In a market brimming with challenges for Intel (INTC), the company receives another blow. The Anti-Defamation League has set its sights on a major American corporation for the first time, as reported by CNBC. The unlucky target? None other than Intel. Reacting to this news, Intel shares stumble by approximately 3.5% during early Friday trading.

The saga dates back to August when the initial lawsuit was filed, addressing Intel’s handling, or lack thereof, of accusations regarding “public antisemitism” amidst the Israel-Hamas conflict. The issue involved antisemitic content associated with the war. A concerned Israeli employee, who highlighted the propaganda, was subsequently relocated to a position where they reported to the original propagator. The employee was then terminated, leading to legal action.

Now, the Anti-Defamation League enters the fray, asserting that the employee was not merely discriminated against but was specifically singled out and harmed. While Intel refrains from commenting on the lawsuit, it stresses its “code of conduct,” advocating a stringent stance against hate speech.

Anticipating Job Cuts

The employment landscape at Intel is currently fraught with apprehension among existing staff, many of whom may find themselves on uncertain ground soon. Reports indicate that Intel is halfway to its goal of slashing 15,000 jobs. A looming deadline further complicates matters, set for mid-October.

Although the lists recommending layoffs are supposedly finalized, the actual personnel facing the axe remain a mystery until mid-October. Given Intel’s recent strategic partnerships with the Pentagon and Amazon (AMZN), surviving employees could find themselves in a promising position post-restructuring.

Evaluating Intel’s Stock Performance

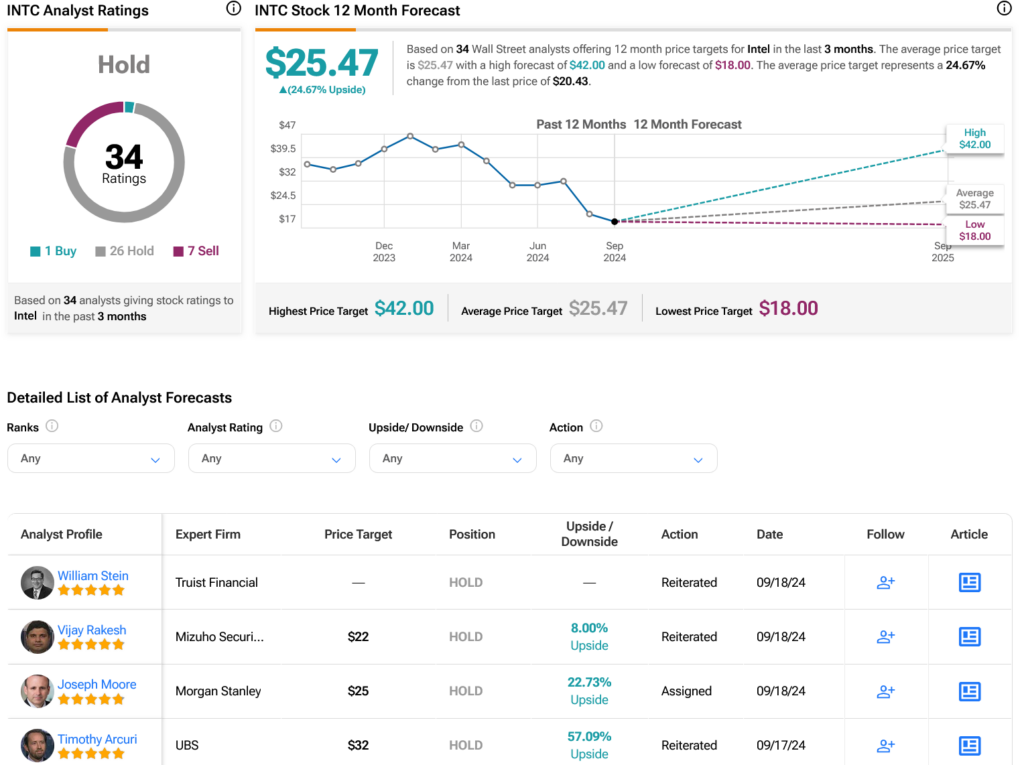

From Wall Street’s vantage point, analysts currently uphold a Hold consensus on INTC stock with one Buy, 26 Holds, and seven Sells in the past three months. Despite a significant 40.23% decline in its stock price over the previous year, the average INTC price target of $25.47 reflects a potential upside of 7.81% per share.

Explore more INTC analyst ratings.