The Lay of the Land

Investors often turn to the whispers of Wall Street analysts to steer their investment ship. But do these so-called experts truly hold the key to market success? Let’s explore the current sentiments circling around Alibaba (BABA) before delving into the intricacies of brokerage recommendations and how investors can leverage them to their advantage.

Peering into the Recommendations

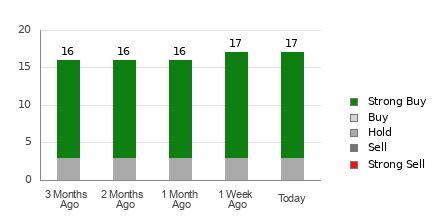

With an average brokerage recommendation (ABR) of 1.35 for Alibaba, the consensus seems to lean towards Buy territory, with a shade of a Strong Buy. Out of 17 brokerage firms, a whopping 82.4% have stamped a Strong Buy on the stock, painting a rosy picture. But, should investors bet the farm on these numbers alone?

Unmasking the Reality

Research suggests that brokerage recommendations may not be the golden ticket to market riches. Analysts tethered to brokerage firms often harbor a bias towards positive ratings on stocks they cover, leaving investors navigating murky waters. While the ABR shines a light, it’s wise to tread cautiously and complement it with a more grounded approach.

The Zacks Rank: A Beacon of Hope

Enter the Zacks Rank – a battle-tested ally in the quest for smart investments. Anchored in earnings estimate revisions, the Zacks Rank cuts through the noise to offer a clearer view of a stock’s trajectory. Unlike the ABR, this tool is fueled by empirical data, steering clear of the pitfalls of analyst biases.

Decoding the Signals

While ABR paints a sunny picture for Alibaba, a closer look at the Zacks Consensus Estimate reveals a different tale. With a 0.4% dip in expectations for the current year, analysts’ somber outlook could spell rough seas ahead. Tagged with a Zacks Rank #4 (Sell), caution might be the wiser path in the current landscape.

The Bottom Line

As the fabled tale of Alibaba unfolds, investors are urged to take the ABR with a pinch of skepticism. Navigating the tumultuous waters of the market demands a multifaceted approach, marrying intuition with data-driven insights for a shot at success.