Market turbulence has not deterred Alibaba Group Holding Limited (HK:9988), as the behemoth recently completed a substantial share buyback totaling $5.8 billion in the first quarter of FY25 (ending June 30, 2024). This move comes amidst a tempestuous selloff that saw a 2.3% reduction in outstanding shares. In response, Alibaba’s Hong Kong-listed shares surged by 3% in today’s trading session, reflecting the market’s approval of the strategic maneuver.

The past year has not been kind to Alibaba’s stock, with a 13.4% slide over the last 12 months, leaving investors in the lurch.

Hailing from China, Alibaba stands out as a tech giant renowned for its expansive online marketplace.

Unveiling Alibaba’s Buyback Initiative

Alibaba’s buyback saga is part of an ongoing program equipped with a $26.1 billion war chest, slated to run until Q1 of 2027. The recent buyback of $5.8 billion eclipsed the preceding quarter’s figure of $4.8 billion, showcasing an upward trajectory. Notably, the tech titan doubled down on repurchases in Q1 FY25 compared to the $2.9 billion spent in the quarter culminating on December 31, 2023.

During FY24, Alibaba executed share repurchases amounting to $12.5 billion, effectively shearing 5% off its total share count.

In a clever financial ballet, Alibaba secured $5 billion through convertible bond issuance earlier in May, primarily earmarked for financing the ongoing buyback spree. Juggling significant share repurchases while nurturing investments in budding domains like generative artificial intelligence (AI) typifies the tightrope walk the company currently treads.

Assessing Alibaba’s Viability as an Investment

The backdrop for Alibaba in 2023 was fraught with challenges, ranging from dwindling domestic sales to intensified market competition and uncertainties surrounding its plans for business unit spin-offs. The current year hasn’t been a cakewalk either, with Alibaba’s shares on a continuous downward trajectory, casting a shadow on its recovery prospects. Despite the gloomy outlook, analysts maintain a cautiously optimistic stance on the stock.

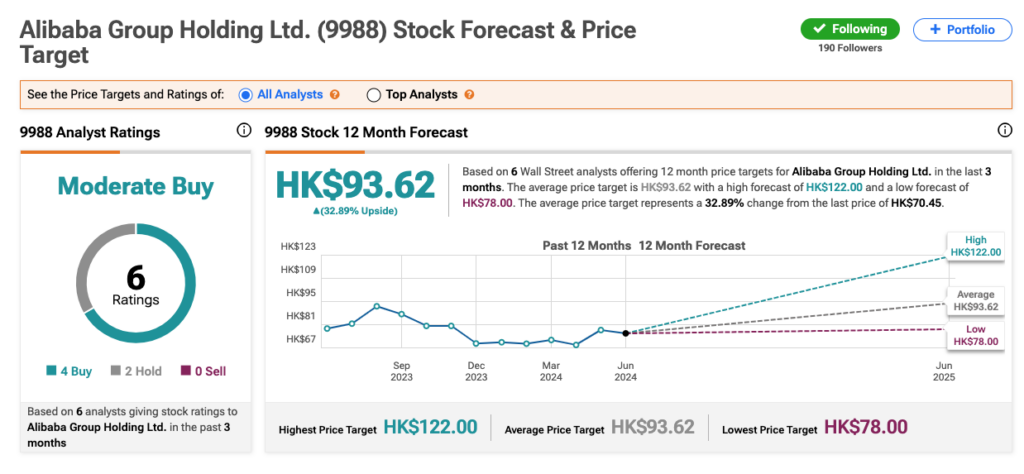

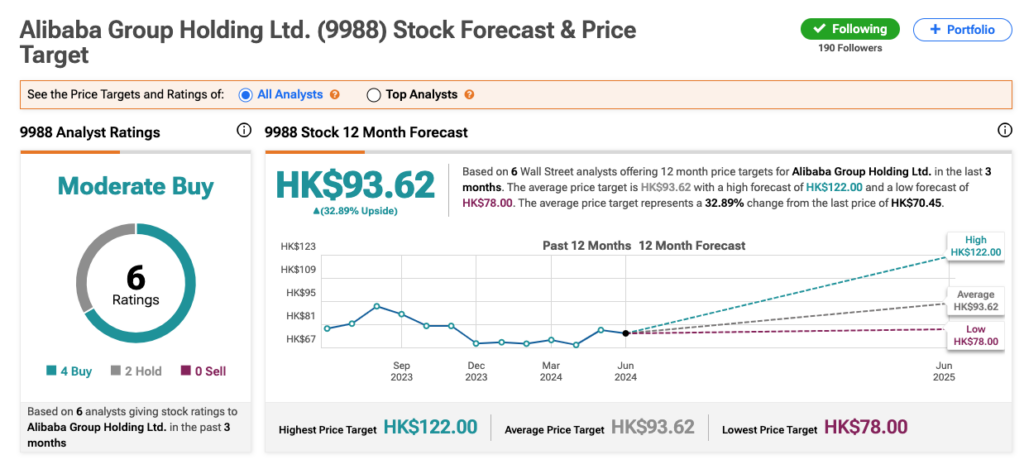

TipRanks analyst consensus suggests a Moderate Buy rating for the 9988 stock, backed by four Buy and two Hold recommendations. Moreover, the Alibaba share price’s target of HK$93.62 hints at a promising 33% upside potential, emboldening investors amidst prevailing uncertainties.

When navigating the tumultuous waters of the financial market, Alibaba’s strategic buyback move stands as a beacon of confidence amidst the storm, hinting at brighter days ahead.

Rest assured, Alibaba’s financial acrobatics aim to steady the ship and set sail towards prosperity, bridging the gap between challenging times and promising horizons.

Steady your resolve, dear investors, for Alibaba’s journey through the fiscal tempest offers hope for calmer waters ahead.