Investors in Apple (NASDAQ: AAPL) have weathered a storm of challenges over the past year as the tech giant grappled with various setbacks. Despite a modest 17% increase in its stock value over the last 12 months, a far cry from the 48% surge of 2023, recent indicators point to a potential turnaround.

Apple Resurges with AI Innovations

Following the Worldwide Developer Conference on June 10, Apple witnessed an 11% spike in its shares. At the event, the company introduced its Apple Intelligence AI platform, showcasing new generative features for its range of products, including iPhones, Macs, and iPads.

The unveiling of Apple Intelligence has reignited investor optimism, propelling Apple briefly back to the pinnacle of the business world as the most valuable company, boasting a market cap of $3.26 trillion on June 12. Apple now stands shoulder to shoulder with rival Microsoft, with a market cap of $3.27 trillion.

Thus, the current climate presents an opportune moment to consider investing in Apple, with its stock positioning itself as a compelling choice this June.

Apple’s Strategic Expansion in the AI Sector

During its recent Developer Conference, Apple showcased a suite of AI capabilities integrated into the Apple Intelligence platform. These innovations encompass features like language and image generation, sophisticated notification prioritization, and data analysis to facilitate specific user commands.

Notably, Apple Intelligence offers AI-driven text rewriting tools and an enhanced Siri smart assistant, now more personalized, intuitive, and context-aware. Siri’s integration with OpenAI’s ChatGPT underscores a burgeoning partnership between the two entities.

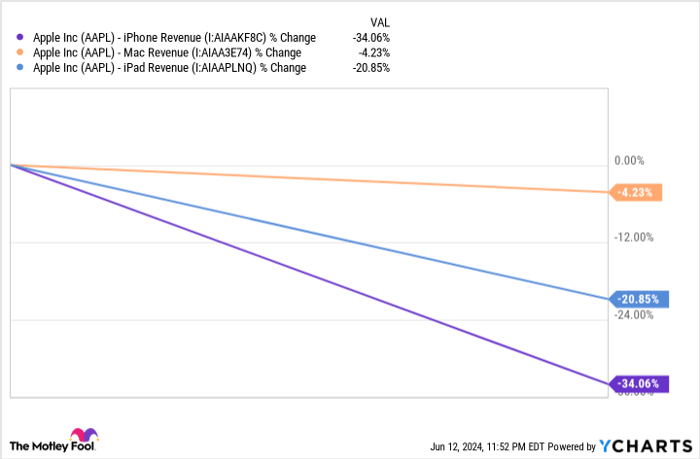

Furthermore, Apple has strategically limited access to Apple Intelligence to select devices, including Macs and iPads equipped with M-series chips, along with the iPhone 15 Pro models. This exclusivity may prompt consumers to upgrade their devices, drawn by the allure of Apple’s cutting-edge AI functionalities.

The Competitive Edge of Apple Stock in AI

Amid a burgeoning AI market that has witnessed explosive growth over the past year, Apple’s incremental approach has diverged from the rapid ascension seen by tech titans like Amazon, Microsoft, and Nvidia. This deliberate strategy has positioned Apple’s stock as a more attractively priced option for potential investors.

Apple’s shares emerge as a value proposition compared to its competitors, featuring the most appealing valuations based on the forward price-to-earnings ratio and price-to-free-cash-flow ratio. With a healthy free cash flow of $102 billion, Apple appears well-equipped to surmount challenges and capitalize on the expanding AI landscape.

Considering the projected 37% compound annual growth rate of the AI sector until 2030, Apple’s foray into this domain indicates that the best time to invest in the company may be now.

Seizing the Moment: Investment Considerations

Before delving into Apple stock, investors should contemplate the trajectory set forth by industry experts. Despite Apple not being among the “10 best stocks” identified by the Motley Fool Stock Advisor analyst team, exploring alternative investment opportunities could yield substantial returns in the future.

Reflecting on past achievements such as Nvidia’s inclusion in the recommended stock list back in 2005, where a $1,000 investment would have burgeoned into $794,196, underscores the potential growth avenues in the market.

Through Stock Advisor’s comprehensive guidance for investors, which has outperformed the S&P 500 fourfold since 2002, individuals can gain valuable insights, receive regular updates, and explore two new stock recommendations monthly.

*Stock Advisor returns as of June 10, 2024