Analyst Upgrade Sparks Positive Momentum

On April 16, 2024, HSBC made a bold move by upgrading Advanced Micro Devices (NasdaqGS:AMD) from a ‘Hold’ to a ‘Buy.’ This shift in outlook has set the stage for potential growth and heightened investor interest in the semiconductor giant.

Price Forecast Indicates Bright Future

The average one-year price target for AMD stands at 194.57 as of March 31, 2024, signaling a remarkable 21.36% upside potential from its latest closing price of 160.32. This optimistic projection bodes well for the company’s future performance in the market.

Financial Projections Paint a Rosy Picture

With a projected annual revenue of 28,980MM, marking a substantial 27.78% increase, and a non-GAAP EPS of 4.82, AMD seems poised for a period of robust growth and financial success.

Strong Fund Sentiment Backs Bullish Outlook

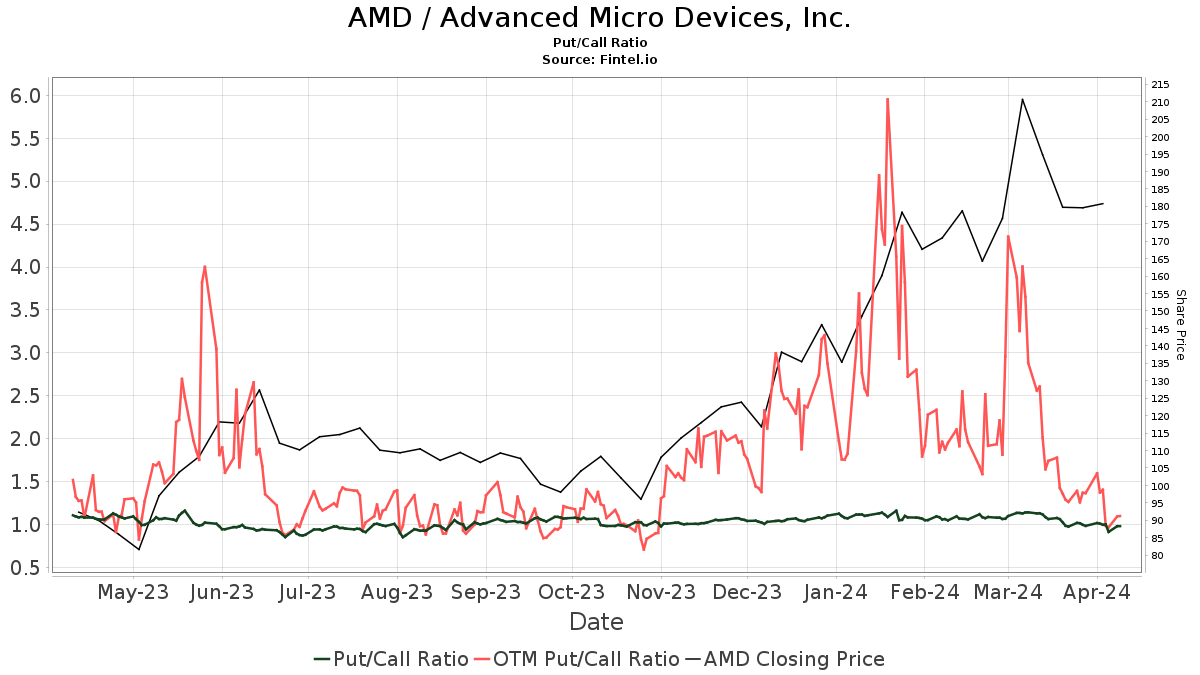

There are currently 3,615 funds or institutions reporting positions in AMD, reflecting a notable 9.98% increase in the last quarter. The average portfolio weight dedicated to AMD has surged by 16.88%, with the total shares owned by institutions displaying a 3.87% rise to 1,264,053K shares. Moreover, with a put/call ratio of 0.97, indicating a bullish stance, the broader market sentiment towards AMD appears positive.

Major Shareholders Show Confidence

Key institutional investors such as Vanguard Total Stock Market Index Fund Investor Shares, Vanguard 500 Index Fund Investor Shares, Jpmorgan Chase, Geode Capital Management, and Invesco Qqq Trust, Series 1, have all exhibited a strong show of confidence in AMD by increasing their portfolio allocations over the last quarter. This uptick in ownership reflects the growing appeal of AMD within the investment community.

About Advanced Micro Devices

With a legacy spanning over 50 years, AMD has been at the forefront of innovation in high-performance computing, graphics, and visualization technologies. The company’s products are integral to various sectors including gaming, immersive platforms, and data centers, catering to millions of consumers and Fortune 500 businesses worldwide. AMD’s relentless pursuit of excellence continues to drive its global presence and technological advancement.