Chipotle’s Impressive Financial Performance

Chipotle’s recent 50-for-1 stock split has caught the attention of investors after its remarkable share price surge. This surge saw the stock nearly double from a low of $35.37 to a high of $69.26 in just a few months. The numbers speak volumes about the company’s financial prowess.

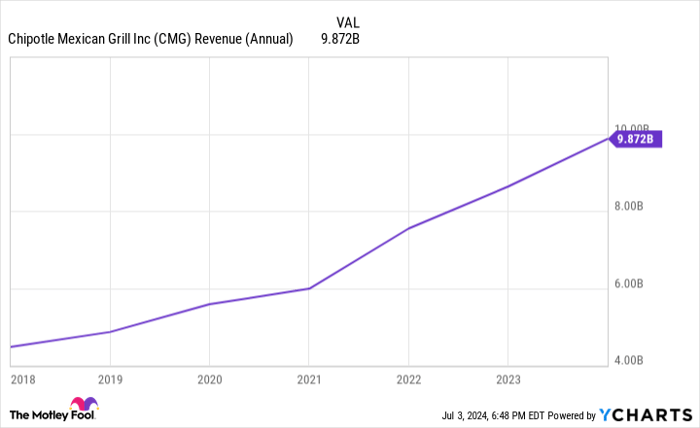

In 2023, Chipotle raked in $9.9 billion in revenue, marking a substantial 14% increase from the previous year. The net income surged by an impressive 37%, reaching $1.2 billion. Earnings per share (EPS) for 2023 peaked at $44.34, a significant jump of 38% from the previous year’s $32.04.

Continuing on its trajectory of success, Chipotle’s first-quarter of 2024 saw revenue hitting $2.7 billion, a 14% increase year over year. Net income also rose by 23%, climbing to $359.3 million from $291.6 million in the same period in 2023. Q1 EPS jumped by 24% year over year, reaching $13.01.

Comparatively, Chipotle’s rival, Yum! Brands, which owns various restaurant chains including Taco Bell, posted $1.6 billion in sales, $314 million in net income, and an EPS of $1.10 in Q1. This data positions Chipotle favorably in its industry.

Chipotle’s Strategic Sales Tactics

Under the leadership of CEO Brian Niccol since 2018, Chipotle has honed a winning strategy that revolves around enhancing throughput in its restaurants. This strategy fueled a significant 7% year-over-year growth in same-store sales in Q1. Bolstering same-store sales is vital to driving revenue, making improved throughput a linchpin in the company’s success.

Chipotle adopts various methods to boost the number of customers it can serve at each location. One approach is the easy online ordering system via its website or mobile app, with digital sales accounting for 37% of food and beverage revenue in Q1.

Another innovation is the introduction of Chipotlanes, drive-through lanes solely dedicated to online order pickups. Launched in 2018 under Niccol’s leadership, Chipotlanes have proven to be successful, with new stores featuring this format demonstrating higher volumes and returns compared to traditional locations. Chipotle plans to include Chipotlanes in at least 80% of new stores in 2024.

Evaluating Chipotle’s Investment Potential

Aside from operational strategies, Chipotle’s growth also stems from new store openings. In Q1 alone, the company inaugurated 47 locations and aims to launch at least 285 new restaurants in 2024, following last year’s addition of 271 stores.

With a target of 7,000 locations in North America, Chipotle is halfway there, boasting almost 3,500 restaurants by the end of Q1. Under Niccol’s stewardship, the company’s revenue has more than doubled since he assumed the CEO role.

Wall Street analysts concur on Chipotle’s promising future, giving the stock an overweight rating and pegging a median share price of $67.69. Given the stock’s dip from its post-split high, now could be an opportune moment for investors to consider including Chipotle in their portfolios.

Final Thoughts on Chipotle Growth Potential

Chipotle’s recent stock split has sparked a surge of interest among investors, eager to capitalize on the company’s stellar financial performance and innovative strategies. The rise in revenue, successful implementation of Chipotlanes, and ambitious expansion plans position Chipotle for sustained growth, potentially leading to a surge in stock value.

As investors navigate the stock market’s ebbs and flows, Chipotle emerges as an enticing prospect for those eyeing long-term growth. With a strong foundation laid by its leadership team and a robust sales strategy in place, Chipotle’s journey following the historic stock split promises to be one worth watching.