stakeholders. Bolstered by a 262% revenue surge year-over-year, reaching $26 billion in Q1 of fiscal year 2025, the company boasts a robust 75% gross margin. Their ambitious growth figures over the past half-decade underscore Nvidia’s financial resilience and promising future.

Dominance in the AI Chip Sector

Nvidia’s foray into next-generation AI chips with the Blackwell architecture signifies a quantum leap in AI capabilities. These cutting-edge GPUs with 208 billion transistors redefine the AI landscape, propelling Nvidia’s market share to a commanding 80%, a realm fortified by strategic partnerships with tech behemoths investing heavily in Nvidia’s AI prowess.

Ebullient Analyst Expectations

Wall Street pundits remain exuberant about Nvidia, with an average “strong buy” rating and a mean price target suggesting a 4.4% upside potential. Projections hint at Nvidia’s EPS ascending to $3.17 by 2026, bolstered by its robust foothold as a premier AI chip manufacturer.