Investors often turn to Wall Street analyst recommendations to gauge the potential of a stock. But do these recommendations hold the key to successful investing?

Let’s delve into the insights provided by Wall Street heavyweights regarding AZZ (AZZ) and explore the significance of brokerage recommendations in guiding investment decisions.

Understanding AZZ’s Brokerage Recommendations

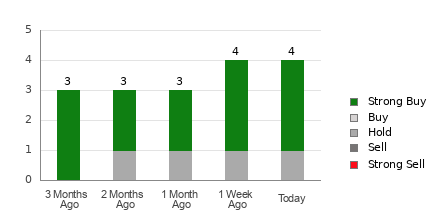

AZZ currently holds an average brokerage recommendation (ABR) of 1.50, suggesting a buy signal based on ratings from four brokerage firms. Of these recommendations, 75% lean towards a Strong Buy rating.

While the ABR advocates investing in AZZ, solely relying on this metric may not be prudent. Studies have shown that brokerage recommendations do not always align with maximizing price gains.

Deciphering Brokerage Recommendation Trends

The bias of brokerage firms towards stocks they cover often skews analyst ratings positively. This conflict of interest can mislead investors, necessitating the validation of such recommendations through other reliable tools like the Zacks Rank.

Zacks Rank, a proven stock rating tool, categorizes stocks from Strong Buy to Strong Sell based on earnings estimate revisions. Unlike ABR, the Zacks Rank offers a more objective perspective by focusing on quantifiable data.

Comparing ABR and Zacks Rank

While both metrics operate on a scale of 1 to 5, ABR relies solely on brokerage recommendations, whereas the Zacks Rank incorporates earnings estimate revisions. Empirical data shows a strong correlation between stock price movements and earnings estimate trends, favoring the Zacks Rank.

Moreover, the Zacks Rank’s timely updates and balanced application across all stocks bring a fresh and unbiased approach to investment decision-making compared to potentially outdated ABR ratings.

Analyzing AZZ’s Investment Viability

With an upward revision of the Zacks Consensus Estimate for AZZ to $4.85, analysts’ optimism in the company’s earnings potential reflects a bullish sentiment. The recent positive consensus estimate change and a Zacks Rank #1 further validate AZZ’s investment attractiveness.

Therefore, leveraging the Buy-equivalent ABR for AZZ alongside the Zacks Rank could offer investors a comprehensive perspective on the stock’s growth potential.

Are you ready for an investing double-header?

Discover the top 5 stocks poised to skyrocket, with previous recommendations soaring triple digits. These hidden gems provide a unique investment opportunity beyond the Wall Street spotlight.