Reflecting on the annals of stock market history, the Nasdaq has stood the test of time for nearly five decades. A resilient entity, the index has weathered the storms of the financial world, facing negative annual returns merely 14 times. Noteworthy dips in the last two decades, particularly in 2002, 2008, and most recently, 2022, saw the Nasdaq plummet by more than 30%.

Interestingly, following the troughs of 2002 and 2008, the Nasdaq catapulted into consecutive years of growth. Basking in a surge between 2003 and 2007, the index boasted an average annual return of 16%. Akin to this, the subsequent years of 2009 and 2010 painted a picture of unabated prosperity with the index delivering average returns of 30%.

Portentous Beginnings of 2024

Despite the tribulations of 2022, the Nasdaq rebounded resoundingly in 2023, boasting an impressive return of 43%. The resurgence was notably orchestrated by the frenzy surrounding artificial intelligence (AI) that cast a favorable light on tech stocks.

The current landscape in 2024 forebodes promising prospects, hinting at further advancements for savvy investors. Clutching the reins of this tech revolution are the “Magnificent Seven” stocks, heralded for their AI-driven momentum and underpinning the potential for untapped growth.

The Reign of Amazon

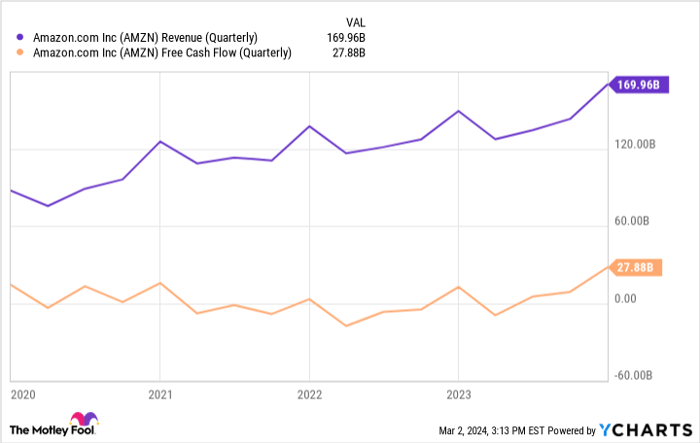

Starting off the roster is Amazon, a venerable titan recognized for its prowess in e-commerce and cloud computing realms. Amazon’s recent years have been fraught with challenges as inflation and surging interest rates constricted its core operations.

Nevertheless, in a bid to reignite growth, Amazon executed strategic maneuvers throughout 2023. Noteworthy among these was a multibillion-dollar investment in Anthropic, a competitor to OpenAI. This partnership is set to elevate Amazon Web Services (AWS) by leveraging generative AI models, portending a renaissance across facets like e-commerce, streaming, logistics, and advertising within Amazon’s domain.

Amidst Amazon’s strategic evolution, its current price-to-sales (P/S) ratio of 3.1 offers a poignant allure, presenting a propitious moment for astute investors to partake in the narrative of this clandestine AI protagonist.

Sailing with Microsoft

Microsoft emerges as a prominent flagbearer in the AI revolution, setting the stage ablaze with its investment in OpenAI and the advent of ChatGPT. Propelled by this foray into AI, Microsoft seamlessly integrated ChatGPT across its Windows operating ecosystem.

Parallel to Amazon, Microsoft’s Azure cloud platform emerges as a bastion of growth prospects with AI at the helm. Notwithstanding, a note of caution resonates concerning Microsoft’s valuation metrics, exemplified by a forward price-to-earnings (P/E) multiple of 35.5. Diverging from its peers, Microsoft commands a premium valuation, indicative of market expectations surrounding the latent power of AI.

Inspite of this premium valuation, the nascent stages of AI beckon Microsoft towards long-term dominance, fostering a landscape where investors prioritize innovation and technological prowess. Hence, the tide may be ripe for investors to consider boarding the Microsoft ship on its journey towards a tech-prominent horizon.

Exploring Tech Stocks: Alphabet, Meta Platforms, and Nvidia

The Reinvention of Alphabet

Alphabet (NASDAQ: GOOG, NASDAQ: GOOGL) stands as a digital colossus, reigning over the cyber realm with its prized possessions – Google and YouTube. While it captures the digital essence, a rising tide of social media platforms like TikTok and Instagram threatens its advertising empire. This assault on its core moneymaker has dented investor optimism, causing Alphabet’s stock to shudder. Yet, despite this tempest, Alphabet’s foray into cloud computing bears fruit, offsetting the ad business’s slowdown.

Meta Platforms’ Metamorphosis

Meta Platforms (NASDAQ: META) nurtures a stable of digital gems, including Instagram and Facebook. It once set sail for the promising shores of the metaverse but encountered stormy seas with shrinking ad revenues and ballooning losses. However, Meta’s recent course correction has seen sales and cash flow soar, prompting it to reward stakeholders generously with share buybacks and dividends. As artificial intelligence infuses its ventures, Meta looks poised for a profitable voyage into the smartphone kingdom.

Nvidia: The AI Vanguard

Nvidia (NASDAQ: NVDA) commands the AI battleground with its cutting-edge GPUs, pivotal to the AI narrative. Its A100 and H100 GPUs stand as the cornerstones of generative AI, propelling it to heights unimagined. What sets Nvidia apart is the ubiquitous AI integration across its businesses – from data centers to software. Fuelled by its burgeoning profits, Nvidia ventures into uncharted AI territories like voice recognition software and robotics, armed to conquer new frontiers.

Riding the Nvidia Revenue Wave: A Promising Investment Opportunity

The Momentum of Nvidia’s Market Cap Surge

Since the dawn of modern finance, few meteoric rises in market cap have matched the crescendo of Nvidia’s ascent, which has burgeoned by $1 trillion within a mere year. Such an unprecedented surge doesn’t merely beckon attention; it commands it with an authoritative gusto, like a maestro orchestrating a symphony of fiscal triumph. As investors ponder the significance of this monumental climb, the resounding question that echoes through trading floors and boardrooms alike is whether this bullish momentum can sustain its fervor.

The Robust Outlook and Warranted Valuation

Peering into the crystal ball of Nvidia’s future, the augurs see a landscape teeming with promise. With a robust outlook that stretches like an expansive horizon, painting the canvas of the next several years with hues of growth and opportunity, Nvidia stands poised at the precipice of greatness. As numbers dance across spreadsheets and algorithms hum with calculated precision, the valuation of this tech behemoth appears not just justified, but necessary—a price tag worn with pride, akin to a badge of honor earned through grit and innovation.

The Corners of Investment Wisdom

Amidst the hustle and bustle of the stock market arena, whispers of sage advice flutter like autumn leaves caught in a gentle breeze. For those eyeing Nvidia with a keen sense of curiosity tinged with ambition, the age-old question of “To invest or not to invest” looms large. As the landscape of investment opportunities unfolds, some herald Nvidia as a shining star in the constellation of tech giants, a beacon of hope in an often tumultuous sea of financial uncertainty. Dare we take the plunge and ride the waves of Nvidia’s revenue to shores of prosperity?