When insiders start buying, it’s like hearing a cheerful bird singing on a gloomy day for investors. These transactions often signal confidence, hinting at smooth sailing ahead.

Insiders operate within a tight framework of regulations. They hold a longer commitment to the company’s shares compared to the average punter, shedding light on the director’s belief in the firm.

Amid the buzz, three companies – Cummins CMI, Packaging Corp. of America PKG, and Public Storage PSA – are experiencing significant insider activity. Let’s dissect the details for each of these promising stocks.

Cummins: The Engine of Growth

Cummins stands tall as a key player in the global market, specializing in diesel and natural gas engines, alongside powertrain-related components. Their VP recently dived into the market, grabbing around 280 shares for approximately $80k.

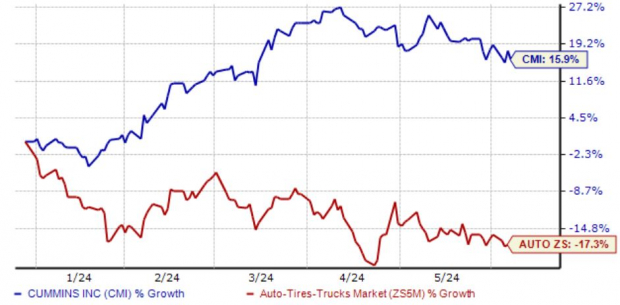

The stock has been revving up its engine this year, showing a healthy 16% growth. This impressive run has left its peers in the Zacks Auto sector trailing behind. Cummins has been riding high post-earnings, attracting positive vibes since 2024.

Public Storage: Unlocking Hidden Value

Public Storage is making space for growth, dominating self-storage facilities as well as other related operations. A recent purchase by a director amounted to nearly 2100 shares, valued at almost $600k in total. This real estate investment trust (REIT) offers shareholders a juicy 4.3% yield per annum.

REITs, known for their generous dividends, require handing out 90% of the earnings to investors. Public Storage is currently outshining the Zacks Finance sector average with its mighty yield, despite a bumpy ride in 2024, witnessing an 8% decline in share price.

Packaging Corp. of America: A Box of Surprises

Packaging Corp. of America plays a pivotal role as a top producer of containerboard goods and uncoated freesheet paper in North America. A recent dive into the market by a director involved picking up 300 shares for about $54k.

The company’s latest quarter was splashed with good news, surpassing expectations and propelling the stock price upwards. Lower expenses and higher volumes in Packaging and Paper segments have boosted the company, sailing beyond the prior guidance. Additionally, the company’s generous dividend growth rate of 13% over five years is turning heads.

Wrapping Up

Insider trading activity can be a treasure trove for investors, offering a peek behind the curtain of confidence and potential growth. With insider activity buzzing around Cummins CMI, Packaging Corp. of America PKG, and Public Storage PSA, investors may find a glimmer of hope.