Investors flocking to Advanced Micro Devices (AMD) has been akin to bees swarming a honey-laden hive in recent times. With its shares returning +4.9% over the past month compared to the Zacks S&P 500 composite’s +5% shift, the interest in this chipmaker is palpable.

What lies ahead for AMD?

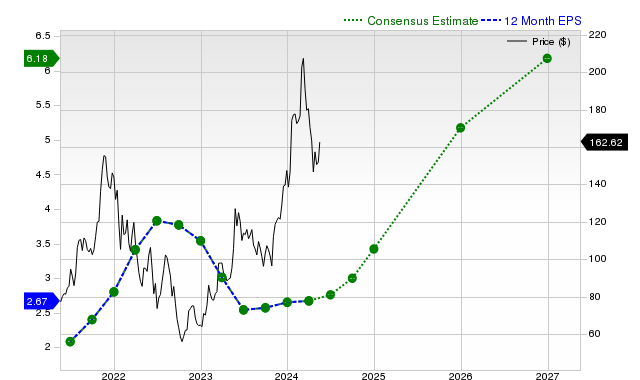

Earnings Estimate Revisions

Peering into the crystal ball of company fortunes, Zacks focuses on the alteration of future earnings projections to gauge a stock’s fair value. An upsurge in earnings estimates often kindles investor interest, leading to a rise in stock price.

For the current quarter, Advanced Micro is anticipated to clock earnings of $0.67 per share, marking a 15.5% rise from the year-ago quarter. Meanwhile, the consensus estimate for the current fiscal year stands at $3.42 per share, a hefty 29.1% surge year-over-year.

Looking further into the horizon, the consensus earnings estimate for the next fiscal year stands at $5.18, indicating a robust growth of 51.3% from the previous year.

With a Zacks Rank #3 (Hold), Advanced Micro stands poised for potential.

Projected Revenue Growth

Revenue growth is the engine driving a company forward. Advanced Micro aims for a 6.6% year-over-year revenue increase in the current quarter. The projections for the current and next fiscal years signal growth rates of +11.3% and +25.4%, respectively.

Last Reported Results and Surprise History

Recent financial reports show Advanced Micro reporting revenues of $5.47 billion in the last quarter, a 2.2% uptick. EPS also demonstrated strength, climbing from $0.60 to $0.62 year-over-year.

In terms of surprises, the company exceeded consensus EPS estimates thrice in the last four quarters. Revenue estimates were also consistently surpassed.

Valuation

Valuation metrics like P/E, P/S, and P/CF provide key insights into a stock’s true worth. Advanced Micro’s current valuation lands a grade of F, indicating a premium position over its peers.

Conclusion

While the buzz surrounding Advanced Micro captivates attention, key metrics suggest a prudent approach. The Zacks Rank #3 hints at a performance in line with the broader market going forward.