Decoding Brokerage Recommendations for Allstate

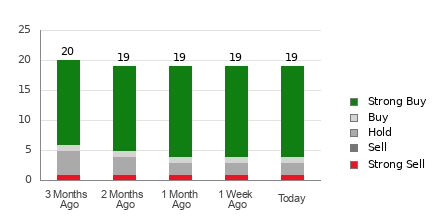

Before diving into the reliability of Wall Street analyst recommendations and their potential impact on stock decisions, investors often seek guidance from these financial experts. The stock in question, Allstate (ALL), currently boasts an average brokerage recommendation of 1.47, implying a Strong Buy to Buy sentiment among 19 brokerage firms.

Analyzing Brokerage Recommendation Trends for ALL

Of the 19 recommendations influencing the current average, 15 stand as Strong Buy, representing a substantial 79% of the outlook, with one Buy recommendation adding to a 5.3% portion of the sentiment.

Comparing ABR with Zacks Rank for Informed Decisions

While brokerage advice can be a signal, relying solely on these recommendations might not be the best strategy. Research often indicates a bias towards positivity due to brokerage firms’ vested interests. Aligning the ABR with tools like Zacks Rank, a model based on earnings estimate revisions, could offer a more insightful investment perspective.

Understanding the Essence of Zacks Rank

Distinct from ABR, Zacks Rank provides a holistic view based on earnings forecasts. Historically, analysts tend to lean towards optimistic ratings, potentially misleading investors. Conversely, Zacks Rank’s focus on earnings revisions can offer a clearer picture of stock movements.

Assessing ALL’s Investment Viability

Allstate’s recent positive earnings estimate revisions, culminating in a 11.8% increase for the current year, present an exciting opportunity. With a Zacks Rank #1 (Strong Buy) designation and an optimistic consensus among analysts, Allstate appears poised for potential growth in the short term.