Investors often turn to Wall Street analysts for insights on stock decisions. The impact of brokerage recommendations on stock prices is significant. The question remains: are these recommendations truly reliable?

Before delving into the tangible utility of brokerage advice and how to leverage it to your benefit, let’s peek into the sentiments of Wall Street towards Alibaba (BABA).

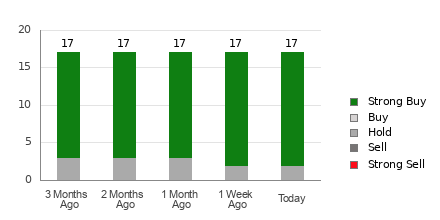

Alibaba currently holds an average brokerage recommendation (ABR) of 1.24, placing it between a Strong Buy and a Buy on a scale of 1 to 5. This calculation is driven by the recommendations (Buy, Hold, Sell, etc.) from 17 brokerage firms, with an overwhelming 88.2% of recommendations advocating a Strong Buy for Alibaba.

Understanding the Trends in Brokerage Recommendations for BABA

The ABR might signal a bullish stance on Alibaba, but relying solely on this metric for investment decisions could be a gamble. Research indicates that brokerage recommendations often fall short in guiding investors towards stocks with optimal price appreciation potential.

Ever wondered why? The inherent bias of brokerage analysts, stemming from their firms’ vested interests in the stocks they cover, tends to skew their ratings positively. For every “Strong Sell” recommendation, there are five “Strong Buy” endorsements, indicating a divergence between institutional and retail investor interests.

Therefore, it’s prudent to view such recommendations as validation tools for your independent analysis or in conjunction with reliable predictors of future stock performance.

Our independently audited Zacks Rank, a stock rating system classifying stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a dependable indicator of near-term stock performance. Integrating the ABR insights with the Zacks Rank could substantiate your investment decisions significantly.

Decoding the Distinction: ABR vs. Zacks Rank

While ABR and Zacks Rank utilize a 1 to 5 scale, they are fundamentally divergent metrics.

ABR relies solely on brokerage recommendations, often expressed in decimals, to gauge analyst sentiment. Conversely, the Zacks Rank employs a quantitative model grounded in earnings estimate revisions, denoted by whole numbers.

Brokerage analysts’ habitual optimism in their ratings, influenced by institutional interests, frequently leads to misguided investor decisions. Conversely, the Zacks Rank hinges on robust earnings estimate revisions, demonstrating a strong correlation with short-term stock price movements.

Moreover, Zacks Rank gradations are equitably applied across all stocks with earnings estimates, ensuring a balanced representation among the five ranks assigned. Unlike ABR, the Zacks Rank reflects timely updates driven by analysts adjusting estimates to mirror evolving business dynamics.

Is Alibaba (BABA) a Worthy Investment Bet?

Recent data on Alibaba suggests positive momentum, with the Zacks Consensus Estimate for the current year climbing by 1.9% to $8.94 in the past month.

The unanimity among analysts in raising EPS projections, signaling enhanced confidence in Alibaba’s earnings outlook, could propel the stock upwards in the near future. This surge, alongside other earnings-related factors, culminates in a Zacks Rank #2 (Buy) for Alibaba.

Hence, the Buy-equivalent ABR for Alibaba presents itself as a valuable compass for investors looking to navigate the market terrain with assurance.