In the world of investing, the recommendations of Wall Street analysts hold considerable sway. Indeed, these critiques can mar or make the fate of a stock, thereby affecting its price. But are these opinions truly worth their weight in gold?

Wall Street’s View on Arista Networks (ANET)

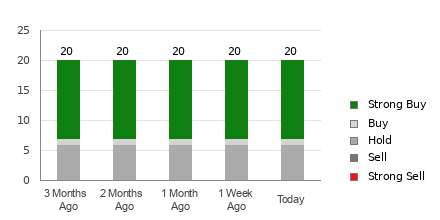

As investors weigh the potential of Arista Networks (ANET), it’s imperative to consider the analysis of 22 brokerage firms. They’ve assigned an average brokerage recommendation (ABR) of 1.61 to ANET, indicating a stance between Strong Buy and Buy. The majority of these recommendations are Strong Buy, accounting for a whopping 63.6%, with an additional 9.1% rating the stock as Buy.

Deciphering the ABR

While these recommendations may seem like gospel truth, it’s prudent not to place all your bets solely on this data. Studies indicate that brokerage recommendations may not always lead to the most profitable investment decisions, given the potential for positive bias due to vested interests.

The Zacks Rank: A Reliable Indicator

Leveraging credible and verified indicators like the Zacks Rank can substantially complement your investment strategy. Unlike ABR, the Zacks Rank is derived from quantitative models based on earnings estimate revisions, which have been empirically linked to stock price movements.

Comparing ABR and Zacks Rank

While the ABR solely relies on brokerage recommendations and might lack timeliness, the Zacks Rank swiftly incorporates earnings estimate revisions and maintains a balanced approach across all stocks covered by analysts, providing a more dynamic projection.

Investment Potential: What Lies Ahead for ANET?

An analysis of Arista Networks reveals a growing consensus among analysts, with the Zacks Consensus Estimate for the current year inching up by 0.3% to $6.55. This positive agreement among analysts has led to a Zacks Rank #2 (Buy) for ANET, indicating potential for near-term price appreciation.

Ultimately, while ABR may serve as a useful guide, it is essential to complement with robust indicators like the Zacks Rank for a well-rounded investment decision.