Investors know the drill – when it comes to stock decisions, the verdict from Wall Street analysts can make or break a potential investment. The limelight often shines on these sell-side experts, influencing market trends and stock prices. But, are their words truly worth their weight in gold?

Before delving further into this discourse, let’s dissect the prevailing sentiments about Leidos (LDOS) among these renowned Wall Street mavens.

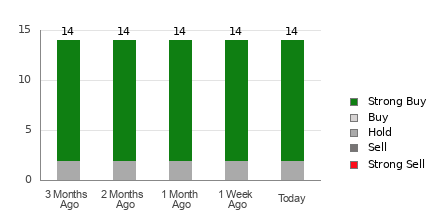

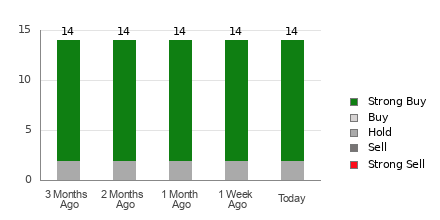

Leidos currently boasts an average brokerage recommendation (ABR) of 1.29, conceding to a scale of 1 to 5, with 1 indicating a “Strong Buy,” and 5, a “Strong Sell.” This calculated figure draws from the composite of recommendations – Buy, Hold, Sell, and such – proffered by a consortium of 14 brokerage firms. The ABR of 1.29 skims between the realms of Strong Buy and Buy.

Of the 14 contributing recommendations embroidered into the current ABR tapestry, a striking 12 resolutions scream Strong Buy, constituting a resounding 85.7% of all suggestions.

Unveiling the Temperaments of Brokerage Recommendations for LDOS

The ABR may sing songs of buying Leidos, but treading the investment path purely on this symphony may not be the wisest serenade. Multiple studies raise doubts on the credibility of brokerage recommendations in steering investors towards equities destined for meteoric price ascents.

Ever pondered why? Brokerage analysts, overshadowed by their firms’ vested interests in endorsed stocks, often paint a rosier portrait than reality would allow. History whispers tales of five “Strong Buy” ratings planted for every scintilla of “Strong Sell” bestowed.

In essence, their compass doesn’t always align with that of retail investors, offering scarce insights into a stock’s true trajectory. Therefore, their utility possibly lies in validating existing research or as a navigational mark synced with proven forecasting tools for stock oscillations.

Enter Zacks Rank, the proprietary alchemy of stock evaluation, flaunting a scrutinized legacy. It classifies equities into five strata, peaking at Zacks Rank #1 (Strong Buy) and plummeting to Zacks Rank #5 (Strong Sell), forecasting the price escapades that lie in wait for a particular stock. Hence, confirming the ABR via Zacks Rank might well chart a course towards a prosperous investment expedition.

Deciphering the ABR From the Zacks Rank Sphere

Although ABR and Zacks Rank trumpet scale symphonies ranging from 1 to 5, they march to different drummers.

The ABR derives its melody from broker recommendations alone, resonating in decimal notes (think 1.28). Conversely, Zacks Rank orchestrates a quantitative symphony, harnessing earnings estimate revisions as its melody. Whole numbers (1 to 5) croon its tune.

Broker-clad analysts have often donned rose-tinted glasses in their endorsements. Their figures, glossier than warranted, often lead investors astray rather than guiding the way.

On another note, Zacks Rank dances to the haunting rhythm of earnings estimate revisions. Thunderous echoes of research echo a compelling liaison between these revisions and impending stock price somersaults.

Furthermore, Zacks Rank diligently distributes its grades across all stocks swathed in current-year earnings warbles provided by brokerage analysts. The balance endures, ensuring every equity lingers within the gaze of its five ranks.

Diverging paths also rise in the freshness domain. ABR may clutch an expired label in its hand. Deft maneuvers by brokerage analysts, tweaking earnings estimates to mirror a firm’s undulant business affairs, swiftly etch their tints onto Zacks Rank’s canvas, ensuring timeliness in foreshadowing future price galas.

Is Leidos (LDOS) the Golden Goose of Investments?

Pouring over the earnings estimate revisions for Leidos, the Zacks Consensus Estimate for the current year has swelled by 2.5% in the bygone month, settling at $8.97.

The harmonic convergence of analysts bodes well for Leidos’ earnings horizons, echoed in their resounding choir, harmonizing in tune to hoist EPS estimates aloft. This crescendo could well orchestrate a symphony of soaring stock figures in the foreseeable future.

The seismic shift in the consensus estimate, coupled with a trifecta of earnings estimate nuances, have christened Leidos with the coveted Zacks Rank #1 (Strong Buy). Dive into the premier league of Zacks Rank #1 (Strong Buy) brethren right here.

Hence, the Buy-friendly ABR for Leidos could act as North Star, guiding investors through the tempestuous investment seas.

Finding the “Unicorn of Investments” – Insights from the Research Maestro

From the fray of myriad stocks, five Zacks wizards have unfurled their banners of favored equities, predicted to skyrocket by +100% or more in the impending months. Among these, the torchbearer – Director of Research Sheraz Mian – has selected the shining star, poised to illuminate the investment cosmos.

This luminary entity caters to millennial and Gen Z cohorts, amassing a staggering $1 billion in revenue during a single quarter. The recent downturn paints the opportune moment to embark on this voyage. Tread cautiously, for amidst the stellar elite, a select few ascend to the heavens, outshining even past exemplars like the luminary Nano-X Imaging, which blazed a trail with a +129.6% leap in a mere 9 moons.

Embark on an Adventure: Discover Our Top Pick and Runners Up

Leidos Holdings, Inc. (LDOS): Explore Free Stock Analysis

Click here to immerse yourself in the full article on Zacks.com