A short while back, optimism was rife that China’s burgeoning economy would surpass the United States. However, a trio of factors have led to diverging paths for the U.S. and China: housing market woes, burgeoning debt, and a sluggish post-COVID recovery. China’s economic woes commenced with an overheated real estate sector that transitioned from boom to bust. The collapse of the real estate bubble saw China’s largest developer, Evergrande, crumble under immense debt. Concurrently, as China’s economy flagged, its debt-to-GDP ratio ballooned to almost 300% by 2023. Moreover, China’s post-pandemic resurgence was hindered by a prolonged lockdown strategy, one of the strictest globally.

Considering an Investment in Chinese Stocks?

China’s stock market has mirrored its ailing economy, significantly underperforming global markets. Nevertheless, there are five indicators hinting that Chinese equities may have weathered the storm, including:

Renowned Investors Bullish on BABA

David Tepper and Michael Burry, two esteemed figures on Wall Street, are known for their sharp investment acumen. Tepper shot to fame by capitalizing on distressed bank stocks like Bank of America (BAC) following the 2008 financial crisis. Burry, immortalized by Christian Bale in “The Big Short,” anticipated and profited from the collapse of the housing market. Fast forward to 2024, and these legends share a common interest – both have placed significant bets on Alibaba Group (BABA), China’s premier e-commerce entity.

FXI Showing Signs of Recovery

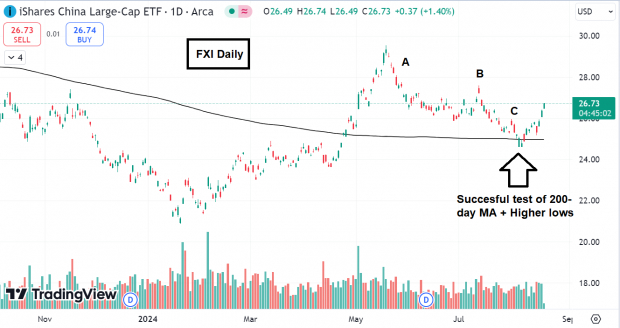

The IShares China Large-Cap ETF (FXI) has stealthily ascended by approximately 15% year-to-date, successfully reclaiming its late 2022 lows. FXI has crossed its 200-day moving average post recovering from an ABC bullish pattern formation (a W-shaped pattern where the second trough dips lower than the first).

Image Source: TradingView

Favorable Expectations for Chinese Stocks

Cognizant investors recognize the futility of isolated earnings analysis; instead, they probe how earnings stack up against estimates. Given the protracted slump in Chinese stocks, the earnings threshold remains modest. Notably, JD.com (JD) exemplifies this trend, consistently surpassing Zacks Consensus Estimates for four consecutive quarters with an impressive 24.04% average outperformance.

Image Source: Zacks Investment Research

Surge in Tesla’s China Deliveries

Recent figures on car registrations in China point to Tesla (TSLA) witnessing its second-busiest week for deliveries in the country this year. An uptick in Tesla’s deliveries subtly signals a resurgence in China’s consumer sentiment.

PBOC Implements Supportive Measures

Acknowledging China’s economic challenges, the People’s Bank of China (PBOC) has initiated measures to bolster the economy, such as easing down payment requirements for first- and second-time home purchasers and removing restrictions in the real estate domain.

Concluding Remarks

Early indications of an economic and market rebound are surfacing in China. Apart from the aforementioned factors, significant call options activity has been observed in Chinese proxies like the Krane CSI Internet ETF (KWEB). Chinese tech behemoth Baidu (BIDU) is set to announce its earnings on Thursday, a pivotal event for investors. In sum, data trends suggest that the clouds are parting over China. With seasoned investors placing their chips on Chinese stocks, a positive outlook for Chinese equities over the following six to twelve months seems warranted.

Exploring Investment Horizons: An Insightful Analysis

Unveiling Potential Gems

Investors always seek the next big thing, the hidden gem that could potentially bring enormous returns. In the world of investments, this quest is akin to searching for a needle in a haystack. However, with the right analysis and a sprinkle of luck, these gems can be unearthed.

A Glimpse into Stock Analysis Reports

Stock analysis reports are like treasure maps guiding investors through the complex terrain of the stock market. They provide valuable insights, trends, and potential risks associated with each stock. Investors rely on these reports to make informed decisions.

Exploring ETF Opportunities

Exchange-Traded Funds (ETFs) offer investors a basket of securities, providing diversification and ease of trading. They can be a strategic option for those looking to invest in a particular sector or region without the risk associated with individual stocks.

Delving into the Chinese Market

The Chinese market has always intrigued investors with its growth potential and market dynamics. Investing in Chinese stocks or ETFs can be a lucrative opportunity, but it comes with its own set of challenges and risks that investors need to navigate carefully.

Final Thoughts

Investing is both an art and a science. It requires patience, diligence, and a keen eye for spotting opportunities. As investors venture into the world of stocks and ETFs, thorough research, analysis, and a pinch of intuition will guide them towards making informed investment decisions.