Recent Stock Performance

Alibaba (BABA) has captured the attention of Zacks.com visitors with an intensity akin to a heat-seeking missile zeroing in on its target. The stock reflects a monthly return of -0.9%, contrasting sharply with the Zacks S&P 500 composite’s 4.1% surge. The Internet – Commerce industry, where Alibaba resides, has swelled by 4.8% during this period. The paramount question beckoning is the trajectory that the stock is poised to embark on in the immediate future.

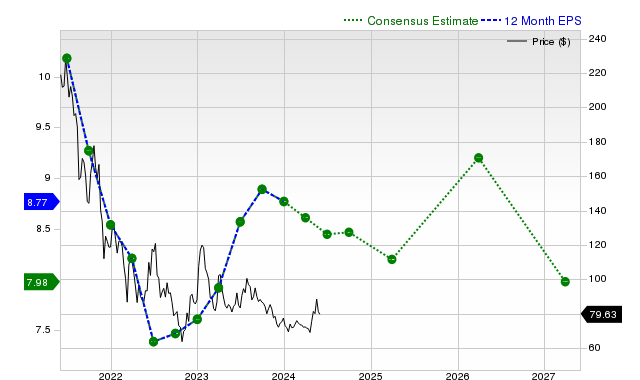

Earnings Estimate Revisions

A glimpse into earnings projections takes precedence in our evaluation at Zacks, eschewing distractions and drilling down into the heart of a company’s fundamentals. Earnings serve as the lodestar guiding the buy-and-hold compass, dictating a stock’s rightful place in the firmament of value.

Forecast and Performance

For the current quarter, Alibaba is anticipated to unveil earnings of $2.24 per share, signifying a -6.7% deviation from the corresponding year-ago term. Notably, the Zacks Consensus Estimate has burgeoned by +17% within the last 30 days.

Future Projections

Anticipations for the subsequent fiscal year indicate a spike of +12.2% in earnings, amounting to $9.20. Within the last month, this forecast has witnessed a negligible downturn of -0.7%.

Tracking Revenue Growth

While earnings amplify a company’s financial pulse, revenue stands as the lifeblood breathing vitality into its core. Alibaba’s sales forecast for the current quarter portrays a robust +8.2% surge year over year, underpinning the company’s growth narrative.

Valuation Metrics

A stock’s valuation is the compass guiding investment rationale; a misalignment could leave investors wandering adrift in a turbulent sea of uncertainty. Alibaba’s A-grade on the Zacks Value Style Score augurs well, signaling a discounted position relative to its peers.

Conclusive Thoughts

Armed with these insights and more from Zacks.com, stakeholders can navigate the choppy waters of market chatter concerning Alibaba. The Zacks Rank standing at #3, suggests that Alibaba is poised to shadow the broader market trends in the upcoming period.