Homebuilder stocks soared to unprecedented heights on a rate-cutting spree driven by a cheery inflation report that solidified expectations for imminent interest rate slashes in September.

The slight drop in the Personal Consumption Expenditure (PCE) price index from 2.6% year-on-year to 2.5% in June 2024, in line with predictions, played a major role in fueling the surge.

The

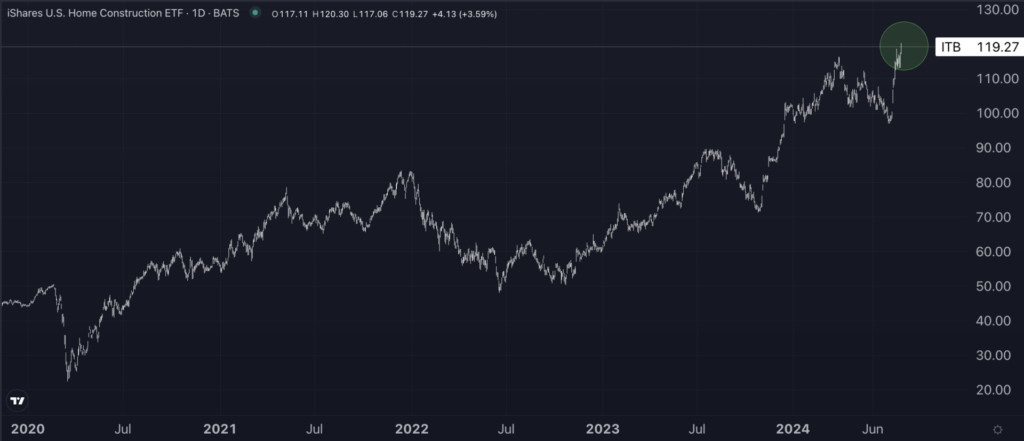

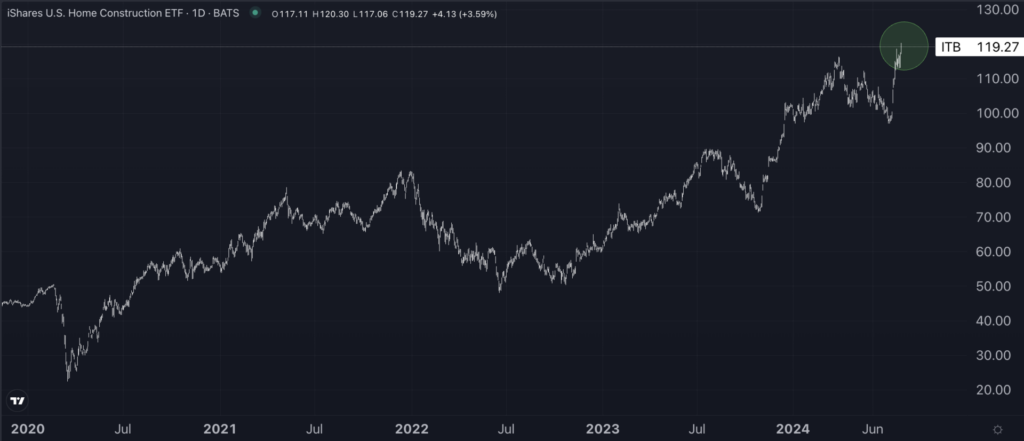

Chart: U.S. Home Construction ETF Surges to Unparalleled Heights

In the last three weeks, U.S. homebuilder stocks have surged by over 20%, fuelled by the expectation of reduced interest rates positively impacting sectors sensitive to rate changes like home construction.

Market players are now fully pricing a Federal Reserve rate cut in September, foreseeing at least one more reduction by December 2024.

Bank of America’s analyst, Rafe Jadrosich, emphasized, “Homebuilders are trading at the high-end of the historical valuation range, justified by higher return-on-equity (ROE). On average, we forecast a 22% return-on-equity compared to the 2019 level of 20%.”

Bank of America’s spotlight on historical valuation levels in 2018 and 2021, triggering sharp pullbacks as the Fed hiked rates, offers context. However, the investment bank underscores a different outlook in the latter half of 2024, with potential Fed rate cuts on the horizon.

Underlining the positive sentiment, Bank of America upgraded Mohawk Industries, Inc. (MHK) from Underperform to Buy on Friday, significantly raising their price target in the wake of better-than-anticipated Q2 2024 earnings.

Top-Performing Homebuilder Stocks in July 2024

The top ten best-performing stocks in the U.S. Home Construction ETF this month include:

| Name | Price Change % (Month-to-Date) |

| Mohawk Industries, Inc. | 37.16% |

| M/I Homes, Inc. (MHO) | 35.92% |

| Green Brick Partners, Inc. (GRBK) | 31.50% |

| American Woodmark Corporation (AMWD) | 28.44% |

| Dream Finders Homes, Inc. (DFH) | 27.42% |

| JELD-WEN Holding, Inc. (JELD) | 26.80% |

| Installed Building Products, Inc. (IBP) | 26.65% |

| D.R. Horton, Inc. (DHI) | 26.29% |

| Tri Pointe Homes, Inc. (TPH) | 26.26% |

| Century Communities, Inc. (CCS) | 26.05% |

Latest Mortgage Rates and Housing Market Data

The Mortgage Bankers Association reports a 5-basis point drop in the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $766,550 or less to 6.62% for the week ending July 19, 2024.

Despite the decline in borrowing costs, other housing market indicators paint a gloomy picture.

Homebuilder confidence slid to 42 in July, registering its lowest reading of the year, according to Bank of America.

Chief economist for LPL Financial, Jeffrey Roach, remarked, “The low inventory of homes and high interest rates have led to affordability issues hitting near-term lows.”

The National Association of Realtors observed a substantial 5.4% drop in existing home sales for June, marking the steepest monthly decline since 2022.

Additionally, the U.S. Census Bureau revealed a 0.6% decrease in new single-family home sales month-over-month, adjusted to an annual rate of 617,000 in June 2024, the lowest in seven months, falling short of forecasts at 640,000, due to persistently high prices affecting affordability.

The median sales price of existing homes climbed 4.1% year-on-year, hitting a fresh record high.

Now Read: