As the streaming behemoth Netflix prepares to unveil its Q3 earnings on October 17th, notions of uncertain subscriber growth are whispering faint doubt into the minds of Wall Street. Yet, steadfast among the storm, Netflix projects a commendable uptick in revenue growth, adorned with a margin hike as it ventures into the realm of advertising for financial gain. Despite the clouds of high volatility swirling in the Q3 forecast, I maintain my unwavering belief that NFLX is a wise investment choice before its earnings unveiling. Especially when gazing through the lens of long-term commitment, as its valuation stands defanged compared to yesteryears.

A Glimpse at Netflix’s Q2 Triumphs

In sync with my optimistic vision of Netflix, the past quarter unfolded like a saga of hope and glory for the streaming colossus. Netflix paraded a 17% surge in year-on-year revenue, flaunting a dazzling $9.55 billion – a figure that outshone all whispers of estimations. This financial jubilation danced to the tunes of hit shows like “Baby Reindeer” and “Bridgerton,” prancing in the company of a 16% uptick in average paid memberships, tallied at a monumental 277.65 million. A grand addition of 8 million subscribers graced the quarter, deftly outshining even the rosiest forecasts of five to six million.

The market gazed upon Netflix’s Q2 feat with measured applause, ensnared by lofty expectations. Yet, Netflix has been a maestro in orchestrating melodious renditions of key metrics, from operating margins to subscriber proliferation. Across the board, the company painted an enviable 27.2% operating margin, ascending from the previous year’s 22.3%. A fine feather in its cap, Netflix serenaded its stakeholders with a tune of $3.35 billion in free cash flow during the initial half of the year, steering comfortably on course to embrace its annual $6 billion guidance. This melodious note reverberated, especially as Netflix continues to sow generously in content while reaping a harvest of robust cash flows.

Moreover, Netflix embellished its Fiscal Year 2024 revenue growth prediction to a vibrant 15%, up from the erstwhile 14%. The company also raised the curtain on its anticipated annual operating profit margin, now billowing at 26%, up from the previous stance of 25%.

Peeking into Netflix’s Q3 Anticipations

Steering into Q3’s grand theater of financials, my conviction stands tall in favor of Netflix as it unveils a script adorned with a 14% revenue growth rate and a 28.1% operating profit margin. This enamoring spectacle marks a stark ascent from the 22.4% margin in Q3 of the bygone year. The magic potion brewing this margin hike is the infusion of burgeoning subscriber numbers and blooming revenues, all acting as harmonious contributors to profitability.

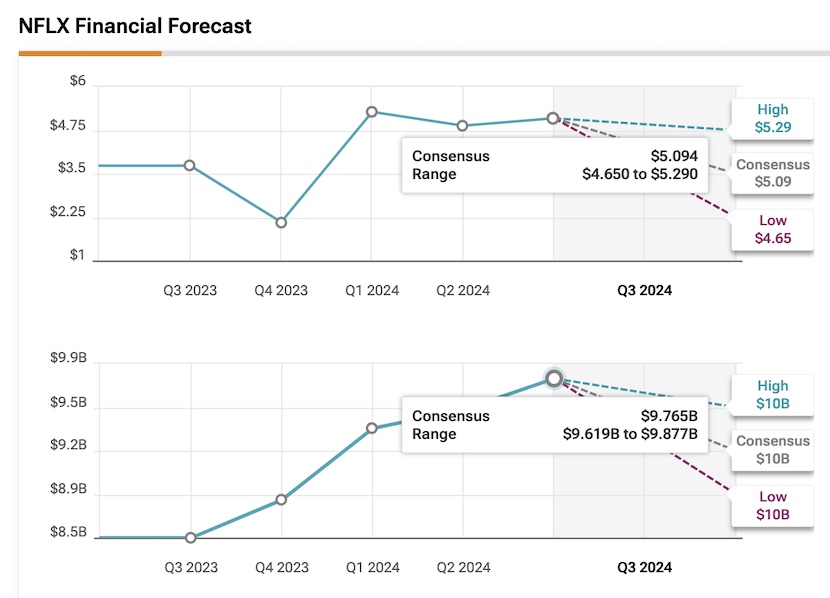

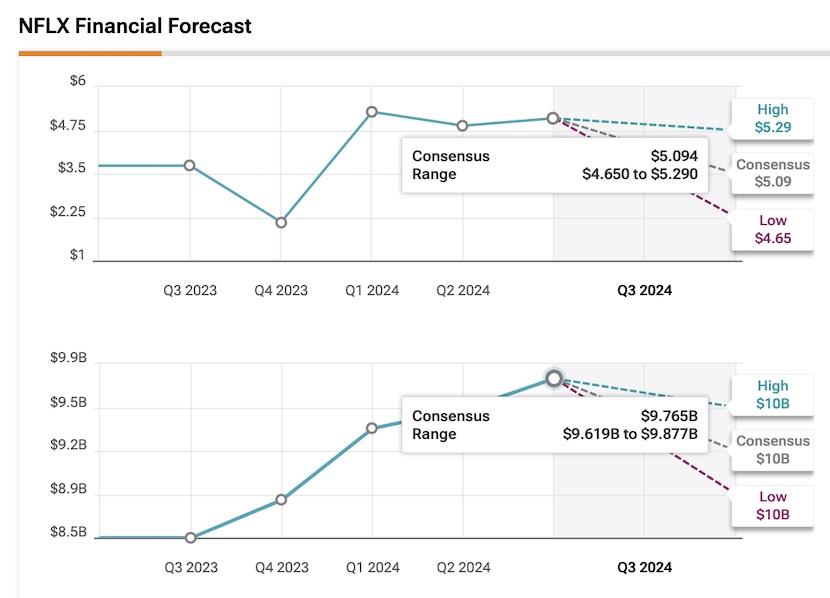

To dazzle the market’s eye, Netflix must unveil an earnings per share (EPS) loftier than $5.09, hinting at a 36.5% year-on-year surge, alongside revenues surpassing the $9.765 billion milestone, an ascent of 14.3%. Analysts, however, tiptoe into the Q3 arena with veiled expectations, with 29 of 31 analysts tweaking their EPS targets skywards in the preceding three months. Yet, only 11 out of 32 analysts have raised their financial projections for the quarter.

Netflix’s Resurfacing as a Growth Dynamo, with a Fresh Twist

Beyond the realm of simply outshining Wall Street’s numerical forecast, Netflix’s revival from the ashes – where its shares dipped below $170 per share in the annals of 2022 post a subscriber stagnation hiccup – broadcasts a new narrative. The market now christens Netflix as a phoenix reborn, a growth stock once more, albeit donning a fresh garb compared to yesteryears.

Subscribers, the lodestar of market musings that could sway the meters post-Neflix’s Q3 unveil. However, as the business ages gracefully, I opine that Netflix is veering from the ‘growth in digits’ juncture to a phase of ‘monetization growth,’ with advertising snagging a key role.

Through the artistry of ditching its basic plan and nudging users towards its ad-rich tier, Netflix charts a sagacious long-term trajectory poised to proliferate ad revenues. Heralding a future where Netflix’s advertising stride may match, if not surpass, subscriber surge in Q3’s recital.

The Turbulent Winds Post the Earnings Sonata

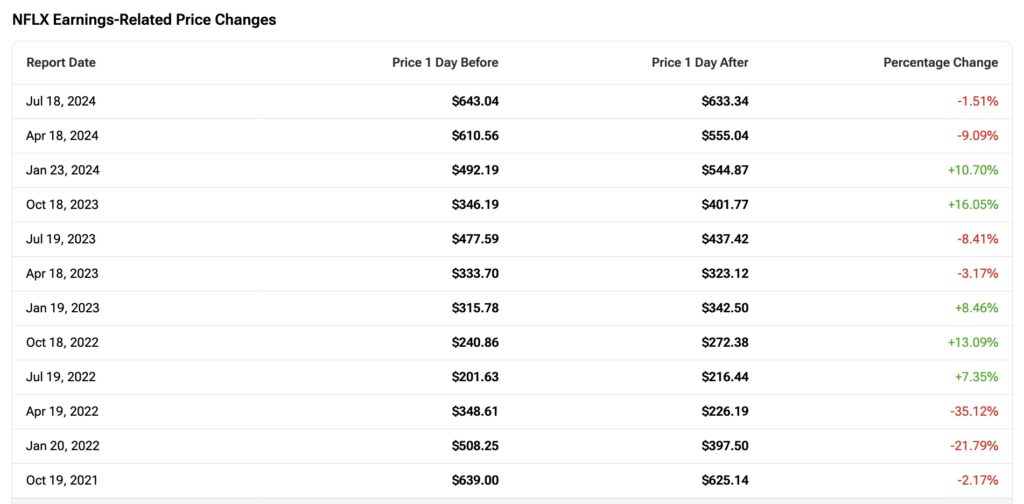

As the curtains draw close on Netflix’s earnings exposé, vivid memories emerge of the turbulent price frolics post previous unveilings. The pendulum of Netflix’s value and growth stock identities swings wildly in the market winds, capturing the essence of volatile price rumbles in the last twelve earnings sessions. Despite the tumult, my sails catch the bullish winds of longevity, daring to whisper that the Q3’s tempest is but a passing squall on the journey of long-term investors.

A pivotal player in the post-earnings waltz of volatility could be valuation. Presently, Netflix trades at a forward price-to-earnings (P/E) ratio of 37.7x, scaling the mountainous heights unseen since the annals of 2022. While this signals an ascending valuation, I maintain the belief that Netflix dons a coat of modesty when juxtaposed against the five-year average P/E of 46.8x.

Furthermore, with EPS set to soar by 59% in 2024 and another 20% in 2025, Netflix might sway towards a forward P/E ratio of 30.4x come that epoch. Not quite a bargain, yet painting a canvas of de-risked growth potential.

Unveiling the Enigmas of Netflix’s Q3 Earnings Through Option Chains

Embracing the Unpredictability: Navigating Netflix’s Growth Trajectory

Forecasting the Volatility

Netflix’s journey through Q3 has been often likened to a rollercoaster ride, expected to continue on a path of growth. However, the option chains are showing a hint of turbulence ahead, with an anticipated 8.33% earnings move in either direction. The at-the-money straddle for options expiring on October 18th, set with a $720 strike price, showcases call options at $31.25 and put options at $28.76.

Insight from Wall Street Analysts

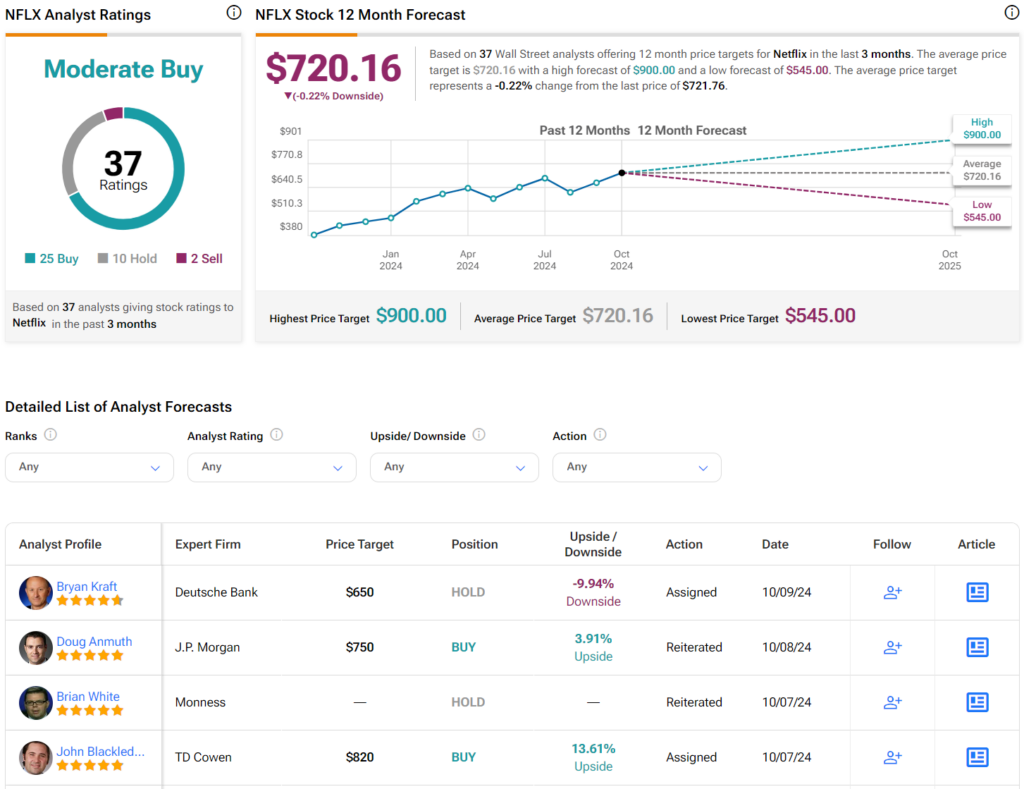

The verdict from Wall Street analysts presents a mixed bag for Netflix. With a Moderate Buy consensus among 37 analysts, the stock draws varied opinions. While 10 analysts stand by a Hold recommendation and two advise selling, the remaining voices advocate for a Buy. The average price target settles at $720.16, painting a picture of limited upward mobility.

Explore deeper into NFLX analyst ratings

Evaluating the Future

Despite the looming volatility, Netflix stands firm in its stance for growth in Q3. The strategic pivot towards advertising and a renewed emphasis on monetization may start to manifest this quarter and potentially gain momentum in the subsequent periods.

While the stock hits record highs nearing the earnings reveal, a short-term bearish undertone could sway the scenario. Nevertheless, the belief remains steadfast that investing in NFLX, even at prevailing valuations, will yield fruitful returns. A recommendation echoes through the clouds – Netflix is a Buy before earnings, with an even stronger case post a probable pullback.