Historical Insights

The Nasdaq Composite, symbolized by the NASDAQINDEX: ^IXIC, embraced a rejuvenated bull market 17 months ago, making a striking 68% advancement. Intensive scrutiny of historical data, however, suggests that the technology-centric index may have more room to soar. Delving into history reveals that during past bull markets since 1990, the Nasdaq enjoyed an average surge of 215%, unfolding over an average duration of 40 months.

If the current upward surge mimics past patterns, another 147% upswing could be in the cards over the next two years. Although a yearly return of 57% may seem far-fetched, prudent investors may find solace in the belief that the Nasdaq’s trajectory remains pointed skyward.

1. Alphabet’s Growth Engines

Alphabet, represented by ticker symbols NASDAQ: GOOG and NASDAQ: GOOGL, boasts two pivotal sources of growth: digital advertising and cloud computing. With Google as its spearhead, Alphabet reigns as the globe’s largest ad tech powerhouse due to its capacity to captivate consumers and harvest data. Empowered by products like Google Search, Chrome, and YouTube — reaching 2 billion users monthly — the company efficiently aggregates data, aiding advertisers in crafting effective campaigns.

Further solidifying its stance is the Google Cloud Platform (GCP), the third-largest cloud infrastructure and platform services provider. Despite trailing behind Amazon Web Services and Microsoft Azure, Alphabet carved out a 1% increase in market share over the past year. This trend is poised to continue as businesses channel investments into artificial intelligence (AI). While Microsoft currently leads in generative AI, Alphabet’s deep-rooted AI expertise is not to be underestimated.

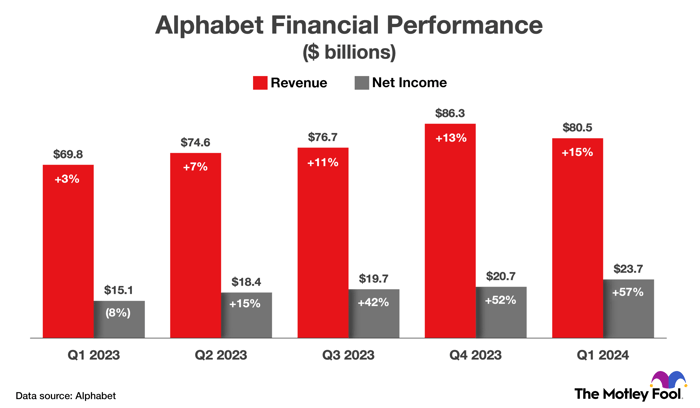

Alphabet unveiled a fourth consecutive acceleration in revenue and net income growth in Q1. Revenue surged by 15% to $80.5 billion, driven by robust growth in Google Cloud. The tech giant also reported a 57% spike in GAAP net income to $23.7 billion, underpinned by stringent cost management.

Looking ahead, analysts foresee Alphabet’s earnings per share scaling at a 17% rate yearly over the next three to five years. Despite its current P/E ratio of 26.8 times earnings, slightly above the three-year norm of 24.6, Alphabet’s potential to outshine the Nasdaq Composite in the next half-decade remains plausible — mirroring its past triumphs.

2. The Fortunes of CrowdStrike

CrowdStrike delivers a repertoire of over two dozen cybersecurity products via a unified platform. Renowned as a vanguard in endpoint security software and MDR services, the company extends its reach across various end markets. CrowdStrike commands a burgeoning share in domains like cloud security, identity protection, and SIEM, driven by cutting-edge AI capabilities and unique engineering that bifurcate its platform as the cybersecurity realm’s “most streamlined and rapid-deploy technology.”

In Q4, CrowdStrike recorded formidable financial performance, marked by a 33% revenue uptick to $845 million and a 102% surge in non-GAAP net income to $0.95 per diluted share. CEO George Kurtz accentuated customer preference for the platform’s consolidated approach. Businesses’ favorability towards Falcon for cloud security, identity protection, and LogScale SIEM solutions signals a broad embrace of Falcon as the go-to solution.

The company’s foray into new products like Falcon for IT and Charlotte AI has depicted promising momentum. Falcon for IT expands CrowdStrike’s market reach into observability by addressing facets like compliance and performance monitoring. Charlotte AI caters to the surging automation demand, further broadening the company’s offerings.

Looking forward, CrowdStrike finds itself propelled by several affirming trends, including the relentless sophistication of cyberattacks and the enduring prevalence of legacy antivirus systems that inadequately detect malicious software.

The Cybersecurity Conundrum: CrowdStrike’s Resilience Amidst Market Volatility

The Rise of Cybersecurity Investments

In the ever-evolving landscape of technology and data protection, the demand for robust cybersecurity solutions has skyrocketed. Companies are increasingly prioritizing the implementation of effective cybersecurity measures, especially platforms that streamline and consolidate products to enhance overall security.

CrowdStrike’s Financial Outlook

Wall Street analysts have set their sights on CrowdStrike, projecting a robust 29% annual revenue growth over the next five years. This optimistic consensus estimate appears to justify the current valuation of CrowdStrike at 28 times sales. The company has demonstrated remarkable resilience, surpassing the Nasdaq Composite’s returns twofold in the past three years.

Investing in Alphabet: A Contrarian View

Before diving into investment decisions regarding tech giants like Alphabet, it’s essential to consider all perspectives. Despite Alphabet’s prominence, the Motley Fool Stock Advisor recently highlighted ten alternative stocks that they believe hold greater potential for substantial returns in the foreseeable future. Notably, choosing the right stock at the right time has historically led to outstanding gains. For instance, recalling when Nvidia appeared on a similar list in 2005, an initial investment of $1,000 could have blossomed into an impressive $652,342 over time.

The Stock Advisor service empowers investors with a step-by-step roadmap to success, offering insights on portfolio construction, regular analyst updates, and bimonthly stock picks. Remarkably, the service has outperformed the S&P 500 by more than fourfold since its inception in 2002, underscoring its credibility and track record of success.

Looking Ahead

Amidst the ever-changing landscape of technology and investments, astute decisions often hinge on thorough research, strategic insights, and a nuanced understanding of market dynamics. While CrowdStrike shines as a stalwart player in cybersecurity, the lure of potential returns from lesser-known stocks cannot be discounted.

As historical anecdotes and market trends reveal, the intersection of opportunity and foresight can pave the way for exceptional financial growth. In navigating the complexities of the investment world, discerning investors are primed to seize promising opportunities and navigate the turbulent waters of the market.