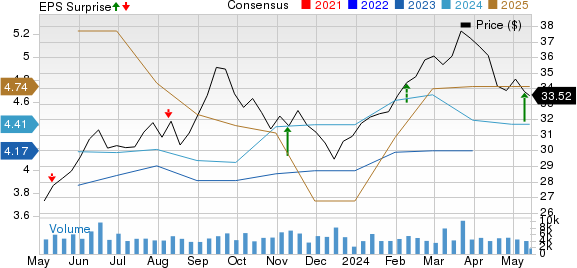

Honda (HMC) surprised investors by reporting earnings of 99 cents per share for the fourth quarter of fiscal 2024, exceeding the Zacks Consensus Estimate of 44 cents. This impressive bottom line growth from the previous year’s profit of 51 cents per share showcased Honda’s resilience and agility in a competitive market. Despite missing revenue estimates by reaching $36.5 billion, down from the Zacks Consensus Estimate of $37.9 billion, the company demonstrated admirable improvement from the $33.1 billion recorded in the year-ago period.

Segmental Performance Breakdown

The performance of Honda’s segments shed light on the company’s strategic direction and operational prowess. In the Automobile segment, quarterly revenues surged by 25.3% year over year to ¥3.59 trillion ($24.22 billion), outpacing projections on the back of robust sales across major end markets. Operating profit for the segment soared to ¥100.1 billion ($674 million), reflecting a remarkable 177.3% increase from the corresponding quarter of fiscal 2023.

Revenues from the Motorcycle segment also stood strong at around ¥862.1 billion ($5.81 billion), marking a 22% year-over-year growth, fueled by increased sales in various markets. The segment’s operating profit of ¥144.7 billion ($975 million) comfortably surpassed expectations, exemplifying Honda’s effective operational management.

Honda’s Financial Services segment experienced a significant revenue increase to ¥862.6 billion ($5.81 billion), outperforming predictions due to improved sales performance in multiple markets. The segment’s operating profit rose by 5.6% year over year to ¥69.1 billion ($465 million), displaying Honda’s ability to navigate challenging economic conditions.

Conversely, the Power Product and Other Businesses segment recorded a slight revenue decline at ¥109.4 billion ($736 million). Despite the decrease, the segment’s revenues exceeded forecasts, showcasing Honda’s adaptability in managing diverse business lines. The segment reported an operating loss of ¥8.3 billion ($56 million), portraying a nuanced operational challenge that the company seeks to address.

Financial Overview

As of March 31, 2024, Honda held consolidated cash and cash equivalents of ¥4.95 trillion ($32.73 billion). The long-term debt increased to around ¥6 trillion ($40.2 billion), indicative of strategic investment and financial decision-making by Honda’s leadership team.

In terms of shareholder returns, Honda’s dividend for fiscal 2024 increased to ¥68/share, up from ¥40 in fiscal 2023. The company also engaged in substantial share repurchases, with ¥250 billion shares bought back in fiscal 2024 and plans to repurchase ¥300 billion in stock in fiscal 2025. Additionally, Honda will distribute an interim and year-end dividend of ¥34/share each in fiscal 2025, rewarding investors and enhancing shareholder value.

Looking Ahead to Fiscal Year 2025

Honda’s forecasts for fiscal 2025 anticipate sales volumes of 13.06 million units from the Motorcycle segment, 2.97 million units from the Automobile segment, and 3.66 million units from the Power Products segment. Despite varied growth projections across segments, with Motorcycles and Automobiles expected to increase by 7% and 4% year over year respectively, the Power Product Unit sales are predicted to decline by 4% in fiscal 2025.

Revenue projections for fiscal 2025 stand at ¥20.3 trillion, representing a marginal decline of 0.6% year over year. Operating profit is estimated to reach ¥1.42 trillion, indicating a modest growth of 2.8% from the previous fiscal year. However, pre-tax profit is forecasted to decline to ¥1.5 trillion, reflecting a drop of 8.7% year over year, highlighting the complex financial landscape in which Honda operates.

While Honda retains a Zacks Rank #3 (Hold) designation, the company’s financial performance underscores its resilience and adaptability in a dynamic market environment. Amidst macroeconomic challenges and industry headwinds, Honda’s strategic initiatives and operational efficiency place it in a position of strength moving forward.

Comparative Performance with Other Automakers

In comparison to other legacy automakers, Honda’s financial performance in the fourth quarter of fiscal 2024 positions it as a formidable player in the industry. General Motors (GM) reported solid first-quarter results, with adjusted earnings exceeding expectations and showcasing growth from the previous year. Ford (F), while reporting a decline in earnings from the year-ago quarter, demonstrated resilience in revenue generation and strategic cash management.