The Ongoing Battle: AMD vs. Nvidia

While Nvidia has soared to great heights with its data center GPUs, Advanced Micro Devices (AMD) is a formidable contender in the field, albeit trailing behind Nvidia’s success. AMD presents a diverse product portfolio, spanning CPUs, embedded processors, and data center equipment, offering a shield against industry downturns.

Despite its diversified offerings, AMD lags significantly in the data center GPU market compared to Nvidia, as evidenced by their respective revenue streams.

| Company | Q1 Data Center Revenue | Growth (YOY) | Growth (QOQ) |

|---|---|---|---|

| AMD | $2.3 billion | 80% | 2% |

| Nvidia | $22.6 billion | 427% | 23% |

Data sources: AMD and Nvidia. Note: AMD’s Q1 ended March 31, and Nvidia’s Q1 ended April 28. YOY = year over year. QOQ = quarter over quarter.

Despite the current disparity, AMD shows potential in the AI realm. Major GPU consumers, primarily cloud computing providers like Microsoft, have demonstrated increased interest in AMD GPUs to diversify their ecosystem offerings instead of solely relying on Nvidia.

However, AMD remains in Nvidia’s shadow as customers continue to favor Nvidia’s GPUs for superior performance, leaving AMD as a secondary choice. While this poses a challenge for AMD, the company still holds promise as an investment option, provided it is acquired at a reasonable valuation.

The Valuation Dilemma: AMD vs. Nvidia

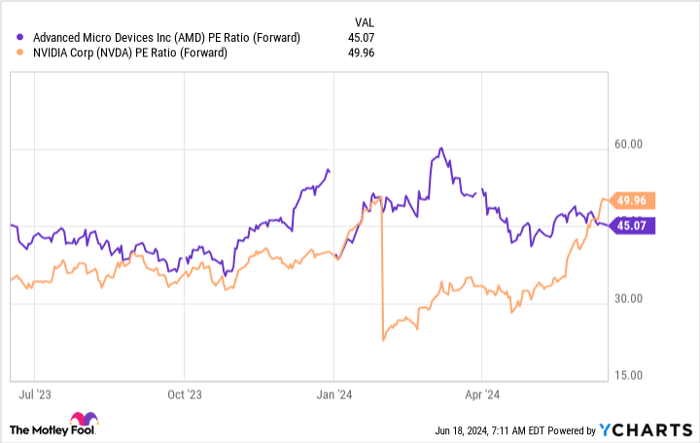

Identifying excellent businesses is complex, but ensuring you pay a fair price for a stock is equally challenging. AMD’s valuation, especially in the context of the AI competition, is primarily evaluated through its forward price-to-earnings (P/E) ratio in contrast to Nvidia.

Previously, AMD traded at a higher price than Nvidia despite its underperformance in various aspects. With Nvidia’s recent surge, this discrepancy has diminished. Nonetheless, investors should not hastily crown AMD as the superior investment based solely on a marginally lower P/E ratio.

While AMD holds the potential of a sleeping giant within the AI sector, Nvidia’s dominance could prevent AMD from fully awakening and seizing a significant market share.

Investment Considerations: Advantages and Risks

Prior to investing in Advanced Micro Devices, it’s crucial to weigh the following factors:

The Motley Fool Stock Advisor team recently unveiled their top picks for investors, excluding Advanced Micro Devices from the list. The highlighted stocks are anticipated to yield substantial returns in the foreseeable future and could be lucrative investments.

Reflecting on Nvidia’s past inclusion in similar lists and the remarkable returns it generated for investors, it becomes evident that investing in industry giants with proven track records can lead to exceptional wealth accumulation.

While Stock Advisor outlines a strategic pathway for investors to enhance their portfolios and unveils two new stock selections monthly, the service has vastly outperformed the S&P 500 since its inception in 2002.

Ultimately, the decision to invest in Advanced Micro Devices requires a careful evaluation of the risks and rewards associated with the company, its industry position, and its potential for growth amidst fierce competition.

*Stock Advisor returns as of June 10, 2024