Contemplating investment avenues often leads individuals to gaze towards the proclamations of Wall Street analysts. These analysts, employed by brokerage firms, proffer recommendations that hold considerable sway over investor sentiments. But do these pronouncements truly wield power?

Before delving into the veracity of brokerage recommendations and how they can be leveraged to one’s benefit, let’s explore the sentiments echoing through the corridors of Wall Street concerning the industrial conglomerate, Honeywell International Inc. (HON).

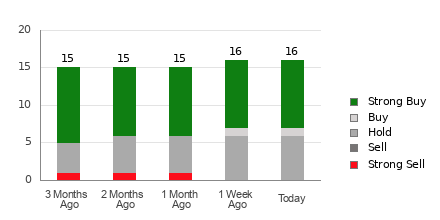

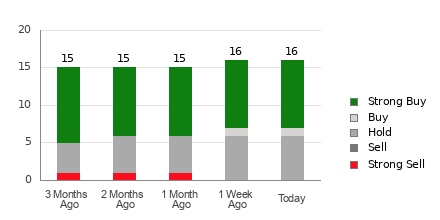

Honeywell International currently stands adorned with an Average Brokerage Recommendation (ABR) of 1.81, portraying a snapshot of Wall Street’s opinion on a scale ranging from 1 to 5 (Strong Buy to Strong Sell). This metric, fueled by the counsel of 16 brokerage firms, positions Honeywell International at a confluence hovering between Strong Buy and Buy.

Within the realm of these 16 recommendations that craft the prevailing ABR, a dominating nine espouse a Strong Buy stance, while a solitary voice propagates a Buy position. These endorsements translate to Strong Buy and Buy constituting 56.3% and 6.3% of the total recommendations, respectively.

Evaluating the Winds of Brokerage Recommendations for HON

The prevailing ABR may nudge towards an inclination to acquire shares of Honeywell International. Nevertheless, overly relying on this solitary piece of information may not escort one towards an astute investment choice. Research showcases that brokerage recommendations hold minimal efficacy in guiding investors towards stocks poised for significant price appreciation.

Why do these recommendations falter? Enveloped within the allegiances woven by brokerage firms towards the stocks they cover, analysts exhibit a penchant for casting favorable ratings. Our investigations unveil a disconcerting statistic – for every “Strong Sell” whisper, brokerage firms chorale five spirited “Strong Buy” hymns.

This disparity illuminates the misalignment between the interests of these institutions and those of retail investors, imparting limited foresight into a stock’s prospective price trajectory. In light of this, it proves prudent to utilize such data as a validation tool for individual analyses or in tandem with a proven instrument adept at divining stock price oscillations.

Bolstered by a verifiable, independently audited past, our proprietary stock rating apparatus, the Zacks Rank, emerges as a beacon of credibility. Dividing stocks into five distinct cohorts, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this tool speaks volumes about a stock’s imminent price performance. Hence, synergizing the Zacks Rank with ABR might entail a profitable investment expedition.

Clearing the Air: Zacks Rank Unveiled

Despite their semblance, the Zacks Rank and ABR chart divergent courses.

Whereas the ABR draws its essence solely from brokerage counsel, flaunting the decimals (e.g., 1.28), the Zacks Rank stands as a quantitative construct empowering investors with the dynamism of earnings estimate revisions, solemnizing its magnitude through whole-number portrayals – from 1 to 5.

The lineage of brokerage analysts, marred by unwavering optimism in their recommendations, veers off-path from their researched stance owing to the fulcrum of vested interests. In stark contrast, the Zacks Rank epitomizes the essence of earnings estimate revisions. Pioneering research spotlights the sturdy correlation between these revisions and the impending stock price gyrations.

Moreover, the diverse grades of the Zacks Rank are evenly meted out across all stocks with earnings estimates from brokerage analysts for the ongoing fiscal year. Ergo, this tool promises equilibrium across the five ranks it allocates at any given juncture.

Divergence paves its way when we tread the path of temporality between the ABR and Zacks Rank. While the ABR may tread on a somewhat antiquated route, the ephemeral nature of brokerage analysts propelling earnings estimates ensures that the Zacks Rank stays abreast of evolving business cadences, ever primed to prognosticate forthcoming stock values.

Should You Dabble in HON?

In the realm of earnings estimate revisions for Honeywell International, the Zacks Consensus Estimate for the present year experienced an upswing of 3% in the bygone month, now perched at $10.16.

An unbridled optimism sweeping through analysts, discernible via a unanimity in heightening EPS prognoses, might well pave Honeywell International’s path towards a soaring trajectory in the near future.

The seismic shift in the consensus estimate magnitude, interlaced with a triad of other facets tethered to earnings estimates, has baptized Honeywell International with a Zacks Rank #2 (Buy). Curious minds can explore an exhaustive compendium of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Hence, the echo of the Buy equivalent ABR concerning Honeywell International might resonate as a sagacious beacon for investors.