Amazon(NASDAQ: AMZN) investors are hitting the jackpot to kick off 2024. Thanks to the e-commerce and cloud giant’s record closeout of 2023, the stock has been on a steady ascent. As of this writing, shares are already up 11% so far this year, and they’re homing back in on all-time highs last reached in late 2021.

Amazon’s Remarkable Transition

Business models rooted in software (of which Amazon effectively holds two, an e-commerce marketplace and public cloud services) are often referred to as “infinitely scalable.” Amazon has undoubtedly exemplified this purportedly “infinite” capability to keep selling more goods and services over time. It amassed an astonishing $575 billion in revenue in 2023, leaving other tech behemoths trailing far behind (with Apple coming in second place with $386 billion in sales over the last 12 months).

This achievement is particularly impressive for relatively “young” Amazon, set to celebrate its 30th birthday later this year. A significant portion of this revenue is categorized as “product” sales ($256 billion in 2023), aligning much of Amazon’s e-commerce business with the likes of Walmart. However, selling products, especially online, isn’t exactly a high-margin business.

Yet, Amazon’s founder, Jeff Bezos, envisaged the company as a major tech player, a platform for the digital era. Now, with epic proportions of scale, Amazon is only just starting to unleash its “infinitely scalable” superpowers. In 2022, Amazon recorded more full-year “service” revenue than “product” sales for the first time, and it’s the services side that boasts the margins investors yearn for.

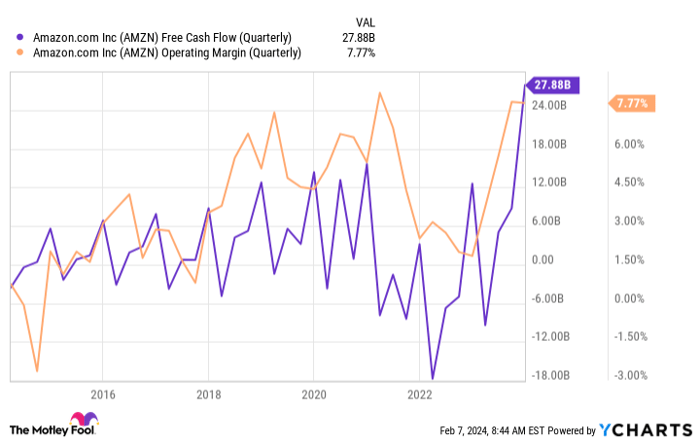

During the peak of the pandemic, operating expenses spiraled out of control. Since 2022, Amazon has embarked on the task of right-sizing its e-commerce distribution centers and data centers supporting cloud customers. The consequent results, gauged by operating profit margins and free cash flow generation, have been nothing short of impressive.

The “Expensive” Amazon Stock and Its Uplifting Prospects

Despite the inspiring upward trajectory, there is still substantial room for improvement. Amazon’s “international” segment continues to operate at a loss, with full-year revenue of $131 billion yielding a negative 2% operating margin – a baffling notion, to say the least.

Then there’s the cloud segment: Amazon Web Services (AWS), the frontrunner in public cloud infrastructure and services. AWS achieved a 29.6% operating margin in Q4 2023, a leap from 24.4% in the year-ago quarter when the bear market still prevailed. Given that cloud computing is a high-growth market, AWS continues to hold incredible potential.

In its core North American e-commerce market, Amazon is just scratching the surface of unlocking profitable gains. For instance, it recently introduced ads on Prime Video and continues to promote its ads, product distribution, and other services to third-party merchants.

It seems that Amazon’s surge in profitable growth is only just beginning. With a base case scenario predicting free cash flow of $50 billion in 2024, Amazon’s stock is trading at approximately 35 times this 2024 free-cash-flow estimate. While it isn’t a bargain, if you believe Amazon will continue to grow and elevate profit margins for years to come, this remains a top buy-and-hold stock for the long haul.

Is it wise to invest $1,000 in Amazon right now?

Before investing in Amazon, ponder this:

The Motley Fool Stock Advisor analyst team recently pinpointed what they believe are the 10 best stocks for investors to buy now… and Amazon didn’t make the list. The 10 stocks that made the list could yield substantial returns in the upcoming years.

Stock Advisor offers investors an easy-to-follow roadmap to success, including guidance on portfolio construction, regular analyst updates, and two fresh stock picks each month. Since 2002*, the Stock Advisor service has more than tripled the return of S&P 500.

*Stock Advisor returns as of February 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors.Nicholas Rossolillo and his clients hold positions in Amazon and Apple. The Motley Fool has positions in and recommends Amazon, Apple, and Walmart. The Motley Fool has a disclosure policy.